(Part five of our series on capital markets)

The Business Cycle

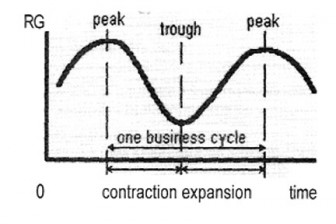

In order to beat the market, you should be able to forecast the market correctly and properly. For example, if the market is expected to move up in a month’s time, by being able to predict that and purchase stocks now, then you could take advantage of the increase in stock price if your forecast is correct. Economic trends come in two forms: cyclical changes and structural changes. A cyclical change is a change that arises from the ups and downs of the business cycle.

The problem is that history may not repeat itself, and the length of a cycle is challenging to predict. For example, if you were studying an agricultural product industry, then a recession would most likely not impact the business as much as compared to a firm in manufacturing. On the other hand, a structural change occurs when the economy is undergoing a major change in how it functions. For example, when there is a structural adjustment like what was done under the ERP, the entire structure of the economy changes as government cuts back on its expenditure and lays off workers. An industry analyst must examine structural economic changes for the implications they hold for the industry under review. Some common factors that influence business cycles are inflation, interest rates, foreign exchange rates and consumer sentiment.

KEY MACROECONOMIC FACTORS AFFECTING ASSET RETURNS

There are different macroeconomic variables that can be used to forecast the business cycle. Although the factors are similar, they impact each asset in a different manner. There may not be one set of economic factors that would fit a particular asset. Some variables that tend to be used include GNP or GDP, inflation, and interest rates.

Structural economic changes

There are four common factors that influence structural economic changes, these are: Demographics, lifestyles, technology, politics and regulation. With demographics, we can notice that there is a lot of focus on products targeted towards say women. This is because there are more women than men in the market. However, if there were more men than women then there would be less focus on women’s products than in men’s products. As for lifestyles, fads or trends would help in increasing the market for certain products, e.g. exercise equipment and diet supplements. In terms of technology, new advances have created changes in the retailing industry such as the increased efficiency in monitoring inventory through the use of information technology.

Evaluating an industry’s life cycle

One can breakdown an industry’s life cycle into five stages: pioneering development, rapid accelerating growth, mature growth, stabilization and market maturity, and deceleration of growth and decline.

COMPANY ANALYSIS

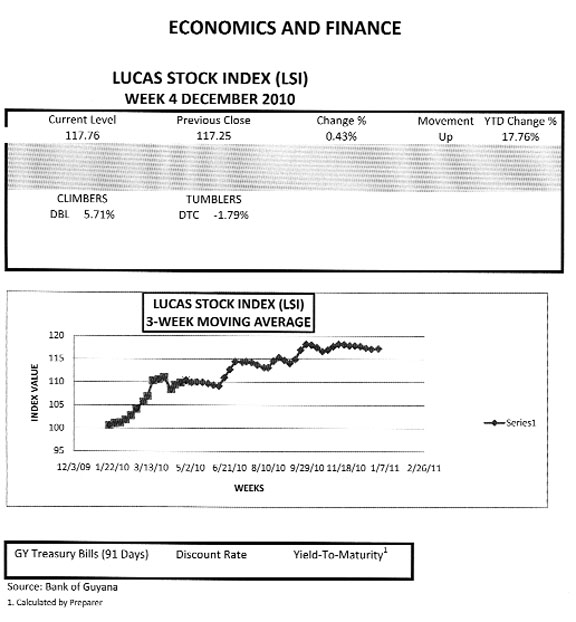

Lucas Stock Index

On the last trading day of 2010, the Lucas Stock Index (LSI) ended with a slight gain of 0.43 percent over trades from the previous week in December to end the year at 117.76. Trading this week which occurred on December 29 involved the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC). DIH and DDL recorded no change in their stock price while the stocks of DBL and DTC had contrasting performances. The stock price of DBL rose nearly 6 percent while that of DTC fell by about 2 percent.

The total market capitalization of the stocks in the LSI at the end of the trading period was G$66.9 billion.

PORTFOLIO MANAGEMENT

We have now finished the discussion on equity and debt securities, which are the two basic forms of investments that individuals or institutions can make. Typically, the answer to the investment problem is not the selection of one asset above all others, but the construction of a portfolio of assets, i.e. diversification across a number of different securities. The key to diversification is the correlation across securities. Just looking at the domestic market, we have 13 equity and a few debt instruments from which to choose. But when we look at the wider Caribbean the number increases rapidly. When we go global, the choices get even higher. As portfolio managers, overcoming the difficulty of choosing the right mix of assets to place in our portfolio is essential to the success of every investor.

