Guyana exports many products to markets in the Caribbean and around the world. Prominent among its exports are bauxite, fish, gold, rice, rum, sugar and timber. As primarily a commodity-exporting country, Guyana has an interest in the behaviour of commodity markets and the prices in those markets since they have a direct bearing on foreign currency earnings and its ability to meet import needs. This article will examine the trends in the cash flows from export of four of the major commodities exported by Guyana. The four commodities have been significant contributors to the Guyana economy, but could face difficulties as a result of market conditions globally. Monitoring the behaviour of these economic variables and its relationship to the foreign exchange of the country is therefore of relevance to economic decisions that affect economic performance.

The four major commodities under consideration are bauxite, gold, rice and sugar. The idea is to compare the export performance of the four commodities and to identify some of the reasons behind the performances. The comparisons are possible because all the performances are based on the index of revenues that they would have generated over the period. The reference period is 2007 and the data being presented extends all the way to 2015.

It is useful to know also that Guyana participates in the world trade as a price taker. The quantity of each of the four commodities that Guyana exports is insufficient to cause world prices to change. Another way to look at it is the withdrawal of exports from Guyana would not affect world prices. The performance of the commodities is therefore of greater importance to Guyana than it is to the rest of the world. In this regard, the index for all four commodities reveals that foreign earnings have risen 75 per cent over what they were in 2007. When gold is removed from the index, foreign earnings only rose 42 per cent revealing the significant impact that the precious metal has on the foreign cash flows and the Guyana economy as a whole. By 2015, cash flows for all commodities, except gold, had slowed considerably. Tables will be provided for the best and worst performing commodities.

Gold

The examination of the issue starts with gold. Gold’s importance to Guyana, as with the other commodities, stems from the role that trade plays in the economic growth of the country and in generating foreign currency, government revenues and contributing to the wealth of individuals. Most Guyanese would know that the strongest performing export for Guyana is gold, as could be seen from Table 1 below. The performance has been so strong that gold prices have never fallen below the price that marks its reference period. Even though prices have moved up and down during the period of review, gold has given Guyana hope by maintaining a strong export performance even in the face of some serious challenges. Gold revenues grew 29 per cent in 2008 and by 78 per cent in 2009. Gold revenues then took off in 2010 bringing in 118 per cent more foreign earnings than it did in 2007. As a consequence of its strong performance, gold was bringing in 228 per cent more revenues in 2011 than it did in the reference year of 2007. The revenue trends, no doubt, had become obvious to many and gold output and exports rose significantly. As a consequence, gold output rose by 45 per cent in 2011 and by 90 per cent in 2012.

TABLE 1

The best year for gold exports was 2013 when it rose 100 per cent over the exports of 2007. However, the best year for gold revenues was 2012 when it was able to bring in 359 per cent more export income than it did in 2007. One should note with interest that exports declined 20 per cent thereafter in 2014 after peaking at 483,000 ounces in 2013. Revenues declined seven per cent in 2015 on account of an eight per cent decline in prices. The World Bank is projecting that gold prices were likely to fall below the 2015 level this year and next year. The principal causes are a stronger US dollar and higher real interest rates. Output would therefore have to remain strong in order to maintain revenue levels.

Rice

The rice revenue index reveals that rice has become a very important contributor to the foreign exchange earnings of Guyana. While it did not perform as well as gold, the contribution of rice was very significant and just as admirable. The year 2010 was largely a very favourable one for rice as it was for gold and even bauxite which will be discussed next. Guyana was able to double its foreign receipts from rice in 2010. Rice was also able to maintain a positive growth record throughout the review period. Foreign receipts from rice grew 47 per cent in 2008 and by 55 per cent in 2009. Rice was able to maintain the positive growth for seven consecutive years owing to a combination of strong growth in output and prices. While rice production peaked in 2013, revenues peaked in 2014. The favourable performance of rice is attributed to the special trade arrangement that existed under the PetroCaribe programme. Rice markets are often influenced by what happens in places like Thailand, Vietnam, Indonesia and the Philippines which are among the largest exporters in the world. The World Bank noted that rice prices declined in 2016 as a consequence of a glut of the commodity on the world market that resulted from the production performance of the four aforementioned countries. The World Bank further expects the stock-to-use ratio of rice to remain stable thus causing very little movement in prices. Consequently, the world prices for grains of which rice is a part were expected to remain depressed throughout 2017 and 2018.

Bauxite

The export performance of bauxite has been extremely variable when compared to the other commodities. Even though for the most part, revenues have been able to stay above that of the reference year, it has not been as robust as in the case of gold and rice. The best year for bauxite was 2012 when revenues exceeded those of 2007 by 49 per cent. The positive winds of change began to blow in 2010 when revenue receipts from bauxite grew 12 per cent over 2007. The positive trend continued in 2011 and carried all the way through to 2015. The growth in foreign revenues from bauxite reflected a 38 per cent increase over 2007 in 2011 and a 35 per cent increase in 2013 following the strong performance of 2012. Revenue growth slowed to a 24 per cent increase in 2014 and declined precipitously to four per cent in 2015. Interestingly, the output of bauxite has been declining. Compared to where it was in 2007, bauxite output fell 24 per cent in 2013, 28 per cent in 2014 and 32 per cent in 2015. It was therefore favourable price movements that enabled the commodity to turn in positive revenue numbers. The World Bank anticipates that prices for bauxite will be relatively stable, thus enabling the country to generate stable revenues from the product.

