Second Instalment

In order to enhance public knowledge of the financial services industry and its significance to the economy, Stabroek Business has agreed to partner with the Guyana Association of Securities companies Intermediaries Incorporated (the Guyana Stock Exchange) to publish a series of articles on the subject.

The articles are tailored to enhance the knowledge of persons who are not necessarily specialists in the business and finance sector.

What Is Macroeconomics?

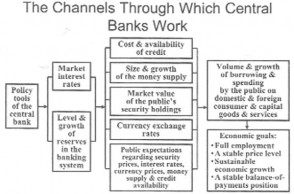

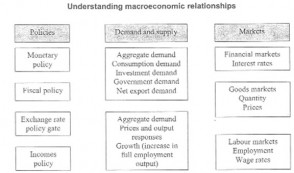

Macroeconomics is the study of what is happening to the economy as a whole. Macroeconomists’ principal task is to try to figure out why overall economic activity rises and falls: the value of production, total incomes, unemployment, and inflation. Intermediate variables like interest rates, stock market values, and exchange rates that play a major role in determining the overall levels of production, income, employment, and prices, are also critical.

Periods in which production grows and unemployment falls are called booms, or macroeconomic expansions. Periods in which production falls and unemployment rises are called recessions, or worse, depressions. Booms are to be welcomed; recessions are to be feared. Today’s governments have the ability to improve economic growth and to smooth out the business cycle by diminishing the depth of recessions and depressions. Sound macroeconomic policy can make almost everyone’s life better; bad macroeconomic policy can make almost everyone’s life much worse.

Tracking the Macro economy

Whenever you work for someone and get paid, that is economic activity. Whenever you buy something at a store, that is economic activity. Whenever the government taxes you and spends its money to build a bridge, that is economic activity. In general, if a flow of money is involved in a transaction, economists will count that transaction as “economic” activity. Overall, “economic activity” is the pattern of transactions in which things of real useful value, labour, goods and services are created, transformed, and exchanged. If a transaction does not involve something of useful value being exchanged for money, odds are that it will not be counted as part of economic activity.

There are some key indicators that are usually monitored. These include: Real Gross Domestic Product, unemployment rate, inflation rate, interest rate, level of the stock market activity and the exchange rate. The first two are directly and immediately connected to people’s material well-being. The other four are indicators and controls that influence the economy’s direction.

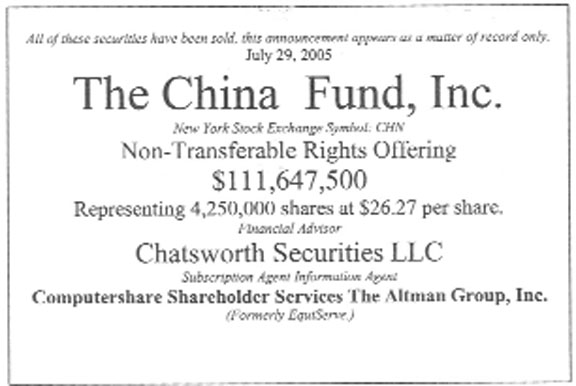

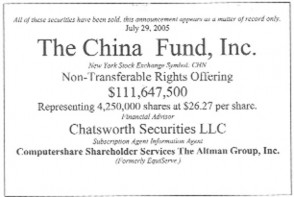

The Initial Public Offering (IPO)

In an IPO, the firm incurs the cost of hiring underwriters who prepare a registration statement for the approval of the regulator, (who in the case of Guyana would be the Guyana Securities Council). They then prepare a prospectus for the investors, which highlight the important sections of the registration statement. A preliminary version of the prospectus, known as a red herring, is prepared before the regulator (GSC) has approved the registration statement.

Traditional Process of issuing securities

There are a number of institutions- that are involved in the primary market, one of which is the investment bank. The investment banks are the key players in the primary market.

