Fidelity Investments attorney, Hukumchand, last night said that he had no comment to make on the now public Auditor General-led report into allegations of collusion between customs officers and Fidelity to defraud the country of hundreds of millions in revenue but the probe team has cited phone logs which show frequent calls between the suspects.

Hukumchand stated that he would need to see the report, and pointed out that even then no comments might be forthcoming since he “could say nothing on the matter”.

The report has concluded that fake documents were submitted to customs by Fidelity Investments Inc and charges were recommended against a top Fidelity official, a broker and 14 Customs employees from various departments who were complicit in the fraud.

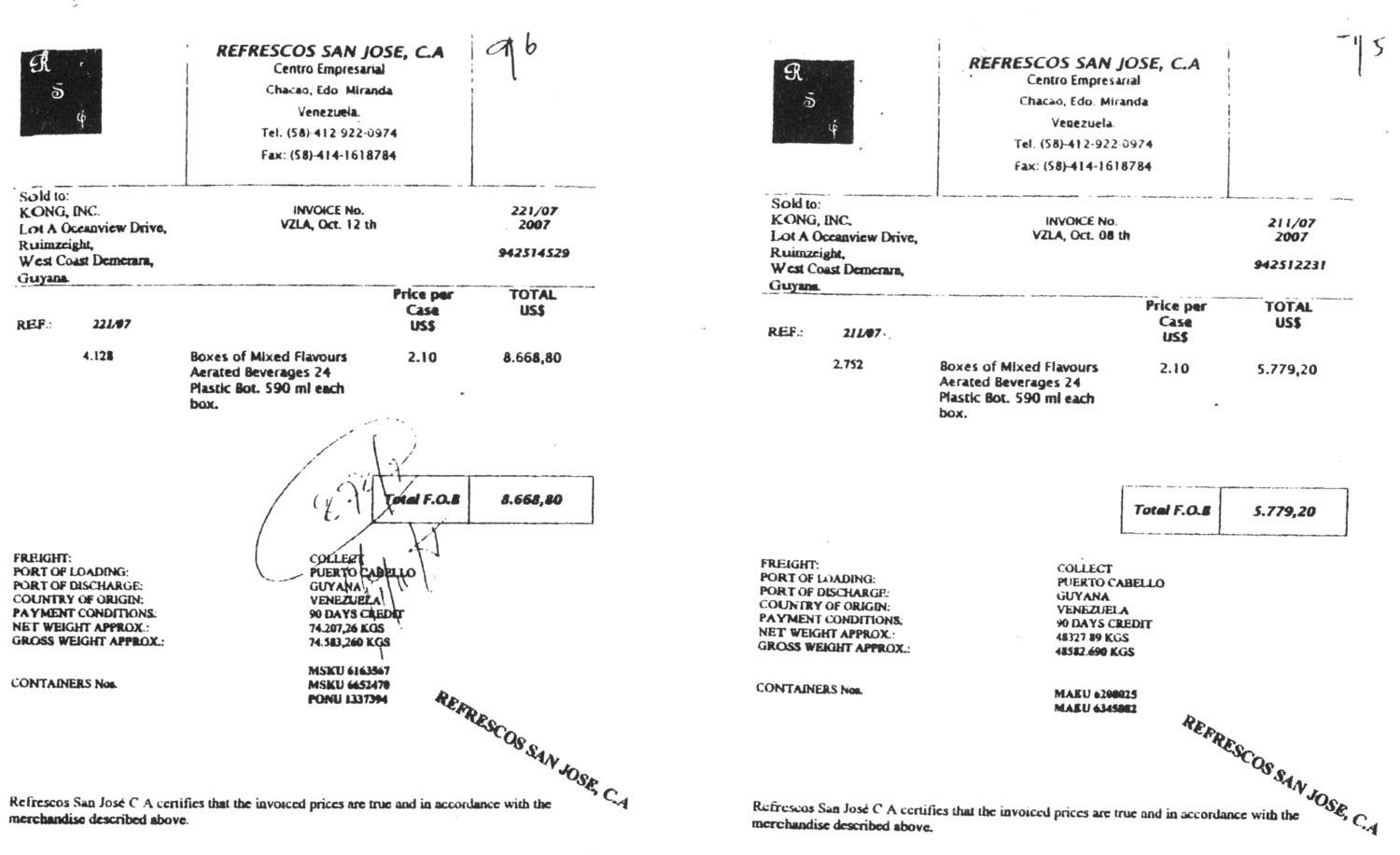

It also concluded that it was polar beer that had been brought into the country and not soft drinks as had been claimed by some Customs employees. Furthermore, while a price of US$2.15 per case had been listed by Fidelity, an investigative team that travelled to Venezuela found that Fidelity had been sold the beer at US$4.40 per case.

