The above disclosure was made at the meeting of the Public Accounts Committee (PAC) to discuss the Auditor General’s report for 2015. That report indicated that last set of audited accounts of the City Council was in respect of 2004 and that draft financial statements were received for the years 2005 and 2014, leaving a gap covering the years 2006-2013, not to mention the almost one-year delay in the submission of the 2015 accounts. The Auditor General, however, did not indicate how long the financial statements for the years 2005 and 2014 were with his office and how soon his reports on these statements would be issued.

An examination of the Auditor General’s report for 2014 indicated no change in the status of the City Council despite the Audit Office being in possession of financial statements for the years 2005 and 2007 dating back to 31 August 2013 and perhaps earlier. As at 31 December 2004, the City Council was only three years in arrears in terms of financial reporting and audit, and there were no gaps. Today, it is eleven years in arrears through a combination of neglect on the part of the City Treasurer and the failure by the Auditor General to deliver based on financial statements received to date from the City Council. As a minimum, the Auditor General should have completed his audit for 2005 and demanded the accounts for 2006 before accepting those for 2007 and later years in sequential order.

Parking meters fiasco and lack of financial accountability

In addition, there are concerns about the level of fees charged, resulting in the paid-parking areas being substantially devoid of vehicles during business hours. This action has resulted in in a significant decline in business activity which does not augur well for the overall performance of the economy. Further, there was a lack of transparency in the award of the contract to SCS since no competitive bidding procedures were followed, as required by Section 231 of the Municipal and District Councils’ Act.

No one denies that the City Council is in dire need of financial resources to undertake its various activities, especially keeping the streets of Georgetown clean and restoring the city to its former glory of the “Garden City of the Caribbean”. However, instead of imposing new taxes (which is what the parking meters are about), the Council should have first reflected on the existing tax regime and assess the extent to which citizens are fulfilling their responsibilities in terms of their financial obligations to the Council. Only after this is satisfactorily addressed, and there still remains a significant shortfall in revenues vis-à-vis expenditure, should there be any consideration of new taxes. Given the City Council’s lack of accountability for eleven years, citizens have no assurance that the funds garnered from the operations of the parking meters as well as from other sources of revenue, will be properly accounted for and used in an economical, efficient and effective manner in the furtherance of the activities of the Council.

The introduction of parking meters as a revenue-generating measure is not dissimilar to the actions of Central Government in relation to a series of new taxes imposed with effect from 2017. This column’s assessment is that the Guyana Revenue Authority (GRA) has the potential of doubling its revenue collections under the pre-2017 tax regime, which would have been more than enough to finance the National Budget. Despite this, the Government has introduced several new tax measures, including 14% value added tax on electricity and water, above a certain level of usage. It therefore means that taxpayers who faithfully honour their obligations to the GRA are made to bear the additional taxation burden at the expense of those who have failed or are failing in their obligations to the GRA.

Accountability of the other municipalities

The Auditor General’s comments in relation to the other five municipalities were similar to those of the Georgetown City Council. Linden Town Council was last audited and reported on in respect of the financial year 1984 and was therefore 31 years in arrears in terms of having audited accounts. The Auditor General indicated that financial statements were received for the years 2008 to 2010, and that the audits have been completed and the related opinions were to be issued. However, this comment was made as far back as August 2013 and perhaps earlier, which suggests some laxity by the Audit Office to expedite the issuing of the Auditor General’s reports for these years. This notwithstanding, there remains a gap in financial reporting covering the 23 years, i.e. from 1985 to 2007, in addition to the failure to submit financial statements for the years 2014 and 2015.

New Amsterdam Town Council was last audited and reported on in respect of 1996. The Auditor General indicated that he received financial statements for the years 2006 -2011 and 2014. It therefore means that financial statements for 12 years, i.e. 1997 to 2005, 2012 to 2013 and 2015 remained outstanding. As of August 2013, the Audit Office had stated that the audit for the years 2006 to 2011 had been completed and that the Town Council was to have corrected the financial statement before the related opinions could be issued.

Rose Hall Town Council is 17 years in arrears in terms of having audited financial statements, the last such statements being in respect of 1998. The Auditor General acknowledged having received financial statements for the years 1999 to 2014 and that the audits were being planned. In August 2013, his office had indicated that it had received financial statements for the years 2008 to 2009 and that the audit was being planned.

Corriverton Town Council was last audited and reported on in respect of 2001 and it is therefore 14 years in arrears in having audited accounts. The Auditor General confirmed that his office received financial statements for the years 2002 to 2014 and that the audits were to be planned. In August 2013, his office stated that it had received financial statements for 2008 to 2010 and that the audit was being planned.

