– Demerara Distillers Limited 2007

By Christopher Ram

Introduction

Coincidentally, today’s column was being written when President Jagdeo attacked Mr. Yesu Persaud, former Chairman of the Private Sector Commission and long-time Chairman of Demerara Distillers Limited (DDL) for his lack of knowledge of the tax laws of Guyana during the launch of the Guyana Times. Fortunately for Mr. Persaud it turned out that it was others rather than he who were unaware of the country’s tax laws. All Guyanese should now worry whether this is the level of knowledge on which the country’s revenues and assets are being irresponsibly given away. Regrettably, Finance Minister Dr. Ashni Singh who by law is responsible for the granting of tax concessions shirks his duty to the country on such a critical issue. I am disappointed but not surprised that the often weak Private Sector Commission on whose behalf Mr. Persaud spoke has not publicly defended Mr. Persaud and let the President and Dr. Singh know that such indifference and discourtesy is not good for the Government-PSC relationship or the development of the economy.

We now turn our focus on the 2007 Annual Report of DDL, one of the country’s leading public companies which holds its Annual General Meeting on June 20, after once again delivering its annual report outside the time permitted under the Securities Industry Act (SIA). Business Page of May 28, 2006 had noted that this seemed to be a recurring and embarrassing problem for the group that has both in-house and external attorneys who should feel uncomfortable with this situation.

Managing Vision

Over the years this column has expressed serious concern about this group’s treatment of several legal, regulatory, accounting, transparency, policy and governance matters. Why would a company with an internationally recognised product compromise its reputation by a series of failures including failure to recognise in its report and accounts its insurance arm Demerara Fire and General Insurance Company Inc., to honour an obligation given to the court with respect to certain disclosures under the Companies Act 1991 and to give a credible account of a transaction involving more than US$1 million. Those are serious issues that speak to the culture of the organisation and its directors, a culture that may have contributed to some rather poor decisions by the directors and below-par performance by a majority of its subsidiaries.

Chairman Yesu Persaud deserved neither the disrespect from the President nor the quality of the results of those subsidiaries and, great entrepreneur that he is he needs a board that is comfortable and capable enough to protect him from his exuberance and over-optimism. There has perhaps been no greater visionary for Guyana than the late President Forbes Burnham but instead of his managers reining in his over-exuberance they acted compliantly with dire consequences. The Board comprising well-known names like Bert Carter, David Spence, Rudy Collins and Komal Samaroo needs to consider any lesson they can draw from that national experience. Is the Board aware and comfortable with the fact that several of the local and foreign subsidiaries lose millions of dollars every year even as they no doubt consume valuable and scarce management time? That the St. Kitts subsidiary has lost some $54 million over the past five years, Trinidad $68 million and that Demerara Contractors Limited has lost money in four of the past five years? Topco, on which hundreds of millions were spent and which was expected to make a “significant leap forward” in 2005, made a loss in 2007 and is now operating well below capacity while the US subsidiary that has inexplicably invested millions and millions of dollars on “Trade Marks” is averaging a mere US$10,000 profit per year.

The group’s information technology arm, Solutions 2000, majority control of which was acquired from two directors in what appeared an egregious violation of their fiduciary obligations has made more than $40 million losses over the past five years and one can only wonder how those directors feel about this. The Chairman in the Annual Report indicates that “several options for Solutions are being considered”. There is in fact only one sensible option – return the company to the directors from whom it was bought, at the price at which it was bought!

Performance

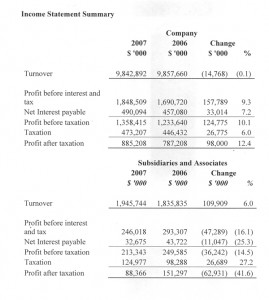

Chairman Persaud described the year 2007 as a good one for the group but the figures hardly justify such an upbeat assessment. The company’s sales for the year increased by 0.1%, a year in which inflation was 14% [and not 13% stated by the Chairman]. Despite an increase in interest payable of 6%, profit before taxation increased by 10% while profit after tax increased by 12%, due in part to a reduction in selling and distribution expenditure by $87 million. On the other hand, the turnover of the subsidiaries and associates increased by 6% to close to $2 billion but profit before tax decreased by 14.5% while profit after tax decreased by an even more troubling 42%. It defies reason that the directors would choose to pay a higher tax rate (45%) on the profits of one of the few successful subsidiaries – Distribution Services Limited – which the directors inexplicably justify as more than compensated for by “economies and efficiencies in reaching customers”! What is unique about DSL that the same “economies and efficiencies” could not be achieved as a division of DDL which is taxed at the rate of 35%? Such action takes away from the cry of the private sector for lowering of the tax rates.

Another of the successful subsidiaries is the European group Breitenstein Holdings BV which reported profits of $54 million, an increase of 17%, part of which is derived from an increase in the exchange rate of the Euro relative to the Guyana Dollar. Breitenstein’s results may however, not be as rosy as it seems with two of its customers making up more than 5% of the trade receivables of the group. One of these with a credit limit of $90 million dollars has a carrying value of $148 million, a very unhealthy sign. Europe is not immune from the economic woes facing all economies and if any of the two was to go sour, that would wipe out most if not the full year’s profits of Breitenstein.

Danger signals

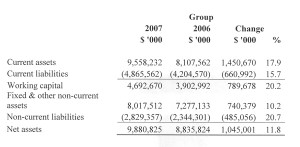

Both the company’s and the group’s liabilities continue to grow reaching $6 billion and $7 billion owing to third parties respectively while cash and bank balances are at their lowest levels for years. Over the past two years alone, the group has had negative cash flows of more than $1.25 billion dollars, a situation that is hardly sustainable, even in the medium term, let alone the long term.

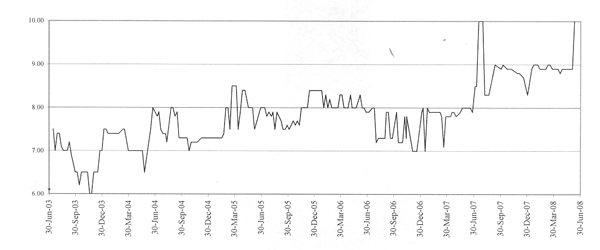

Share Price

The market has not been very kind to the company but the share price ended at $10, the level at which it peaked in July 2007 and its highest ever, after trading last Monday. With the company earning some $1.27 per share, the price earnings ratio, a key investor measure is close to eight which by most standards is quite attractive.

Conclusion

It is clear that the group is facing some serious challenges. In better times, caught up with the flavour of the day, it made some very poor and costly investment decisions including into some over-ambitious ventures in which it has little skill or experience, taking away from its core business and competencies. The group needs a radical restructuring and – before long – a reversal of some strange decisions including posting the group’s de facto No. 2 to Canada, a decision that would be hard to justify to shareholders. The first step to return the company to a new and higher plane would be to repatriate its No. 2 back to Guyana with the mandate of a phased close down of the multiplicity of subsidiaries and a refocus on the business which the company knows best – to make and market rum. It is unfair of the directors to expect Chairman Persaud to continue to carry the relentless workload that such a business demands in an increasingly competitive and challenging environment.

(Business Page is dedicated to providing objective information and opinion on issues of interest to the business community and the public at large. The articles in Business Page are prepared and contributed by Christopher Ram who is the Managing partner of Ram & McRae, Chartered Accountants, Professional Service Firm. This and previous columns can be found at www.chrisram.net)