Focus and attention

The national economy is usually divided up into four sectors, namely, agriculture, mining, manufacturing and services. Forestry and fisheries are usually joined with agriculture while mining is usually paired with quarrying. These sectors contain several industries which form the backbone of Guyana’s productive capability.

Guyana heads to the New Year with the economy still in positive territory, but with some risk of a downward trajectory from parts of the economy that performed very poorly in 2016. Clearly, the economy is not firing on all cylinders and if decisive action is not taken, the poorly performing areas of the economy could continue in 2017 and drag the economy down further. Those areas need some focus and attention.

Stability and durability

In a market economy such as Guyana’s, both wages and profits need to grow in order for a business to be deemed stable and healthy. Stability comes from worker satisfaction and motivation and their unwillingness to disrupt the operations along the value-chain. When workers are satisfied, they help to protect the enterprise and work to ensure that it remains healthy. Under a philosophy of liberalism, profits must grow for a business to remain in existence. Durability, the concept of the going-concern, is linked to economic growth and profitability. It is also linked to the environment in which business takes place. Frequent disruptions in electricity supply, constant flooding and a perceptively unsafe and corrupt environment influence what happens to growth and profitability of business enterprises. Perceived hostility to an industry or a major enterprise in that industry can also disrupt growth and profitability and lead to a sudden withdrawal of capital from the economy. It is through the prism of stability and durability that this article will examine the prospects for some industries in the Guyana economy as the New Year comes upon the nation. The lengthy treatment of the subject causes the article to be presented in two parts.

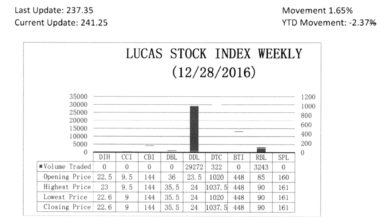

The Lucas Stock Index (LSI) rose 1.65 percent during the final period of trading in December 2016. The stocks of three companies were traded with 32,837 shares changing hands. There were three Climbers and no Tumblers. The stocks of Republic Bank Limited (RBL) rose 5.88 percent on the sale of 3,243 shares. At the same time, the stocks of Demerara Distillers Limited (DDL) rose 2.13 percent on the sale of 29,272 shares and the stocks of Demerara Tobacco Company (DTC) rose 1.72 percent on the sale of 322 shares.

Government and private sector

The investments in the four sectors referred to above are controlled by government and the private sector. Even though spending by the two sets of actors accounts for about one-third of the economy, their decisions are far-reaching.

They affect employment and profits throughout the economy.

Together, employment and profits account for household spending, savings and government revenues. Therefore, it is the decisions and actions of government and private businesses that determine the trajectory and progress of the economy and to a large extent what government can do to help. These decisions could be made separately as is often the case and, on occasions, jointly. Consequently, when one thinks about the Guyana economy, one must think about its binary ownership and how that ownership can shape the wealth and well-being of the people.

The responsibility for thoughts and actions for the economy in 2017 therefore falls upon both the government and the private sector. A stable and healthy relationship between the two is critical to economic and social success in Guyana.

In considering the action that should occur by both the government and the private sector, it would be important to keep in mind some very critical data that the government shared with the people during the budget presentation. It was pointed out that forestry was experiencing a 33.3 per cent decline in output. Milk production was dropping by 19 per cent and that sugar production was going to do no better with a decline of 18.7 per cent in its output in 2016. Rice was projected also to decline by 12.8 per cent while construction declined by 7.3 per cent.

The manufacturing sector is expected to decline by 7.1 per cent. The livestock subsector is expected to decline by 5.1 per cent. Good things happened in the economy in 2016 and were expected to continue into 2017. But with three-quarters of the sectors facing some kind of serious challenge, there is very little time to bask in the small glories of the recent past.

The troubled industries exist now and cannot be replaced automatically by others. Even with the promulgation of a new development focus, the emergence of new industries will take time. Consequently, some specific action is required to change the economic fortunes of the troubled industries. Since the government has direct ownership of some of the industries, what it does to fix these problems would be reflected in decisions about, and by, its public enterprises and its public service.