Anna Regina Town Council is not in such a bad shape in terms of financial accountability, compared with the other five municipalities. The last set of audited accounts was in respect of 2010. The Auditor General received financial statements for 2014, and therefore there is a gap in financial reporting covering the years 2011-2013.

Conclusion

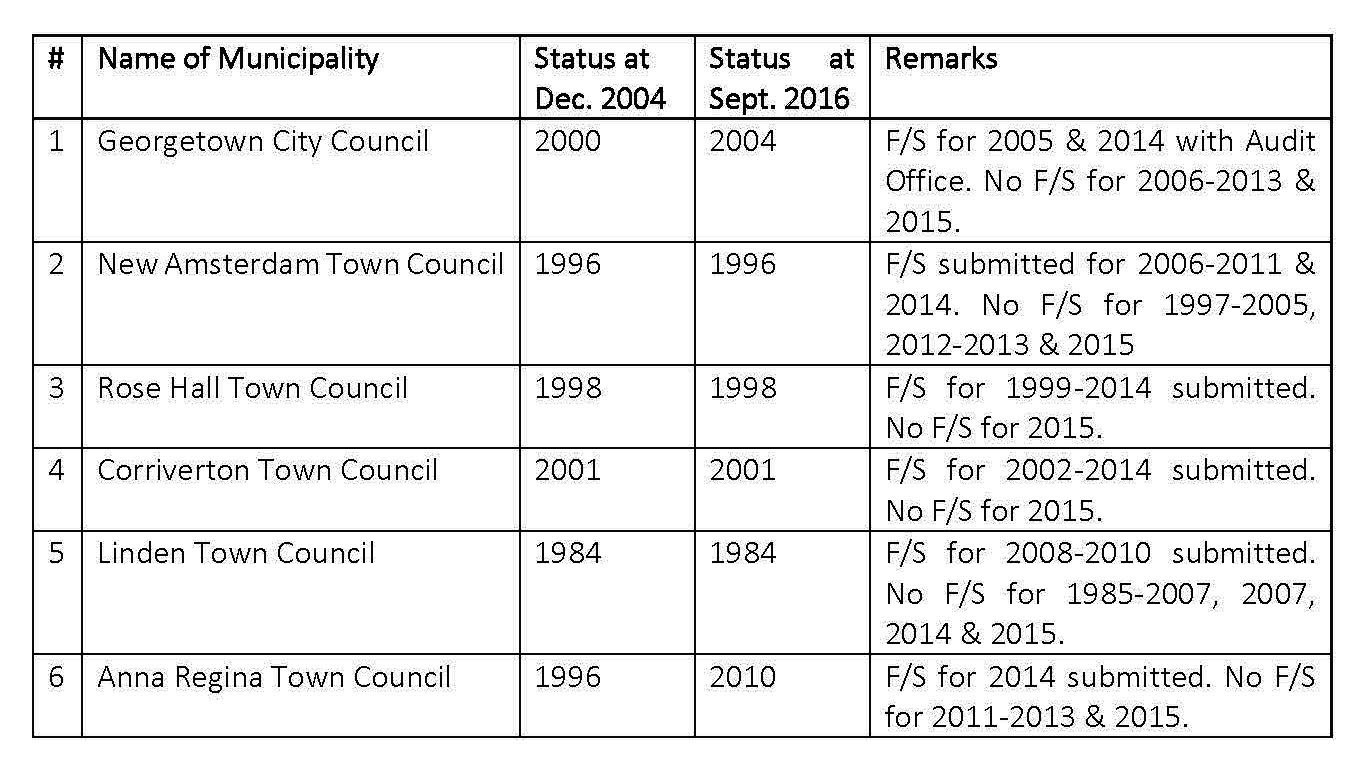

The financial accountability of our six municipalities is in a state of complete disarray and has been an area of total neglect. The following table shows the status of financial reporting and audit as at 30 September 2016 compared with that of 31 December 2004:

Status of financial reporting and audit of the six municipalities

As can be noted, except for Anna Regina Town Council and to a lesser extent Georgetown City Council, there has been no movement for 12 years in terms of having audited financial statements. The Auditor General has in his possession a total of 50 years of accounts to audit, some of which are with his office for a considerable period of time. He therefore needs to expedite the auditing of these accounts. If the Auditor General has difficulty in doing so because of staff constraints, he should seek to prioritize his work in such a way so as to free his office to undertake such audits. This will require contracting out some more of the commercial-type audits to Chartered Accountants in public practice.

Meanwhile, the respective Treasurers should get their act going by preparing financial statements for the outstanding years and submitting them to the Auditor General for audit. The Minister of Communities may also wish to take a more hand-on approach in dealing with the financial accountability of the municipalities.