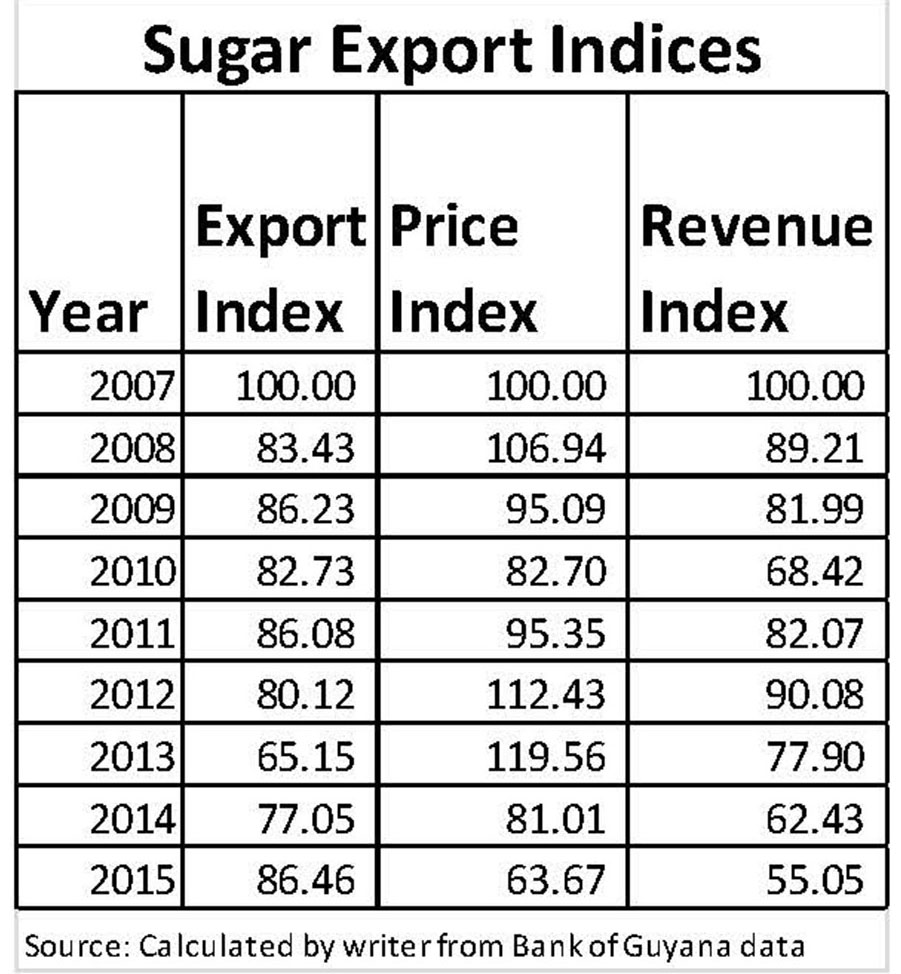

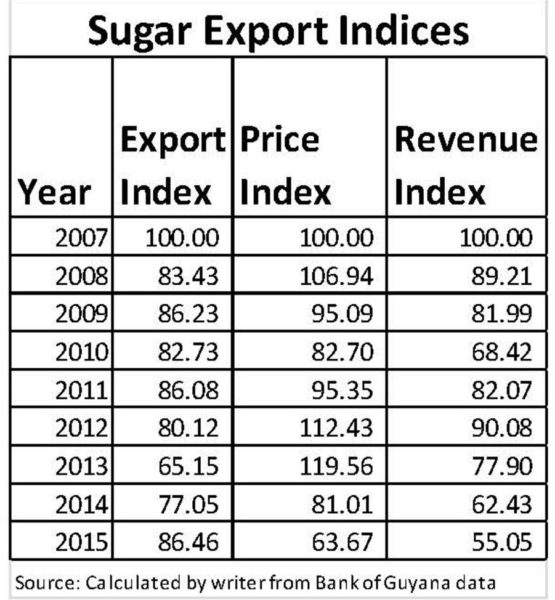

Sugar

Sugar is the only product that seems to be facing severe challenges in bringing in foreign earnings. Revenues from sugar consistently declined over the period 2007 to 2015. Revenues declined 11 per cent in 2008 and by 18 per cent in 2009. The trend worsened in 2010 when sugar revenues declined 32 per cent. Sugar revenues never stopped falling below its 2007 level and recorded its worst revenue performance in 2015 when revenues reached 45 per cent below what it earned in the reference year. Sugar’s woes stem from both quantity and prices.

Export quantities declined 14 per cent over the nine year period from 2007 while prices went down 37 per cent. As a consequence, the cash flow from sugar in 2015 ended 45 per cent below the level at which it was in 2007. According to the World Bank data, the trend for sugar prices will not rise above US 18 cents over the next four years and if there is not a change of fortune could fall even further by 2025.