Tax act

In presenting the 2011 budget, the administration informed the country that it was reducing the tax rates that were applied to the income of commercial and non-commercial companies doing business in Guyana. Commercial companies will now pay a rate of 40 per cent and non-commercial companies will pay a rate of 30 per cent. The rate reduction of five percentage points by the administration applies to both types of companies, even though the starting point for each is different. To get a better understanding of the consequences of the rate change, Guyanese need to keep in mind what is a commercial company and what is not. The Corporation Tax Act provides some help.

Label

A reading of that document reveals that a commercial company is any entity which derives at least 75 per cent of its gross income from trading in goods which it does not manufacture. It leaves little doubt that the definition applies to all and sundry who obtain a significant share of their income from selling goods that they do not produce. It does not matter if the business is incorporated or unincorporated. Neither does it matter if the business is licensed or unlicensed. To help clarify things further, the tax act identifies commission agencies, insurance companies, commercial banks and telecommunication companies as being among commercial enterprises. Placing a face to the label brings entities like Citizens Bank, Hand-in-Hand Insurance Company and Guyana Telephone and Telegraph Company under the commercial banner. This means that these companies and those like them would have their tax rate reduced from 45 per cent to 40 per cent. On the other hand, non-commercial companies in Guyana would include entities like Demerara Distillers Limited and Banks DIH which get the bulk of their revenue from the things that they manufacture. Companies like these would have their tax rates reduced from 35 per cent to 30 per cent.

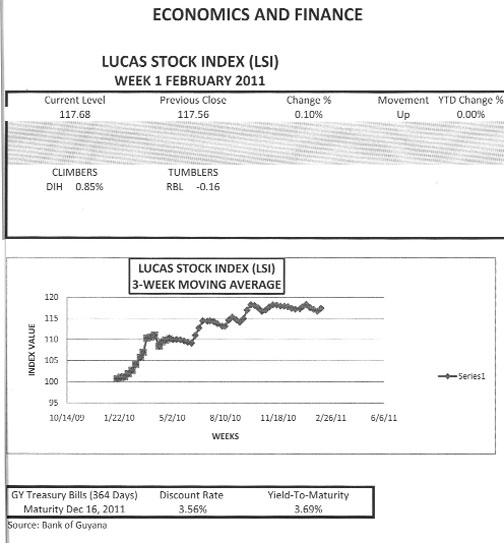

LUCAS STOCK INDEX

At the end of first trading period in February 2011, the Lucas Stock Index (LSI) remains unchanged from where it was at the end of January 2011. The index displayed another anemic performance and added a mere one-tenth of one per cent to continue its slow but painful climb towards positive territory. Even though the stocks of five companies were traded this week, only two of them had any impact on the index. Banks DIH recorded a positive change of less than one per cent while Republic Bank Limited (RBL) recorded a negative change of nearly similar proportion. The rest of the traded stocks showed no change from their last trade price. These included the stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Sterling Products Limited (SPL). The negligible movement in the value of the index keeps it lagging behind the yield on the risk-free Treasuries that will mature in December 2011.

Beholden

While the tax change is welcomed news, the impact might be of limited consequence when it is placed in context. One thing that is already known is the new corporate tax regime discriminates against the telecommunications companies. No reason was given for excluding the telecommunication companies from participating in the rate change and as appears to be standard practice, the administration feels that Guyanese do not need to be provided with any explanation for the difference in treatment between the telecommunication companies and the others that are similarly classified. A second thing that is known is that even with the rate change, the tax rates for both commercial and non-commercial companies are substantially higher than they were under the rule of the PNC. Despite claims of an enlarging tax base, the administration is reluctant to bring the rates down to where they make good business sense. Doing so seems to be a problem for the administration, since it might look like an admission that the PNC is more business friendly and was correct in having a commercial tax rate of 35 per cent and a non-commercial rate of 25 per cent. If not, then the rate change is merely to ensure that the business community remains beholden to the administration.

Applicable rate

Politics apart, the substance of the tax rate change offers its own concerns. On the face of it, the tax change might appear equitable for both types of companies, but the impact is different and raises questions as to how beneficial the changes will really be to the economy. Guyanese might believe that all companies doing business in Guyana are paying taxes at the maximum rate. This is not necessarily the case. A key metric in assessing the tax consequences on a company is the effective tax rate. The effective tax rate refers to the actual amount of taxes paid by a company on the income that it actually earned during a year or a given operating period. Because some companies are required by law to produce annual reports, it is possible to determine the effective tax rates applicable to them on an annual basis.

Concessions

One set of such companies are the commercial banks in Guyana and a review of their income statements reveals that none of the locally-owned banks have paid taxes anywhere close to the maximum tax rates for several years now. The average tax rate of these commercial banks since 2005 was 20 per cent. The last time that any of these companies paid taxes at a rate above 30 per cent was in 2006 when Guyana Bank for Trade and Industry (GBTI) paid an effective tax rate of 36 per cent. Ever since then, no locally-owned bank has paid taxes at a rate above 28 per cent. Part of the reason for this variance between the old corporate tax rate of 45 per cent and the effective tax rate has to do with the concessions granted to commercial banks. Since 2005, the commercial banks have enjoyed special concessions that exempt some of their income from taxes for making mortgages to low-income borrowers. The rationale for the tax concessions lies in making the banks competitive against the New Building Society (NBS) in the mortgage business.

The taxes that banks currently pay are 50 per cent below the new marginal rate proposed by the administration and 56 per cent below the old rate of 45 per cent. It should be obvious that the current rate reduction would have no serious impact on the investment decisions of the commercial banks. If the locally-owned commercial banks have not been creating jobs in significant quantities before, it would not happen now as a result of the reduction in the corporate tax rate. Perhaps, the only commercial bank that will benefit from the change is Republic Bank which paid 42 per cent of its income in taxes last year and an average of 41 per cent each year since 2005. The change to 40 per cent however would be marginal for that bank. As such, where that group of companies is concerned, the administration has only fiddled with the tax rate.

Size

Another important metric for putting the tax rate change in context is the size of the rate change. The subtle difference in the rate change between commercial and non-commercial companies might go unnoticed with a focus on the equity in percentage point change. It should be noted, however, that the impact of the tax rate change is greater for non-commercial companies than it is for commercial companies. The commercial companies whose rate has gone from 45 to 40 per cent will experience for their part an 11 per cent reduction in the amount of money that will leave their coffers. By moving the rate from 35 to 30 per cent, the administration reduced the tax impact on income of non-commercial companies by about 15 per cent. Since non-commercial companies include manufacturing companies, this rate change could be beneficial to the manufacturing sector.

No guarantee

Some of the companies in the manufacturing sector have been paying high effective tax rates. Within the last three years, Banks DIH and DDL, for example, have been paying an effective tax rate equal to the corporate tax rate for those companies. The tax rate change clearly offers some relief to those companies.

The problem with that sector is it is dominated by a few large and well established companies that show little growth potential. Output in the manufacturing grew by less than one per cent last year and by only 3 per cent since 2006 while income grew by 32 per cent during the same period. The sector is plagued by a number of problems none of which would be solved by the reduction in tax rates. Unreliable electricity supply, limited market growth and unreliable supply of inputs would not be solved by the tax rate change.

So, the only thing that Guyanese could expect to see is a further redistribution of income with no expectation or guarantee that that money would be spent on creating jobs for them.