In portfolio management, we want to get a return for our mix of assets given its level of risk. If you hold a portfolio of different government treasury securities, you would want to get the highest possible return, i.e. the appropriate risk-free rate. Thus, if you hold a risky portfolio, you expect a return higher than the risk-free rate for your portfolio. If not, you would have been better off investing in risk-free assets in the first place. At least in theory, portfolio management deals in the optimal mix of all assets. This includes, but is not limited to, stocks and bonds. Real estate, automobiles, and even jewellery are included. What is more important is not just how good the assets are in the portfolio, but also how well they interact with one another. For example, if your portfolio is comprised of AAA corporate bonds and a prime piece of real estate ,then individually, these two investments may be very good choices. However, if interest rates rise, what will happen to your investments? Let us look at the impact of rising interest rates on corporate bonds. Corporate bonds, just like any bonds, lose value when interest rates rise. How about real estate? Real estate becomes valuable when interest rates are low, because more people are able to afford to purchase properties due to lower mortgage rates. Thus, rising interest rates would cause the value of your real estate to decline. The offsetting movements of the two investments would yield to diversification. Diversification is an important concept that we have to grasp before we end this course, and it is the backbone of portfolio management.

Therefore, it would seem that these two investments make a good combination for an individual’s portfolio. Portfolio theory assumes certain things, which may or may not be intuitive at the onset. Individuals are assumed to be risk averse in portfolio theory. Risk aversion is when the individual is faced with a choice of two assets with equal return, that individual will choose the one with less risk. In addition, when companies have exposure to currency risk, some purchase forward contracts to offset the risk.

MANAGING INDIVIDUAL INVESTOR PORTFOLIOS

Each individual has a different goal and unique circumstances. A person with high net worth would not have the same goals for their portfolio as one with only a moderate amount of income. Thus, portfolio management for individual investors should be approached not as a standard one-size-fits-all problem but it should begin by considering the different biases, preferences, and perceptions of risk of the individual investor.

INVESTOR CHARACTERISTICS

Individual investors have different characteristics. In order to create a more meaningful discussion of portfolio objectives and a lasting relationship with the client, it is essential for the portfolio manager to be able to realize what the client’s needs and wants are. One should also try not to generalize investors by just plugging them into a stage of life or economic circumstance bracket.

However, situational profiling is a good place to start understanding the investor. Some approaches to situational profiling are:

Sources of wealth: One can think of two extremes in the sources of wealth category. At one end are those “self-made” investors who have greater familiarity with risk-taking and can, therefore, take on much more risk. At the other end are those passive recipients of wealth who can be associated with reduced willingness to take on risk. Measure of wealth: This category is quite difficult to characterize, because wealth is a subjective matter. For example, one may view a portfolio as small, but others may already think that it is huge. Someone who has lived a luxurious lifestyle since birth may believe that a GY$200 million bank account is small, whereas other people would think of that as a vast amount so we have to be careful in looking at wealth. Stage of life: People at different stages of life may really think differently. Younger individuals may be willing to take on more risk, because ceteris par/bus they would have more time to recover their losses. These people would have a higher tolerance for risk. When the individual matures, he or she would have accumulated a little bit of wealth, along with liabilities, and they start planning to achieve their long-term goals. These individuals can still be considered long-term investors, but their ability to take on more risk is reduced. Finally, at the latter stages of the investment cycle, the liabilities have been paid off and wealth accumulates more rapidly. Nearing the end of one’s career, the individual becomes more risk averse and prefers security.

An important thing to note about situational profiling is that investors do not neatly fall into one of these three categories.

The next step is to undertake psychological profiling. Every individual brings to the investment equation a unique set of financial circumstances, goals, and constraints that will strongly influence the set of investment alternatives from which he or she chooses. Yet, there are often underlying behavioural patterns that also play an important role in setting individual risk tolerance and investment objectives.

MANAGING INSTITUTIONAL INVESTOR PORTFOLIOS

Institutional investors are corporations or other legal entities that ultimately serve as financial intermediaries between individuals and markets. Frequently, representing large pools of financial resources, institutional investors have attained greater importance in financial markets worldwide. There are two main types of institutional investors that you should be aware of even though we will not discuss them here; they are pension funds and insurance companies.