Minister of Finance, Dr. Ashni Singh tabled the report in Parliament yesterday nearly a year after investigations had commenced into the multimillion dollar fraud, and after the President had declared that the report would be released publicly in Parliament.

The report submitted to President Bharrat Jagdeo also made a number of recommendations to plug loopholes in the Guyana Revenue Authority (GRA) and lamented that key cameras had not been functioning at a time when it would have been useful for the investigation. It also found that the software suite for the GRA had been manipulated.

The payment of millions in duties in cash and the disappearance of key documents have also raised question marks. The polar beer fraud grabbed national attention in April last year, resulting in President Jagdeo initiating a task force to conduct an investigation.

The report also points to telephone records, which revealed frequent calls being placed between customs employees embroiled in the fraud and the office of a broker working for Fidelity during the period when certain documents were being processed for the company; records which the task force said helped established collusion.

Prior to the report going public there had been talk of a top custom official being paid off by Fidelity through the company broker and while the report makes no specific mention of this it does point to similar allegations being made against customs officials; officials that were later cleared following the investigations for lack of evidence.

The task force checked phone logs which showed that over three days July 12, 13 and 22, 2007 there were 20 calls among the various suspects, some of lengthy duration, on the clearing of one entry. On July 19, 2007 alone, there were 20 calls alone among the various players for the clearing of another entry.

The majority of these involved the broker who the task force has recommended should be charged. For each of the other entries there were varying numbers of calls. The appendices also include photos of the broker at the Fidelity office.

Venezuela checks

The task force went to Venezuela to ascertain whether polar beer or assorted beverages were imported by Kong Inc/Fidelity Investments Inc; at what price were polar beer or assorted beverages imported and the identity of the exporter/importer of polar beer or assorted beverages.

In the company of Roxanne Vandeyar, who is in charge of the Guyana Consulate in Venezuela and who acted as an interpreter, the task force visited the manufacturers of Polar beer brand products in Venezuela- Cerveceria Polar C.A and had discussions with Klaus Rodrigues, Export Manager; : Luis Alfredo Camelon, Logistics Officer and Freddie Vasquez, the company’s attorney.

The discussions centred on the company’s relationship with Fidelity, which was verified, but Cerveceria pointed out that it had no knowledge of the company Fidelity named as its importer in Venezuela- Refrescos San Jose. Cerveceria said it was concerned that Refrescos San Jose C.A and another company, Polar Beverages Co. Inc are using their logo.

The task force was unable to verify the physical existence of Refrescos San Jose C.A based on the address obtained from invoices; Fidelity later explained that the company was registered in Saint Vincent and the Grenadines though the documents they produced showed that Refrescos was not in existence when they said purchases were made from it. Fidelity later said it was a mistake and subsequently produced another certificate of registration showing that the company was set up in 2008.

The task force also visited MAERSK Shipping Office in Venezuela pertaining to the shipping of 40ft containers of polar beer in July 2008 by Cerveceria to Fidelity. Some records were uplifted including permission to export and a letter of confirmation which originated from Cerveceria. While there the report discovered a discrepancy on an invoice that had been submitted by a Fidelity official for the importation of polar beer into the country.

The date, invoice number, container numbers, gross and net weights, and quantity and description of the goods were similar, but the name of the exporter, form of shipping and cost of goods differed. The task force also came upon documents with a diagonal stamp which led them to believe that the documents were forged.

The report concluded that fake documents were submitted to customs by both the broker and Fidelity Investments Inc and charges were recommended against a top Fidelity official, a broker and 14 Customs employees from various departments who were complicit in the fraud.

The probe team also found evidence of signatures being changed even after documents had been inputted into the Total Revenue Integrated Processing System (TRIPS) at the Customs and Trade Administration. It also pointed to invoices that had been reproduced and were carrying identical numbers because “someone forgot to change the numbers”. After examination of the documents for 17 shipments which were under scrutiny, the investigating team found that the importer should have paid $321M in duties and taxes as opposed to the $32M that was paid.