Introduction

We have not heard much from or about it recently. Passing its offices at High and Robb Streets it is hard to believe that this is the institution that was set up with much hype, expectations and hope that it will make access to capital easier and cheaper, widen shareholder ownership and raise the bar of corporate governance. The Guyana Stock Exchange, or to use its more formal name the Guyana Association of Securities Companies and Intermediaries Inc, was incorporated on June 4, 2001 after several studies with the principal aim of encouraging companies to “go public,” a term generally used to mean companies offering their shares to the public. To encourage such companies the government offered them favourable tax treatment including waiver of duties payable on the transfer of shares in quoted companies and exemption from Capital Gains Tax on gains made on the disposal of shares in public companies.

The Stock Exchange has had only limited success, being largely ignored by the government and failing to attract any attention from this Finance Minister. With a private sector body that seems to have a view only if prompted by the government, its chief spokespersons in the Private Sector Commission have been similarly silent. In fact I find it hard to believe from any of their utterances that they even remember that the exchange exists.

Access to capital

This in no ways suggests that the commercial banks should open their vaults to all and sundry or indeed that it is sensible to do so. Financed mainly by customers’ deposits, banks and other deposit taking financial institutions operate like trustees, and it takes only a couple of their larger loans to go bad to create havoc with their financial results and balance sheets. More recently the Anti-Money Laundering and Countering the Financing of Terrorism Act 2009 has added to the challenges and risks facing such entities, since the act requires lenders to have the most intimate detail about their customers.

‘Well done, Mr Minister’

Dr Ashni Singh wrapped up the debate on the 2011 budget by sweeping and disparaging remarks about the parliamentary opposition’s poor contribution during the debate. Yet, his budget speeches are themselves devoid of any real underlying vision or philosophy, more rhetoric than substance, and even in budget measures there was clearly a failure to apply any intellect or effort at analysis. It is disrespectful and arrogant of Dr Singh to believe that he alone has the capacity to speak or think through a proper national budget. In fact had it not been for the annual stealing of VAT from the people of this country, the ineptitude of the President and his successive Finance Ministers would have been on national display.

In none of his four budget speeches has Dr Singh shown any understanding of the role of a stock exchange or concern about its failure to take off, or to explore and exploit the opportunities and possibilities which a stock exchange can bring. Has the PSC not seen this or the National Competitiveness Council or the Chamber of Commerce or anyone else? Would Dr Singh include them as part of that group that makes no constructive contribution to the budget, or is their endorsement, “Well done Mr Minister,” what he considers constructive criticism?

If only we were more imaginative and innovative, if only we understand that there is trading in government paper all year round, if only we really believed that the private sector is the engine of growth and a functioning capital market its fuel, GPS and steering system, we will still be able to bring the stock exchange back to life.

As the stock exchange enters its eighth year of operation, policy holders may wish to look at the steps taken by Jamaica, where its exchange too had slowed almost to a crawl. Jamaica’s answer was the creation of a Junior Stock Exchange that within a couple of years has seen eight companies entering the market with another ten lined up for listing in 2011.

A brief history

The Exchange began trading on July 8, 2003 at which time the market value of the shares of companies to be traded was approximately $17.7 billion. At December 31, 2010, this had increased to $69.4 billion. Trading on the Exchange has been slow not only because the concept of public ownership of shares is still not strongly promoted or embraced, but also because many of the country’s public companies are controlled companies and the number of shares available for trading is therefore limited. Yet, the total value of trades on the Exchange since its inception has exceeded two billion dollars with four companies accounting for 83% – Banks DIH, (50%); DEMTOCO (13.2%), DDL (10.8%); and GBTI 10.7%.

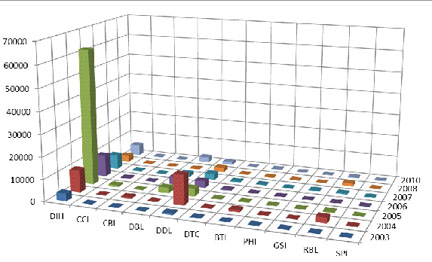

That is confirmed by the following chart which shows the number of shares traded by year (the acronyms are expanded in the table following).

Source: Stock Exchange

Banks DIH Limited DIH

Caribbean Container Inc. CCI

Citizens Bank Guyana Inc. CBI

Demerara Bank Limited DBL

Demerara Distillers Limited DDL

Demerara Tobacco Company Limited DTC

Guyana Bank for Trade and Industry Limited BTI

Property Holdings Inc. PHI

Guyana Stockfeeds Inc. GSI

Republic Bank (Guyana) Limited RBL

Sterling Products Limited SPL

Source: Guyana Stock Exchange

Another expectation was that the Stock Exchange would have a positive impact on share prices. In the first couple of years the results exceeded expectations with substantial increases on the prices of almost every company with gains ranging from 29% to 500% in one extreme case. The market made adjustments for the shares in Demerara Tobacco Limited, the Guyana Bank for Trade and Industry and Republic Bank Limited, while a significant movement in the shares of Banks DIH Limited accompanied the interest in the take-over of that company by the Trinidad company Ansa McAl.

To be continued