The Guyana economy has performed reasonably well during the first half of the year according to Dr Ashni Singh, Minister of Finance, and there is cautious optimism about the domestic economy for the rest of the year. This is according to the mid-year report presented to the National Assembly by the Minister on October 27, 2008. However, anyone with a serious interest in the economy and concerned about the several important omissions contained in the mid-year report should read the report in conjunction with the half-year report done by the Bank of Guyana and published on the bank’s website.

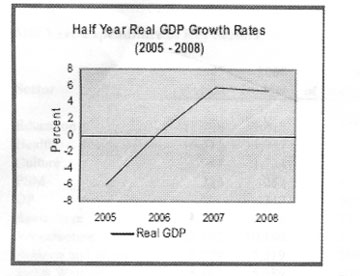

Driven by improved performances in agriculture, mining, engineering and construction, and services, the economy recorded a 3.8 per cent GDP growth during the first half of 2008, but still a sharp decline from the 5.8 per cent growth in the corresponding period of 2007. The Bank of Guyana – using that well-known oxymoron – reports that the manufacturing sector recorded negative growth, due partly to the high cost of inputs − fuel and imported raw materials, challenges to which the sector is no stranger.

Source: Bank of Guyana Half-year report 2008

Revenue and expenditure

On central government revenue and expenditure, the mid-year report presents some interesting information. Value-added and excise taxes were budgeted to increase by 12.8% from the $36.7 billion collected in 2007 to $41.4 billion in 2008. For the half-year actual collections amounted to $17.8 billion (43% of full year) compared with the $17.1 billion collected last year. On a period by period comparison these collections represented a marginal increase in value-added tax to $11 billion from $10.2 billion, although excise tax collections declined to $6.7 billion from $7 billion.

Internal revenue collections amounted to $19 billion in the first half of 2008 compared with $17.4 billion collected last year. The bulk of such revenue comes from a handful of companies, including the commercial banks, telecommunications companies and Banks DIH, DDL and DEMTOCO. Despite the many unincorporated businesses, the self-employed category pays less than one billion dollars in taxes, or just about 15% of the taxes paid by the employed persons.

While both reports indicate significant growth in key sectors, tax revenues have not risen correspondingly and one is left to wonder whether this is a case of generous tax concessions or continued tax evasion within key sectors.

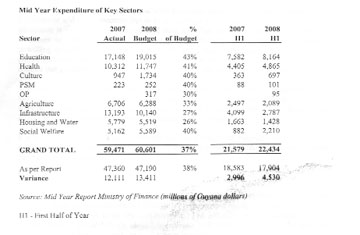

But it is in relation to expenditure that the picture is particularly interesting. And while the Minister in his report did not discuss the table which contains several errors, it must now be a matter of speculation why only 38% of the full year budget has been expended in what the table itself describes as key sectors. Particular attention is drawn to the Health, Infrastructure and Agriculture sectors where only 41%, 27% and 33% respectively, have been spent in the first half of the year. Are we going to see a mad and irresponsible rush to spend during the second half of the year, simply because the money has been allocated?

Debt

The mid-year report deals very inadequately with external debt and omits completely any information on domestic debt which has been rising alarmingly over the past several years. The Bank of Guyana Report shows the stock of government’s domestic bonded debt increasing by 7.6 per cent, while its external public and publicly guaranteed debt rose by a whopping 16.8 per cent from end-June 2007.

The outstanding stock of government domestic bonded debt, which consisted of treasury bills, debentures, bonds and the Caricom loan, amounted to G$74,223 million, an increase of 7.6 per cent from end-June 2007 and 7 per cent from end-December 2007 balance. The increase from one year earlier reflected the expansion in the stock of outstanding government treasury bills at end-June 2007.

Over the year July 1 2007 to June 30, 2008, the stock of outstanding public and publicly guaranteed external debt rose by 18.2 per cent to US$774 million. This increase reflected disbursements of US$45 million by the Inter-American Development Bank and the delivery of US$44 million credit by the Venezuela Petrocaribe agreement.

Employment

This very critical economic and social indicator once again fails to attract the attention of the Minister and again recourse has to be had to the Bank of Guyana Report which by its own admission is not based entirely on hard data. One has to wonder why the government continues to refer to labour surveys but yet the Ministry of Finance seems unable or unwilling to deal with the issue. While indicating that preliminary data indicated that public sector employment remained relatively stable, the Bank of Guyana reports some decline due primarily to factors such as resignation and retirement of employees.

The Bank of Guyana reported that while “data on private sector employment are sparse, there are indications that the growth sectors recorded higher levels of employment.” It went on to state that the mining, distribution as well as the engineering and construction sectors seem (emphasis mine) to be associated with increased employment.

It is interesting how the Bank of Guyana and the Ministry of Finance are so sure of the performance of the various sectors of the economy but cannot establish similarly reliable numbers on employment.

Inflation

Inflation has been one of the most disputed and massaged variables in the Guyana economy. Both reports indicate a 5.8% rate of inflation but again the Bank of Guyana is more informative even if no less controversial. The Minister of Finance attributes the increase mainly to food items, identifying cereals and cereal products as the principal contributors which are unlikely to be the main concerns of the average consumer. In fact in a typical food basket done monthly by Ram & McRae, Chartered Accountants, the price increase in food items over the six month period was 10.2%, compared with the Bank of Guyana figure for the food group of approximately 9%.

Conclusion

While the date on the Minister’s report is shown as September 12, in fact it was presented to the National Assembly on October 27, repeating a pattern of wrong dating by this Minister. Despite the additional time he took in presenting his report, the Minister chose not to address the serious global economic issues that surfaced in the third quarter, nor did he treat in any serious way his duty under the law to include in the report a list of major fiscal risks for the remainder of the fiscal year, together with likely policy responses that the government proposes to take to meet the expected circumstances.