By Tarron Khemraj

Introduction

In past columns in this series on elected oligarchy, I argued that the primary channel through which the Jagdeo elected oligarchy retards progress is through the stifling of independent private investors and the pursuit of sub-optimal government investment projects. This column develops this thesis further by providing data to show that the government’s investments have a negative effect on private investments at the macro level.

Sub-Optimal Investment Projects

When the Jagdeo oligarchy is not crowding out private businesses, it is busy making economic decisions that could hardly be seen as optimal in terms of long-term economic transformation. As these columns have repeated, economic transformation must commence with production transformation. The masses are as rich as what they produce. An ACCA accountant lives a better life than an accounts clerk with only CXC because the ACCA was able to upgrade his/her skills. The same principle applies to the economy as a whole. If the country continues to concentrate on primary products, then it will stay poor.

At times these decisions appear devoid of logic. Take for instance the road project and the Amaila hydro electricity project. A contract was awarded to build the road but it was reported by the Stabroek News on August 10 that the IDB is yet to determine the feasibility of the project. Earlier the President noted that the Chinese government is willing to fund the hydro project. These reports raise all types of questions and suspicions. For example, is the Chinese government willing to part finance a project without a feasibility study? If that is the case, what is the quid pro quo? What is the back up plan for the road that would be built should there be no financing for the hydro? Is US$15 million enough to build new roads through swamps and virgin forests? Is this entire episode an election year gimmick?

Of course, perhaps the best example of a sub-optimal investment would be the Skeldon investment which dives Guyana deeper into sugar production rather than moving mainly into ethanol or low calorie sweeteners. These columns have argued many times why renewable energy is better than sugar. The use of bagasse for energy would materialize in any case whether the factory produces sugar or ethanol.

The Crowding Out of Private Investments

I have provided micro level examples of a trend to crowd out some private investors who are not on the “right” side of the political divide. I will present some data in support of a suggestive macro level negative effect of the government’s public investments. Before doing so let me present the popular economics textbook story of the crowding out thesis. The thesis goes like this: the government first borrows heavily to finance its investments. When it does so it causes interest rates to increase and therefore makes it hard for private investors to finance their investments. There is a quantity effect also as the government competes for the scarce stock of investment funds (or national savings) to finance its spending, private investors find it more difficult to obtain funds.

While I will not discount the quantity effect in Guyana given the tendency for the banks to demand large quantities of excess liquid assets (short-term Treasury bills), my argument is more a political economy argument. The Jagdeo government has decided to create its own private sector using state largesse. This private sector was termed the Newly Emerging Private Sector (NEPS) by the President himself. In other words, we have a situation where an oligarchic government crowds out private investors that could also be creating jobs. The crowding out, therefore, results from a quest to control the economic space, which eventually results in the total domination of the political space. The quest of domination of course has its own financial rewards as those who obtained favoured treatment must either shut up politically or pay up to finance election campaigns, build homes for the oligarchic leaders, provide fancy cars, and other things. It is therefore a classic oligarchy where we have the interaction of the political and economic sphere in the pursuit of total domination.

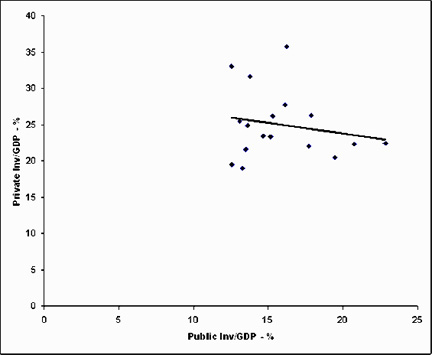

To obtain a macro effect, I use Bank of Guyana data to calculate the annual percentage of GDP accounted for by private investments and government investments. I use annual data from 1993 to 2009. I obtained a simple correlation of -19%. The scatter plot (Figure 1) below shows a case where as government investments increase private investments decline. This is shown by the negatively sloping trend line. The old saying goes that correlation does not imply causation. However, I have proposed the causative channel of an elected oligarchy crowding out the private sector in the pursuit of political and economic domination. The scatter plot is certainly consistent with my argument.

Figure 1. The crowding out of the private sector

What matters at the end of the day is for government investments and spending to crowd in (increase) private investments rather than crowd out (decrease) private investments. The net effect matters for long-term production transformation and jobs creation. Indeed, some of the members of the NEPS have benefitted from the Jagdeo consolidation of power. However, others have suffered, some were frustrated, and some investors lost money. What matters is the end result or the net effect of the power consolidation.

I am still optimistic that the State can become a developmental one rather than a semi-predatory one. We have to study the roles played by the developmental states of Taiwan, South Korea, Japan, Mauritius and other places and shun the methods of the predatory and semi-predatory ones. In the Guyana context, at least three important tasks will have to be accomplished to reverse its current semi-predatory instincts: (i) Constitutional reform; (ii) the formation of a meritocratic public service; and (iii) the Freedom of Information Act. These themes will be picked up in the next column.

Please send comments and criticisms to: tarronkhemraj@gmail.com