Members of the tax reform panel set up by former President Donald Ramotar in 2011 yesterday listed unfavourable regimens which should be addressed and adverted to the findings of an international study which showed a concentration of tax collection from a limited number of taxpayers.

Ronald Alli and Clifford Reis in a presentation to the Private Sector Commission (PSC) also said that the study by the Duke Center for International Development of Duke University in the US had determined that there was weak tax analysis and tax policy formulation capacity in the Guyana Revenue Authority (GRA) and the Ministry of Finance. Furthermore, there was underutilization of the detailed data available in the Total Revenue Integrated Processing System (TRIPS) leading to weak monitoring and evaluation of the GRA by the Ministry.

While cautioning that the presentation was not intended to identify solutions or establish recommendations, they noted unfavourable tax incentives and profferred the following suggestions:

(i) reducing the commercial Corporate Income Tax (CIT) rate to 30%,

(ii) lowering the Individual Income Tax (IIT) rate for middle-income earners to 20%,

(iii) the government paying down up to 10 percentage points of the NIS contribution by employees with incomes below the threshold,

(iv) raising the IIT rate for high income earners to 35%,

(v) introducing withholding taxes on individual services to businesses that mimic the PAYE withholding, and

(vi) tightening up on import exemptions and fraud.

Alli and Reis said that the data gathered points to a relatively stagnant formal sector with much of the growth in activity, particularly in terms of numbers of business entities coming outside of the formal sector. The two focused on identifying key tax factors that could be discouraging the growth of the formal and complaint taxpayers.

These factors include:

(a) CIT rate for commercial corporations at 40%, exceeding the top IIT rate of 30% which encourages the rapidly growing trading sector to do business as unincorporated business, mostly in trade. At the same time it said that self-employed IIT taxpayers have declined. Unincorporated businesses, the duo argued, tend to keep weaker sets of books and records than audited corporate entities.

(b) The high tax rate of 30% on middle income earners (above the threshold, but below the NIS maximum contributing income) allied with the 14% NIS contribution tend to discourage the creation of formal sector employment.

(c) The import-based economy largely driven by external remittances and financing, favours individuals either importing directly for their own use or importing for trading purposes as unincorporated businesses. The duo said that the latter is evidenced by the rapid growth in individuals involved in importation.

Immediate

The two committee members said that their immediate concern was the finding by the Duke Center of weak tax analysis and policy formulation. It said that one example of this was the unavailability of tax data by sector and sub-sector as sought by the committee to pinpoint the groups contributing to tax collection and those benefiting from tax exemptions, remissions or waivers.

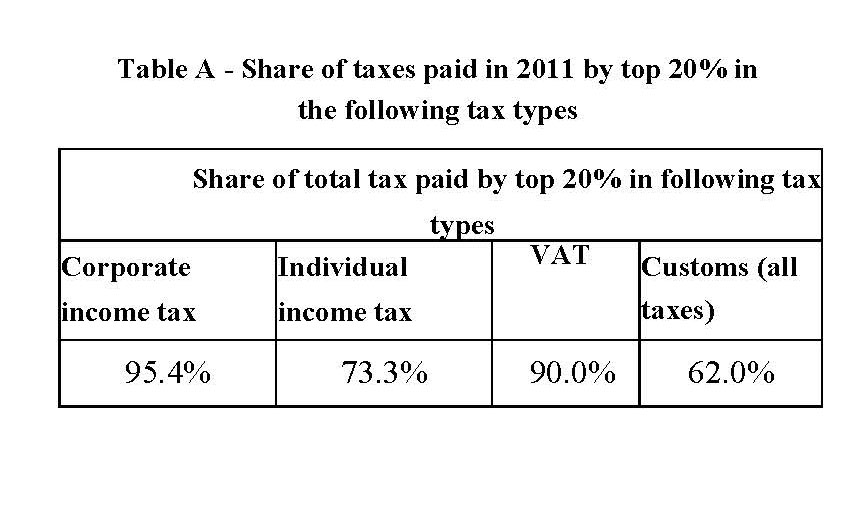

It said that the data obtained by the Duke Center consultants reflect a concentration of tax gathering among a limited number of top taxpayers in each category of tax as shown in the table below.

The duo said that the high concentration was supported by the numerical analysis – for example, 9 and 14 taxpayers (2% and 1% of the total of paying taxpayers within the tax type) respectively paid 50% of the corporate income tax and VAT in 2012.

In addition to this concentrated collection from relatively few taxpayers, the more perturbing findings are that for corporate income tax, VAT and self-employed individual income tax the number of taxpayers has been flat or has declined since 2008.

The committee members told the private sector that only amongst individual taxpaying employees (of which about 50% are government employees) and importers were there increases in the number of taxpayers. “Taxpaying employees grew by 16%, corporate importers by 10% and individual importers increased by a startling 40%. This is in the presence of an economy growing at about 4% per year”, the presentation said.

The duo added that at 21% of the Gross Domestic Product, Guyana’s tax burden is comparatively high with respect to other lower middle income economics. With the concentration of tax collection amongst a limited set of taxpayers, the impact is the perpetuation of high tax rates.

“The obvious omission of submitting taxable income data to GRA cannot be overlooked as a contributor to low compliance”, the duo said.

Of the total taxes on imports payable on imports in 2012, a little less than half were exempted.

“While the overall difference is large (a little over half of assessed taxes payable are actually collected after exemptions) the difference for the customs collections (is) even larger at approximately 1/3. What is even more surprising is that the bulk of the exemptions come from the conditional categories. In fact the total taxes exempted conditionally are over 10 times the taxes exempted through trade agreements and other unconditional exemptions. The relevant ratio for customs is around 24 to 1. Given that total tax revenue in 2012 was GS118.3 billion, the total exemptions at the border of GS49.3 billion amounts to 41% of the total revenue Guyana actually collected. Over 90% of this was exempted conditionally and not on account of trade agreements and other unconditional exemptions”, the presentation by the duo stated.

They also cited broader concerns, pointing out that high tax rates being borne by a minority of companies and individuals raise a number of concerns that can undermine tax compliance. This can occur where the high tax rates raise the effective gains from smuggling and other informal trading in goods and services to avoid taxes.

“This unfair trading puts pressures on the formal business to cut corners in complying with the taxes to remain competitive with tax-free goods. Tax efficiency, equity and revenue collections are also all undermined when high tax rates create pressures to exempt select persons from paying these taxes. Additionally, the question is to be asked whether it is the consumers who are bearing much of this tax burden by paying high prices and by the workers who take home lower wages because of the taxes”, the presentation said.

Investigating the concentration of tax collections by tax type, a parallel concern is the issue of reliance on the formal corporate sector for tax collection versus less formal unincorporated or individual businesses.

“It is a common experience internationally that tax compliance is most effective where taxpayers are subject to cross-checks through reliable third-parties that reveal information about their business activities and this information is available to tax authorities. This is generally true for corporate businesses, but not true for small scale unincorporated businesses”, the committee members said.

A concern in Guyana is that this is not happening, their presentation said.

“Some policies clearly encourage the unincorporated conduct of business such as the corporate tax rate, particularly that on commercial or trading activities being higher than that under individual income tax for an unincorporated business doing the same business. In addition, keeping business activity levels below the turnover limits for compulsory VAT registration tends to encourage the splitting or suppression of business activity to give the appearance of being small to avoid the compliance costs arising with VAT registration. This avoidance behaviour is easier as an unincorporated business”, they asserted.