Introduction

The annual general meeting (AGM) of the New Building Society (NBS) returned to Georgetown after a two-year sojourn in Berbice. Unfortunately neither the press nor the directors of the Society made any report on the meeting which had its own moments of interest. Today’s column will try to fill that void. Once again the NBS Concerned Members were present, vocal and prominent. There were from the Office of the President big fishes, including letter writer Dr Randy Persaud, and small fishes. There were also some prominent figures who, like Dr Persaud, perform political functions and work in the public service. But it soon became apparent that while it is always good to have adequate members’ attendance, quality matters more than numbers, except when a vote is called and proxies can be pulled out.

Comical

Shortly after the meeting was called to order, Mr Cyril Walker, Secretary of the Concerned Members group questioned why the Society had not responded to a request from long-serving member for a copy of the minutes of the last AGM. Chairman Eileen Gopaul ruled him out of order, and that was that. This was not the first time that the indefatigable Ms Cox has suffered the indignity of her request for a copy of the minutes of a members’ meeting being ignored.

The meeting then moved to the report of the auditors. Apparently it did not strike the board and its Finance Committee headed by former Commissioner of Police Mr Floyd McDonald that the firm presenting the audit report – Maurice Solomon and Company – was not the same firm – Solomon and Parmessar – that the members had appointed on the board’s recommendation after the previous auditors had declined re-appointment after decades as the Society’s auditors. It would be hard to imagine a more comical situation in a regulated financial business controlling close to $40 billion in public funds.

Corporate arrogance

The directors had proudly boasted that the results were the best ever for the Society, describing these as a 97% increase over 2008. While the Concerned Members suggested that the comparison was misleading, and the line for line increase was 9.6%, they did not dispute the actual profit in 2009. Instead, they proposed a rebate to specified classes of borrowers and adjustment to the borrowing rates, a common practice some years ago. The Society is a mutual organisation so the profits in practice belong to the members and like any corporate entity, the members are paid a dividend. The Chairman did not allow for this to be put to the members but promised that the directors would “look at it.”

Contributing to the profit comparison was a gain on exchange losses on UK investment in 2009 compared with a $200 million loss in 2008. Called to explain why a 2009 decision of the members that the UK investments be repatriated, Dr Gopaul asserted that it was not a decision but “a discussion.” He is possibly the only person whose recollection would have led him to that interpretation, but again members are powerless in the face of this corporate arrogance. So it seems the investments stand, waiting for the usual swings that have characterised the pound sterling for the better part of the last decade.

No estoppel in tax evasion

Two other corporate governance issues attracted much attention. Concerned Members argued that whatever may have been the practice in the past, there should be no pension scheme for directors, to which the Chairman asked, apparently rhetorically, whether directors were not workers. The only problem is that workers are subject to contracts of employment and their employment is subject to an age limit. The directors may also note that there is no contractual relationship and that the same body – the members – that voted pensions can also vote to end the scheme. This is a governance issue, not a dubious claim of worker rights.

The second was in relation to remuneration. The practice of the NBS has been to split the remuneration between fees and travelling – the one being taxable and the other presumed non-taxable. Dr Gopaul’s first response was that directors use their own vehicles to do NBS business and the second was that that the practice came from the days of “Ram” which prompted Gaskin to reply that there is no estoppel in tax evasion.

Statutory breach

There was a sustained exchange between this columnist and the Chairman and the Society’s CEO that exposed how little the bosses understand the New Building Society Act under which the Society operates. I asked Dr Gopaul for the statutory reference and further explanation for his statement in the annual report that the Society was “racing near to the lending limit.” I pleaded with him that the Society had already exceeded that limit and offered to move a motion for an amendment that would have begun the regularization process. Dr Gopaul would have none of it, pointing out that his own board, its auditors and the Bank of Guyana were all convinced that they were right and I was wrong.

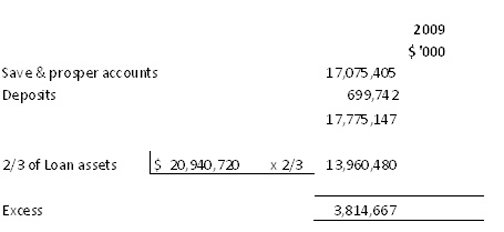

I have since confirmed my interpretation with a source in the Bank of Guyana and am more convinced than ever, that the NBS at December 31, 2009 had breached the lending limit prescribed by section 7 of the NBS Act by $3.8 billion, as follows:

Application of the proviso to section 7 (d) of the New Building Society Act to the financial statements for the year ended 31 December 2009

Despite being described in the annual report as an “uninformed little group of mischief makers and pseudo intellectuals,” Concerned Members take no pleasure in being proved right when the NBS is found to be in breach of its own act. We believe however that the tardiness of the Minister of Finance in introducing legislation to bring the NBS under the regulatory oversight of the Bank of Guyana would have saved the NBS from this embarrassment.

Expel the…

If lack of understanding of its own act by the board was not bad enough, their support for an amendment to the rules that would permit the NBS to expel a member at any time shows how mischievous or misinformed the board members are when it comes to serious issues. Originally, rule 13 only allowed the NBS to decline “to admit or continue a member” within one month of the payment of the entrance fee. That time restriction was removed on a motion under Any Other Business, fourteen days notice having been given.

Immediately after the motion was read by the new member, the Chairman sought to put it to a vote, which was objected to by the Concerned Members who asked for a discussion. The motion was supported by all the directors, and overwhelmingly by the floor. The member who moved the motion is an attorney-at-law working at the Office of the President and is a daughter of a PPP/C member of parliament. Afterwards, I met and spoke with her outside of the meeting, in the presence of another top PPP person. She did not even understand what she had done. What was worse was that the board on which sits a Senior Counsel, did not know either.