Dear Editor,

The auto dealers of Guyana would like to co-operate and work with the government’s vision of a green and clean Guyana. As with any developing country, one cannot stress enough the importance of the auto industry, which has a direct impact on taxes (revenue earner for government) and provides mobility for all sectors which is equally important.

The proposed tax structure changes:

- Reduce the taxes on 2013-2016 (newer than 4 years old) vehicles with a 1500cc engine to approximately 68% Import tax

- Reduce the taxes on 2013-2016 (newer than 4 years old) vehicles with a 2000cc engine to approximately 85% import tax

- Ban the importation of all motor vehicles older than 2008.

Assumed challenges with the new proposed tax structure:

- 2013 to 2016 vehicles normally cost high prices overseas and then to add 68% or 85% taxes to them will still make them way too costly for the average Guyanese to afford. The import duties paid on these will in most cases still be way higher than the current flat rate structure taxes that we pay on vehicles which are older than 4 years, and since the purchase cost overseas will be higher (based on the newness) and the import taxes will be higher it’s obvious the cost of the cars will be much higher overall and thus be out of reach of the average Guyanese .

- The planned ban on motor vehicles older than 2008 will also have a huge impact on vehicle prices and affordability. The best selling, stocked and affordable vehicles in Guyana range between the years 2002 to 2010 with pricing as follows:

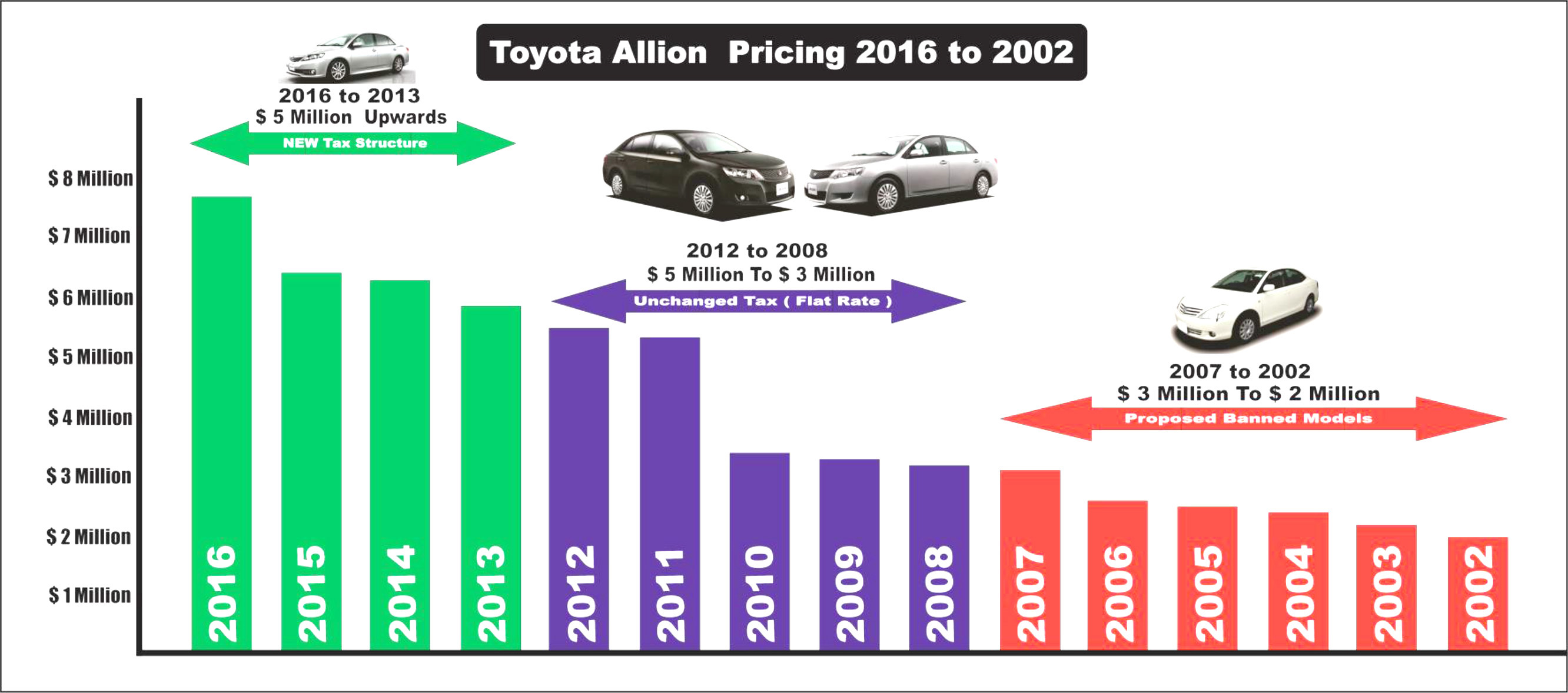

2002 to 2007 approximately $ 2,000,000 to $ 3,000,000 (the majority)

2008 to 2010 approximately $ 3,000,000 to $4,000,000 (a minority)

With the proposed ban we will be removing the two million to three million ranges and basically just leaving the three million up range, which knocks out the most purchased and afforded models currently in Guyana. And since the models that were reduced work out to way higher than these models, the new entry level models will start around the three million range in the Guyana market.

The graph below gives an average idea of how much Toyota Allions will cost from the 2016 models all the way to the 2002 models as calculated by the flat rate tax as in the case of 2002 to 2012 models, and the new tax structure in the case of 2013 to 2016 models. A Toyota Allion was chosen because it’s one of the most popular cars on the market and is suitable for many purposes and applications from families to individuals to executives to taxi drivers to car rentals, etc. So it should be a model that will gave us a good base to examine the various structures and how they will relate to selling price and affordability.

What is also worrying is that the majority of the customers who purchase the 2002 to 2007 models do so based on auto financing either via bank financing or dealer financing, and in most cases these customers barely qualify and barely make the necessary payments. Now to ask them to increase the acquisition cost to three million upwards, will either makes it too expensive for them to afford or forces them to sacrifice financial resources from other key aspects of life in order to afford a vehicle which has become a necessity for many.

Buses, pickups, trucks and canters, provide many services on our roadways and also provide a business income to many persons being vital to many industries and businesses. The most popular ones imported and their approximate prices are as follows:

Buses 2002-2008 approximately 2.2 to 4 million

Pickups 1990-2008 approximately 2.4 million to 5.5 million

Trucks and Canters 1997-2004 approximately 1.7 million to 4.8 million

Similarly these are the affordable models that are available to purchase internationally; as you pass the 2008 year the prices for these vehicles move up tremendously. In addition the older pickups and trucks have unique advantages for Guyana , The older pickup models offer a much stronger suspension setup as compared to the newer models and the regular hinterland operators choose these repeatedly and even claim that the newer models are much softer and can’t make it to some of the locations that the old ones go to in our vast undeveloped terrain. In the case of the canters and trucks, the newer models suffer from diesel fuel pump issues and are very costly to maintain or repair, since the newer ones carry electronic diesel fuel pumps which are mostly unserviceable in Guyana, whilst the older ones use mechanical diesel fuel pumps that are easily fixable in Guyana.

We the auto dealers of Guyana respectfully ask that the tax structure be reconsidered so that the perfect balance can be found between revenue earner, newer models and affordability. We also suggest that discussions be held between the auto dealers, government and all stakeholders to find the perfect balance that meets the needs of all.

Yours faithfully,

Richard Singh

For the Guyana

Auto Dealers Association