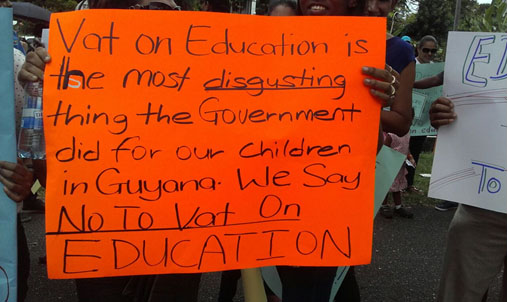

Scores of administrative staff, parents and students came together under the ‘Guyana Private Schools United’ platform yesterday to protest the tax on private education.

The protestors assembled in front of the Ministry of Finance for the first of what is intended to be a weekly protest.

The Guyana Private Schools United is about one month old and constitutes private schools, including Mae’s, Green Acres, Chase Academy, Apex, Saraswati Vidya Niketan, and School of the Nations.

Taslikyah Fox, Academic Director of School of the Nations, which had started a petition calling for government to remove the tax on private education, stated that one of the reasons for the protest, aside from the group not being in support of the tax, was that the response they received from government in relation to the petition was unsatisfactory.

Fox said that the petition was delivered to the ministries of Education and Finance as well as the Ministry of the Presidency, but other than a response acknowledging its receipt, there had been no reverse in the decision.

“…It’s not the case where the schools could absorb the VAT or should absorb the VAT because they are just agents for the state to collect the VAT and remit it to the government, so this is a tax on parents and it’s a tax on children and students because it’s not only the ones that in the lower school but it’s also those who’re doing tertiary education, if you’re doing your Masters or a post-grad, you have to pay an additional VAT. To me, education should be tax-free,” parent Andrea Bryan-Garner stated.

Jonathon Yearwood, who is currently involved in a Masters of Business Administration programme at the Nations University, said that the tax may require him to adopt a change in lifestyle in order to go on funding his educational pursuits. “As a working person who now has to go in their own pocket to find that extra 14%, it’s extremely difficult… It takes your whole budget and throws it out of the window because you now gotta go back to square one, back to the drawing board to sort out your budget. How are you going to find this extra money? And for me it’s not a small amount, it’s a very large amount of money I have to find in addition to the 14% that’s now being added on to it…,” Yearwood stated.

Protestor Nyall Jodhan expressed his belief that government had not taken a holistic approach to the issue, but rather a “lazy” one.

“I think the government needs to address the way the schools are being taxed or not being taxed and ensure that that is put into place so even though it may see an increase in school fees to the parent, at least this doesn’t mean that an entity is escaping taxation,” he explained.

Another parent, Sharon Lalljee-Richard, echoed Jodhan’s sentiment. While she shared that she at the moment would not be impacted by the tax as she took her nursery-aged child out of the private education system, Lalljee-Richard said she may very well resort to enrolling her into a private school again for her secondary education given what she described as “inaccuracies in the education system.”

“…Nobody is refuting that the government needs to make money, but if it’s the case of you looking at a private school as a business, a money-making entity, they are more than eligible for taxation just like any other business. Put your efforts into ensuring that those people have transparent systems, audit them if you feel you need to, but don’t put VAT on education because VAT is passed on to the parent,” Lalljee-Richard stated.

“My reason for being here is to try to encourage other parents—parents particularly with children in the private school system to come out—stop sitting down and taking everything that government gives to you, and I am talking about any government… Those governments, they have to remember that they are there to serve the people and in order to serve the people, you have to start from a standpoint of genuinely caring and understanding their circumstances in order to properly serve them and I believe that this is not what government is doing and I would like to urge all parents to come out and stand for this issue of VAT on education. It is utterly unacceptable,” the woman added.

Private education became subject to VAT on February 1, following the removal of zero-rated items as a measure of the 2017 national budget.

Earlier this month, President David Granger announced that VAT on education will remain in place for the time being, while noting that only eight out of 57 private schools in operation are currently tax compliant.

Minister of Finance Winston Jordan soon after clarified the president’s statement, saying that non-compliance had nothing to do with the implementation of the taxes. The taxes he said, were a way of broadening the tax base and reducing the tax rate. He said he anticipated some $350 million in revenue from the industry and that only private schools that earn more than $15 million a year and are registered for VAT will be expected to charge the tax. The tax, he also clarified, is not being applied to education or education supplies, but to tuition fees payable to private schools.

The protest will convene again at midday next Wednesday.