Benefits special to all

It should be clear from the preceding discourse that the hog of government’s money intended to deliver benefits to Guyanese goes to special purposes or special needs. These special expenditures are part of the distributive and redistributive policies of government. The distributive policy focuses on expenditures on issues that are special to all, dealing with matters aimed at facilitating individuals to act in a certain manner or to move in a particular direction. For instance, if government desires to increase investments in the agricultural sector, it will ensure that the infrastructure was in place that made it possible for interested persons to undertake the investment.

Policy actions are designed to create and present an attractive and friendly environment for investors, enticing them to invest in the sector. Benefits that are available to all individuals in society, although not designed to serve all individuals all at once are described herein as benefits special to all. For example, the bridge across the Demerara River might never be used by someone living in the Rupununi area, but the bridge is there for whenever that person wants to use it. Similarly, the judicial and educational systems are there for all persons to use but some persons might never use them. That is also the case with the public roads and public health system. They are there for all to use but don’t necessarily have to be.

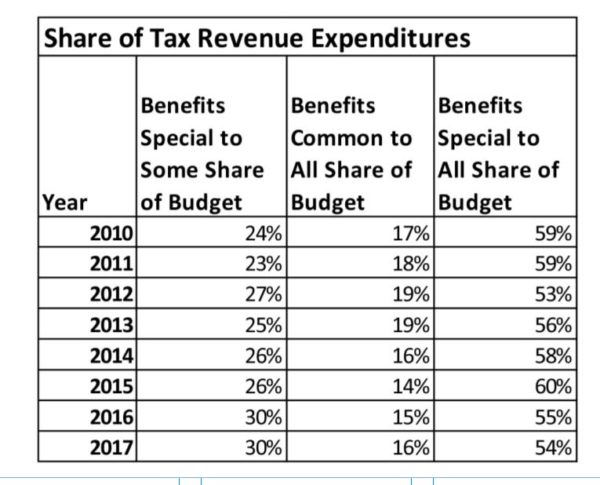

The share of tax revenues spent on policies that provide benefits special to all individuals in society are significantly greater than the share spent on benefits common to all or even those special to some over the period 2010-2017. An average share of 57 percent of the budget was allocated to policies aimed at providing benefits special to all over the period in review. This heavy focus on distributive policies therefore suggests that government places more emphasis on policies special to all Guyanese citizens. Despite this heavy emphasis, disputes can arise as a consequence of the focus of the investment. For example, the location of the bridge across the Berbice River did not enjoy consensus. The bridge was expected to generate greater economic and social benefits to East Berbice if it was placed closer to New Amsterdam. After all, the purpose of investments that are special to all is to enable individuals and groups to function in society by facilitating their activities. Government also facilitates activities of individuals through the provision of services in various sectors including housing, water, infrastructure, postal services and the legal institutions. The provision of these benefits by Government ultimately results in enhanced living standards for members of society.

Table 2 below gives an indication of the revenue allocations for the provision of benefits special to all, common to all and special to some. It is clear from the comparative data that, on average, 26 percent of the annual budget was spent on benefits that are special to some, 17 percent was spent on benefits that are common to all individuals and 57 percent was spent on benefits special to all individuals, with the largest expenditure on benefits special to all.

Slippage

Despite the large budgetary allocation to benefits special to all, there has been some slippage in the investment over the years. There were equal years of decline and increases for allocations special to all. The declines were noticeable in the following three years 2012, 2016, and 2017 while the increases occurred in 2013 through 2015. Allocations between years 2010 and 2011 remained constant. However, the years of decline had a greater effect than the years of growth on the overall budgetary allocations of benefits special to all over the eight-year period. As a consequence, the trend in allocations was in a downward direction. Benefits special to all allocations reached its highest for the period in 2015, representing 60 percent share of budget. However, thereafter, these benefits began to decline culminating in a five-percentage point decline in 2016 and a one-percentage point decline in 2017. Prior to 2015, the largest share of budgetary allocation was in 2010 and 2011 which both stood at 59 percent. In looking at the decline in 2016 and 2017, one might observe a divergence between the rhetoric of the government and its actual budget allocations to things like infrastructure development, education and healthcare.

Benefits special to some

The redistributive policy focuses on expenditures that are special to some people or businesses. They are typically concerned with governmental actions that deal with equity within the society. These governmental actions aim to facilitate the activities of specific groups of individuals, regions or sectors within the society and enable them to improve their own welfare or, in the case of businesses, to expand national output. For instance, government spends money to boost specific sectors such as tourism, agriculture, mining and the distributive trade. Government also gives money to each of the 10 Administrative Regions to address the specific needs of each Region.

In comparison to the share of tax revenues spent on policies that provide benefits special to all, budgetary allocations spent on policies that provide benefit to some are significantly lower for the period 2010 to 2017. However, benefits special to some are higher than allocations towards benefits common to all. Over the period, an average of 26 percent share of the budget was allocated to policies directed at benefits special to some individuals, suggesting that an increasing amount of attention is being placed on policies that provide benefits special to some than those aimed at providing benefits common to all.

There has been a minute overall increase in benefits special to some over the period, with three years of decline (2011,2013,2015) and four years of growth (2012,2014, 2016 and 2017). It is clear that the growth in allocations had a greater impact on the overall budgetary allocations over the period under observation. Benefits special to some reached an all-time high for the period, representing 30 percent of budget allocation in 2016 and 2017. Prior to these years, allocation to these benefits averaged 25 percent, signifying a five-percentage point increase in benefits special to some from 2016. This therefore suggests that Government is placing more emphasis on policies aimed at providing benefits to some. Prior to these increases in 2016 and 2017, the largest share was in 2012 which stood at 27 percent. It may be fair to say therefore, that the five-percentage point decline in 2016 and 2017 of benefits special to all has been re-distributed to benefits special to some.

Likely increase

One reason for the increased allocation to redistributive policies might be the attention being given to hinterland development. Government gives substantial amounts of money to hinterland development. This emphasis on hinterland development is in part driven by the two decades on Indigenous People that was adopted by the international community. With the International Decade for People of African Descent, it is expected that allocations for activities special to some were likely to increase in future budgets.

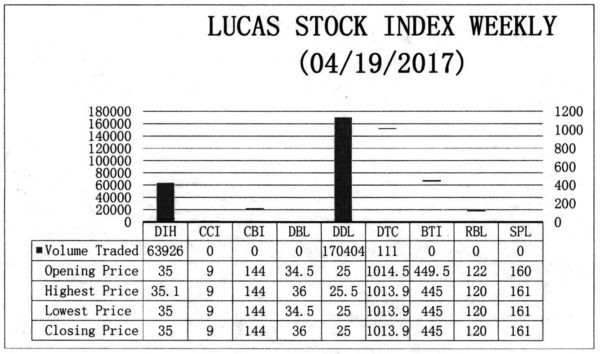

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) fell 0.01 percent during the third period of trading in April 2017. The stocks of three companies were traded with 234,441 shares changing hands. There were no Climbers and one Tumbler. The stocks of Demerara Tobacco Company (DTC) fell 0.06 percent on the sale of 111 shares. In the meanwhile, the stocks of Banks DIH (DIH) and Demerara Distillers Limited (DDL) remained unchanged on the sale of 63,926 and 170, 404 shares respectively.