Combination of circumstances

Through a combination of circumstances, including security concerns, monopoly conditions, market failure and an outdated policy of nationalization, government finds itself in control of some key industries in the Guyana economy. The Guyana Sugar Corporation (GuySuCo), the Guyana Oil Company (GUYOIL), the Guyana National Printers Limited (GNPL), the Guyana National Shipping Corporation (GNSC), and the Guyana Power and Light (GPL) are key public corporations that were the result of nationalization.

These organizations are identified by the government as income-generating enterprises which mean that stability and durability are important factors in their business models. The satisfaction of workers and achieving growth and profitability are critical to their success in 2017.

Several of the aforementioned public corporations fly under the radar because they do not generate as much political attention as others. Public ownership is justified on the grounds of national security and market failure as well. As it is presently configured, oil is very critical to the Guyana economy.

Both stability and durability of enterprise would be threatened if oil supplies were disrupted as was the case in the 1970s and 1980s. One should not discount the importance of oil as a factor that was responsible for pushing many Guyanese to leave these shores during a period of unreliable electricity supply and rising transportation costs. Its impact on the disruption of electricity supply, and hence healthcare, education and production, was dominant.

Market failure is largely responsible for GPL being a public enterprise as it is with all the power utilities found in different parts of Guyana. It is difficult for private investors to operate efficient and cost effective generation and distribution systems in some of the far flung and lightly populated parts of Guyana.

Some countries, including the USA, have dealt with this problem by enabling rural communities to form cooperative societies that operate electric utilities at either the generation or distribution end of the electricity value-chain. It is the same situation with the GPOC which has the responsibility of ensuring that mail reaches those who must get it whether they live near or far. Most of these enterprises rely on demand from the internal market for survival. Some public enterprises like Guyana Rice Development Development Board (GRDB) provide critical institutional support for local farmers to serve foreign markets.

Important roles

As one can see, the government plays important roles in all three at-risk sectors through its involvement in the sugar industry, support for the rice industry, control of the oil industry, participation in the shipping industry, the generation and distribution of electricity and water, and investment in public infrastructure.

One of government’s first tasks is to ensure that those industries perform well or operate in ways that can add value to the economy. While many public enterprises may enjoy some dominance, their performance also impacts the contribution of the private sector. Chief among them are oil, shipping, electricity and water. Given the compromise reached by OPEC and some non-OPEC countries for future oil production, oil prices are expected to rise in 2017.

Oil prices will affect the other three industries. This is likely to push up the price of imports, the cost of generating electricity and providing water. It is critical to pay attention to the threat from inflation to both public and private investment. With so many households depending on oil and gas, their budgets will be affected adversely too.

Hardest hit

The presentation to the nation revealed that it was the agricultural sector that was the hardest hit and therefore needs to receive significant attention in 2017. Of the many government enterprises, it is only GuySuCo that depends mostly on external markets to justify its existence.

The discontent of workers affects the stability of GuySuco and the politics that surrounds it affects its durability. The sugar corporation has lost millions of man-hours over the last 10 to 15 years. The government controls GuySuCo on behalf of the true owners, the Guyanese people. The durability of GuySuCo is linked to its ability to grow its output and profitability.

If one understands what the GDP is, it will be plain as day that GuySuCo has contributed nothing or very little to the economy over the past five years. It has not been able to grow and it has not been able to be profitable. GuySuCo’s business model has always been built on serving a foreign market. It is unable to do that effectively now in a liberated global sugar market. By selling sugar at a loss, what GuySuCo is doing unnecessarily is transferring much needed resources from Guyana to foreign consumers.

It makes no business or economic sense to do that in light of the risk of a crisis in the agricultural sector. It makes no political sense either since Guyanese will not tolerate the endless misuse of their tax dollars. In 2017, GuySuCo needs to pursue activities that utilize its resources better so that it can grow its output and profits and add value to the Guyana economy.

In contrast to sugar, rice production is dominated by private growers and millers. On the supply side, they receive tremendous support from the National Agricultural Research and Extension Institute (NAREI). On the demand side, they receive support from the GRDB. Unlike sugar, rice has been adding value to the Guyana economy. The aim of any policy should be to ensure that rice can continue to add value to the economy. The growth and transformation of the rice industry must be encouraged.

(To be continued)

As Guyanese ponder their actions for 2017, I would like to take this opportunity to wish everyone, especially the readers of Stabroek News and its Business Page, a happy, healthy and prosperous New Year.