Investment banking, however, is a function performed by securities houses, commercial banks, some insurance companies. Their role in the market is given below:-

Advising

investment banks advise the issuer about the timing, terms, and pricing of the issue, as well as the regulation involved in selling the issue to the public.

Underwriting

investment bank buys the securities from the issuer, and then resells them to the public, bearing the price risk of the new issue. Typically, several investment banks are involved in underwriting an issue.

Best efforts placement

is the alternative to underwriting. Here the investment bank sells issues at the highest possible price, but gives no guarantees about that price. In this case, the issuer retains the price risk of the new issue. Best efforts placements are typically done with firms deemed risky or with limited market recognition.

Distribution

The -lead underwriter will maintain a large inventory of securities to support the secondary market.

Regulation of the Primary Market

The industry regulator regulates the primary market. It does so through laws, a series of rules and regulations. For example, the rules deal with disclosure of information to protect investors from fraud, rules against insider trading to ensure equality in trading and access to information.

Regulation is important in order to:-

a) Increase the information available to investors

b) Reduce insider trading

c) Ensure the soundness of financial intermediaries

d) Restrict market entry e) Ensure adequate disclosure of information

f) Restrict the types of assets and activities that are allowed

In addition, the issuer must register a new security with the regulator and provide a prospectus. A prospectus is a disclosure document containing essential financial and non-financial information that an issuer makes available to potential investors when it issues securities (shares, bonds, derivatives, etc.) to raise capital and/or when it wants its securities admitted to trading in stock markets. A prospectus includes information about the following:-

a) nature of the firm

b) features of the security

c) risk

d) firm management

e) Audited financial statements

If the regulator approves, then registration is effective and sales are allowed.

Secondary market – secondary markets involve trading of existing securities.

Secondary market transactions neither raise capital nor change the supply of securities.

Markets may be either dealer markets or auction markets, with a trend toward electronically connected dealer markets. Stock Exchanges are structured around a set of rules determining who may trade securities on the exchange and what securities may be traded there. The rules place requirements on both individuals wishing to trade and on companies wishing for their stocks to be traded.

In order to trade on the stock exchange you must be a member of the exchange.

Membership carries privilege and prestige. The privilege is the exclusive right to conduct business on the exchange floor. The prestige is partly due to the fact that there are at all times a limited number of memberships available on the exchange. In Guyana, there are currently four active members representing four firms registered to trade on the Guyana Stock Exchange. While many stocks and bonds are traded on the organized exchanges, there is significant volume in ‘Over-the-Counter (OTC) markets’. OTC markets are electronically connected dealer markets.

The Goal of Financial

Management

What are some possible goals of financial management? These include the following:-

i) Maximize profit or net income

ii) Maximize sales or market share

iii) Maximize the size of the firm

iv) Maximize employee welfare;

v) Safeguard the environment

vi) Grow shareholders wealth

vii) Survive or avoid bankruptcy

FORMS OF BUSINESS ORGANIZATION

Organizational Forms of businesses

Most businesses are organized as a sole proprietorship, a partnership, or a corporation. We will examine these in what follows.

Sole proprietorship

A sole proprietorship is a business that is owned by one person. Such organization has some benefits as well as pitfalls. In terms of benefits, the major advantage is that it is easy to establish, at the same time, however, the owner of the business has unlimited personal liability for all debts incurred by the firm. In addition, the owner might have some difficulty raising the capital needed for future expansion. As a result, these types of organizations are small and tend to remain so and are usually undercapitalized.

These firms are usually found in construction, agriculture, services, especially personal care and retail trade.

Partnership

A partnership is a step above the sole proprietorship and is a business in which there are two or more co-owners. These tend to be of different types ranging from general to limited partnerships and are easy to form.

Corporation

A corporation is a legal entity, which is separate and distinct from its owners. A partnership and sole proprietorship are, in general, indistinguishable from their owners.