ASSET ALLOCATION

Asset allocation is a major decision for every portfolio manager. Asset allocation is a result of portfolio management strategies. Thus, it is best for us to start by discussing briefly the strategies first. There are two major types of management styles. The first is passive and the second is active. Passive equity portfolio management is a long-term buy-and-hold strategy.

Active equity portfolio management aims to outperform the market. For many individual investors, their approach to the investment decisions has two stages. Asset allocation is the first stage, while security selection is the second stage. In asset allocation, decisions concerning the key asset classes in which funds can be invested and the amount of money to be invested in each class are made. In contrast, many institutional investors use three stages. The first stage is asset allocation, while the second stage deals with manager selection, then the final stage is security selection. In manager selection, decisions concerning the managers that can provide portfolios of securities within the class and the amount of money to be invested by each one are made.

Different types of investors have different approaches to asset allocation. This makes generalizations very difficult. Despite these difficulties, almost all participants agree that asset allocation is by far the most important decision made by an investor.

Different asset mixes will provide varying combinations of risk and return. Different levels of risk and return provide varying levels of utility to investors. The overall asset mix decision must take into account both investment opportunities and investors’ preferences.

In assessing investment opportunities, it is important to determine the goal. Examples are the value of the fund in one year or the rate of return on the assets. Let us take maximizing the rate of return on assets as the goal.

Those asset mixes that offer the highest return for a given level of risk or lowest risk for a given level of return are called efficient portfolios, and those below are considered inefficient.

Capital market conditions represent only half of the optimal asset mix decision. The investor’s preferences and constraints represent the other half.

PORTFOLIO CONSTRUCTION AND REBALANCING

After portfolios are constructed, the managers make revisions when circumstances demand it. What may be optimal yesterday, may be inefficient today. The market conditions or the net worth of the client may have been altered with different circumstances, and this would result in a different asset mix altogether. The question to the portfolio manager is, “How does the investment manager assure the portfolio remains appropriate to the ever changing environment”?

Portfolio rebalancing involves a simple trade-off: the cost of trading versus the cost of not trading. Examples of the cost of not trading are 1) holding an asset when it has become overpriced, 2) holding assets that no longer fit the needs of the client, or 3) holding a poorly diversified portfolio. On the other hand, trading also has costs, which include 1) commissions or 2) the impact that a trade may have on the market (some investors are huge enough that their trades can “move” markets. Portfolios should be rebalanced when there are changes in the client’s objective or the market’s risk attributes. Changes affecting the client are numerous, including:-

1) Bull and Bear Markets – when there is a bull market securities tend to do well, and when in a bear market securities tend to do poorly;

2) Central Bank Policy – monetary policy can impact the amount of investments in stocks and bonds;

3) Changes in Asset Risk Attributes – when the perceived and actual risk are different, the manager may actually have to buy or sell assets in order to benefit when the consensus view is unduly pessimistic;

4) Changes in Wealth – the less the wealth, the less risk tolerant the client becomes;

5) Changing Liquidity Requirements – when the client needs money, the portfolio manager must provide it, but usually at the expense of the investment opportunities;

6) Changing Return Prospects -when yields increase, bond prices decrease and returns also decrease. Thus, to meet return requirements, it is important to rebalance the portfolio to include those that can generate enough to meet the investor’s objectives.

7) Changing Time Horizons – when the time horizon decreases you have to reduce risk;

8) Inflation Rate Changes – as much as possible, purchasing power must be protected and if inflation is runaway the returns that will be received from the previous asset mix may not be sufficient;

9) New Investment Alternatives – when there are new instruments that can

lead to a more efficient means of achieving the client’s goal, the manager

must reallocate the asset mix to include such an instrument;

10)Tax Circumstances – taxes are certain, but how much it is in future periods cannot be ascertained and, as such, the goal of the manager is to reduce the tax liability;

There are transactions costs that serve as barriers, and managers must think before they rebalance in order not to incur high transactions costs. Otherwise, the rebalancing costs might outweigh the benefits. Investment monitoring and revision is a continuous and complicated process. The process requires the manager to be aware constantly of shifts in client circumstances and in the investment constraints he faces and .to understand the changes in the capital markets and the way they relate to the client’s particular situation. The most important part is to assess how the changes impact the client’s tolerance for risk. When the needs of the client have changed, then the manager must start considering transactions costs.

There is only a limited chance to improve on diversified portfolios that is only possible when there is a new instrument previously unavailable.