By Rawle Lucas

Rawle Lucas is a Guyanese-born Certified Public Accountant and Assistant Vice-President of the Lending Services Division. Mr. Lucas has agreed to serve as a columnist with the Stabroek Business and will be contributing articles on economic, financial and development matters.

“…greater attention and emphasis would have been placed in the first ten years of the new century to the cultivation of crops such as oil palm, coconuts, green vegetables, ground provisions, fruits and flowers. Although a significant amount of these products would be utilised locally, the greater proportion would be destined for the tourist havens of the Caribbean, and the niche markets of North America and Europe.”

Legitimate Measure

The quotation above was taken from the updated version of the National Development Strategy (NDS) of Guyana. The NDS gives Guyanese a chance to assess the performance of the administration against the commitments it made about achieving economic progress, providing an objective benchmark against which the efforts of the administration could be measured. Last week’s article looked at the status of the housing drive in Guyana. This week the focus is on “other crops”, a sub-sector of the agricultural sector. The commitments made in the NDS emerged from the free will of the administration and thus could be used legitimately to measure its performance. Driving the commitment to emphasize “other crops” production was the desire to achieve a different kind of economy, one that saw agricultural activities other than rice and sugar generating jobs. There was also a recognition, at that time, that Guyana depended too much on rice and sugar for a sizable portion of its export revenues. Those revenues were not always determined by market prices since a significant percentage of those two crops were sold in the European market where prices were predetermined under special preferential regimes. Europe had begun to signal that those preferences would be discontinued leading to the realization that the decline in export revenues from rice and sugar would have to be made up by other products.

With the foregoing understanding, the quotation leads people to believe that the production of other crops, such as cassava, ground provisions, bora, eschallot, fruits, legumes, plantains, tomatoes and coconuts would have been much more significant than they are today. The administration had a long time and access to lots of money to make this happen. Through the years, there were high hopes, but two years of floods and an unclear strategy helped to diminish those hopes. Studies showed that crops such as bora, boulanger, hot pepper, cucumber, papaya, pineapple, and mango could be successfully exported to North America, Brazil and the Caribbean. If handled properly, the opportunities in the agricultural sector offered a real chance for Guyana to diversify its economy and to bring many other entrepreneurs into the mainstream of economic life. Not only was building up production of the other crops important to increasing export revenues, it was also critical to giving the manufacturing sector a boost through the development of agro-processing industries. Building up this portion of the agricultural sector could easily have positioned Guyana to achieve the goal of diversification and, perhaps, increased competitiveness.

Production

With that awareness, it is natural to inquire about the administration’s performance in taking agricultural production to the next level. Today, there is little proof that the economy is diversified and has become competitive in global markets. The best way to find out is to look at the statistics put out for use by the public, on behalf of the administration, by the Guyana Bureau of Statistics. The Bank of Guyana often reproduces this information in its annual reports, thus providing one more place to look. A review of the 2009 Annual Report of the Bank of Guyana leaves us in doubt about the direction in which the production of “other crops” is going.

The table in the report that indicates the direction best is the one entitled “Indices of Output of Selected Commodities”. The BOG gets its information from both the Bureau of Statistics and the Ministry of Agriculture. From the table, it is seen that the production of rice in 2009, for example, was 23 percent more than it was in 2000. Similarly, poultry production was greater in 2009 than it was in 2000 by 130 percent. The BOG apparently did not bother to publish information on the all important “other crops” production for 2009. The reason for the lack of data on “other crops” is unclear, leading Guyanese to believe that the performance of this sub-sector of agriculture was not as impressive as reported in the 2010 budget speech. This viewpoint is validated by the general notes contained at the back of the Annual Report. In the notes, the BOG explains the meaning of the dash appearing in the table for each of the “other crops” reported on. The dash indicates that the figure is zero or non-existent. In other words, the output of bora, eschallot, tomatoes, coconuts and other commodities was too small to matter. The observable trend of the previous years’ output of other crops shows a steady decline since 2000.

Increasing Doubts

“Other crops” is only one component of the Guyana economy, but it is significant for the impact that it could have on the intake of food and the progress of the manufacturing sector. Demerara Distillers Limited reported that the lack of raw materials, fruits in this case, hampered the production of juice by its subsidiary TOPCO. If food prices were low in 2009, then they could have been lower if “other crops” production was meeting expectations. It should be recalled that the administration reported in the 2010 budget speech that the output of other agriculture increased by 5.8 percent. There is no doubt that some amount of “other crops” was produced in various parts of the country. Output of “other crops” using the data based on 2006 constant prices grew by only one percent. The lack of data in the report of the BOG and the sharp decline in the increase in output reflected by the rebased data bring to mind the observation made by the Economist Intelligence Unit that economic data in the 2010 budget of the administration are difficult to decipher and that the administration had overstated the performance of the Guyana economy in 2009. The data on “other crops” only serve to increase those doubts and show that Guyana is nowhere near fulfilling the promise of the NDS.

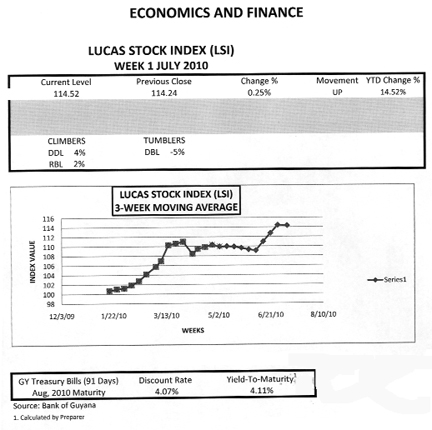

LUCAS STOCK

In week one of July 2010, the Lucas Stock Index (LSI) showed a slight increase of one quarter of one percent. The increase was due to a four percent increase in the value of the stocks of Demerara Distillers Limited (DDL) and a two percent increase in the value of the stocks of Republic Bank Limited (RBL). These positive performances were offset by the five percent decrease in the stock price of Demerara Bank Limited (DBL). As a consequence, the gain of the LSI increased to 14.52% for the year and three and a half times higher than the yield on the risk-free Treasuries that would mature in August 2010.