Characteristics:

i) Limited liability – a corporation has limited liability. This means that the most a shareholder can lose is whatever he/she paid for the shares. Once shareholders have paid for their shares, they are not liable for any obligations or debts the corporation may incur.

ii) Unlimited life – a corporation has unlimited life. The legal existence of the entity is not affected by whether a shareholder sells his shares, dies etc.

iii) Transferability of ownership – in general, shares of a corporation may be bought and sold easily in financial markets. Transferability of ownership is particularly important for financial reasons, as it makes it much easier for a corporation to raise capital.

iv) Separation of ownership and control – in general, those who own the corporations are a different group of people than those who make the day-today decisions regarding allocation of corporate resources (management). This separation has advantages and disadvantages. In terms of the advantage, the shareholders can specialize in risk bearing, while management can specialize in managing the corporation. Owners do not have to know how to manage. The disadvantage, however, is that managers may pursue goals which are inconsistent with the goals of shareholders.

v) Taxation – corporations must pay taxes.

When a firm is liquidated, this means that all the assets will be distributed to the holders of claims on the corporation. In the event of liquidation, creditors receive distributions based on the priority rule. This rule states that senior creditors are paid in full before junior creditors are paid anything. In the case of reorganizations, a new corporate entity will result. The security holders of the bankrupt corporation will receive cash in exchange for their claims, others may receive new securities in the corporation that results from the reorganization, and others may receive a combination of both cash and new securities in the resulting corporation.

When a corporation issues securities, there are numerous factors that” affect its ability to raise the funds needed in the case of equities and the cost of its debt issue where debt securities are the ones being issued. One key factor is the capacity to provide a reasonable rate of return to investors. This is related to, among other things, the state of the economy and to the operations of the business.

Equity Markets

One of the most widely known equity instrument is common stock. These give the owners a share in the company’s success and failure. Investing in common stock entails all the advantages and disadvantages of ownership and is relatively risky investment compared to say, fixed-income securities.

There are two main types of corporate stock: Common stock and Preferred stock. Common stock represents ownership in a corporation and holders of the stock retain residual rights to the company in the event it is liquidated. In the event of such liquidation, all debtors’ claims on the company are senior to stockholders.

As such, the stock’s price tends to suffer in periods of low profits (as the likelihood of liquidation rises) and tends to fare better in periods of high profits. Partly as a consequence of this, stock prices are more volatile than bond prices. Holders of common stock are also entitled to stock dividends. Dividends are periodic cash (or stock) payments made to holders as a form of profit-sharing. Dividends are paid to all owners of the stock on record on a certain announced date by the corporation.

On a particular day, the stock begins to trade ex-dividend, that is, it trades without the dividend. Investors who purchase the stock on or after the ex-dividend date are not entitled to receive the dividend payment. As a consequence, in theory the stock price should drop an amount exactly equal to the dividend amount on the ex-dividend date.

Corporations may alter the supply of their stock in the market place in one of four ways. To understand how this is possible, it is important to note that when a company goes public, its articles of incorporation state the total number of shares that the corporation is authorized to issue. These shares, called authorized shares, are usually not issued all at once. The number of shares that are issued, are called the outstanding shares. Corporations can change the number of outstanding shares in one of four ways: flotation of new shares, rights issue, stock splits or share repurchase.

The total number of outstanding shares times the current market price of the stock is called its market capitalization, and represents the total market value of the stock.

One reason a company might institute a stock split is to increase demand for a stock by lowering its price. A lower price can make purchasing the issue more attractive to small investors. Also, some corporate boards feel that a stock split sends a positive signal to the market about the future growth prospects of the firm. Sometimes companies split their stock simply to make their share price more attractive to investors who like low priced stocks. If a company thinks a stock is priced too high, to attract investors, it can split the stock – in other words, give shareholders more shares and revalue the stock at a lower price.

Shareholders are residual claimants on the assets of the firm. As such, the returns that accrue to shareholders may be either big or small. This means that there is a large variation in returns that can occur if you are a shareholder. The tradeoff for the shareholder is to potentially lose their entire investment in order to get a chance at making a large gain.