Part 5

Last week the Bank of Guyana announced via one of the local daily newspapers that the foreign exchange market

It is still useful to continue the discussion about developments in the FX market, mainly because this market signals and aggregates the general economic and political feelings in the society. One of the reasons proposed by government officials and the central bank for causing the depreciation is the purchase of hard currencies by Caribbean nationals from local cambios.

I do not find this to be a plausible or fundamental cause for various reasons. First, we have seen that 2011/2012 is an important turning point in the macroeconomic data, suggesting that the present weaknesses are caused by events over the past five years. I argued these are mainly political uncertainties generated by the conflict between the two main factions inside and outside of Parliament. These uncertainties will eventually dampen business and consumer optimism. They also dissuade foreign investors as the data below clearly show.

Second, when we think about trading of foreign exchange, we do not mean trading a fist full of US dollars, euros or Canadian dollars. Most foreign exchange transactions involve the exchange of one country’s bank deposits for another. They are essentially electronic transactions. Therefore, if Caribbean nationals were indeed putting pressure on the exchange rate, it had to be done via large scale exchange of Barbadian, Trinidadian, and Suriname currency bank accounts for US dollar accounts drawn on banks locating in Guyana. This would most likely be led by the multinational Caribbean banks that are based in several territories of the Region. It is not particularly difficult to control these bank arbitrage exchanges via moral suasion or a stick.

Furthermore, it is unlikely that cash transactions from people

Third, and relating to the previous point, the quantities purchased and sold continue to be dominated by the six commercial banks. In both 2015 and 2016 non-bank cambios accounted for just over 3% of purchases and the commercial banks accounted for the rest. The same pattern holds with respect to sales: non-bank cambios sold around 3.4% of hard currencies for both 2015 and 2016, while the banks account for the dominant share.

This is important because since the six commercial banks account for close to 97% of foreign exchange transactions, the BOG has a much more centralized oligopolistic market to persuade in the direction of policies meant for stabilizing the rate (Mr Sukrishnalall Pasha and I published a paper on this exact issue in 2012). A decentralized competitive market would make targeting or managing the exchange rate much more difficult. It is clear that Guyana does not possess a decentralized competitive FX market.

Finally, the underlying weakness in the economy is also showing up the capital account of the balance of payments, which records Guyana’s transactions with the rest of the world. In column 2 we examined the trend of the current account balance, which improved from 2012. We attributed the improvement to lower oil price and weakness in the production economy that diminished the demand for import of machines and other capital goods.

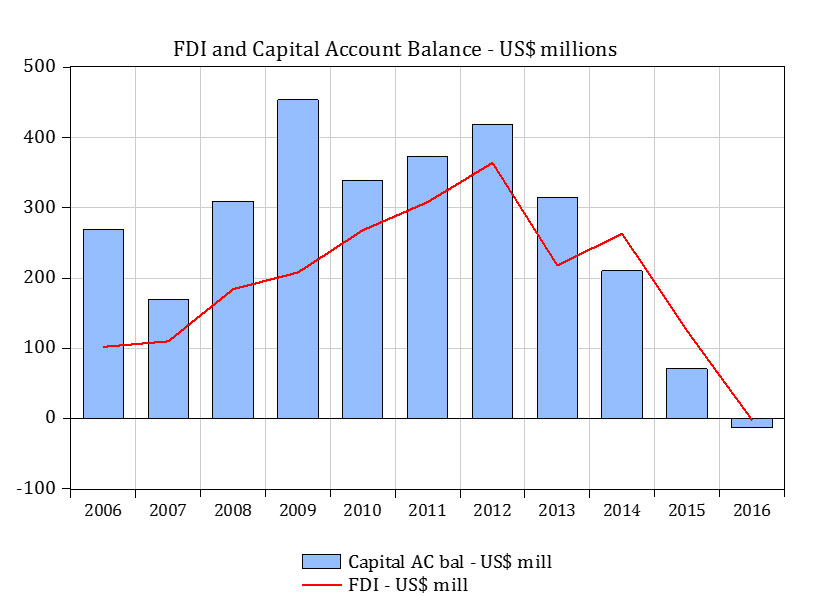

The chart presents the trend of the capital account balance over the 2006 to 2016 period. While the current account records things like exports, imports, remittances, etc, the capital account records new debt disbursements, official aid to government, foreign direct investments, short-term money flows and a few more.

The chart indicates that over the review period, the capital account recorded a surplus for each year, except in 2016 when a deficit of US$13 million was recorded. The highest surplus of US$454 million occurred in 2009. It subsequently declined but increased to US$418 million in 2012. Thereafter the capital account surplus fell to US$71 million in 2015 and turned negative US$13 million in 2016 (the bars).

The major contributor to the decline is the dwindling foreign direct investments (FDIs) since 2012 when the recorded amount was US$363 million (see line chart). It rose somewhat in 2014, but declined significantly in subsequent years. By 2015 foreign investments dropped to US$125 million and further plunged precipitously to negative US$1.8 million in 2016. This is the only negative foreign private investment over the review period 2006 to 2016. I have been tracking these numbers since my employment at BOG from 1996 to 2000. This is the first time I have seen a negative net FDI.

The data presented in this column and previous ones clearly suggest that private investor sentiments are weak. This is reflected in the decrease of FDI and domestic private investment since 2011.

As I implied in a previous essay, the APNU + AFC government triggered the foreign exchange pressure because of several anti-business measures since May 2015. I will explain this in greater detail in the next essay.

Comments: tkhemraj@ncf.edu