Introduction

My Sunday Stabroek column last week ended with the observation that, the European Community (EC) ‒ African, Caribbean, Pacific (ACP) Sugar Protocol under which about 90 per cent of Guyana’s export of raw sugar was made, is a direct descendant of the Commonwealth Sugar Agreement (CSA), which Britain had put in place in 1951 so as to avoid future disruption in the supply of raw sugar from its colonial possessions to UK refineries, including war time. However, as a condition for its entry into the EC, the CSA was transitioned into a broader Sugar Protocol (SP) in 1975, this time between the EC and its colonial and post-colonial possessions in the ACP.

For our immediate purposes, four features of the SP should be constantly borne in mind. One is that it was a legal (treaty) obligation of the EC to purchase 1.3 million tonnes of sugar (raw or white) from the specified ACP countries, based on a mutually agreed and pre-determined annual allocation of quotas.

The second feature is that, as an agreement covering the purchase and sale of sugar, the ACP countries were obligated to fulfil their quota obligations. Failure of a country to fully supply its quota would result in the re-allocation of that country’s quota to another country in the ACP grouping. If, however, unforeseen disastrous events disrupted supply, the affected country could claim force majeure in order to prevent quota re-allocation.

Fourthly, the price at which the sugar sale was to be made had to be negotiated annually.

Full dimensions

Remarkably, except for a few economists at the University of the West Indies, this subsidisation the ACP countries were providing to the EC never received significant public attention. Later, however, when the situation was reversed and the SP price rose above the world price, the EC frequently complained that Europe was subsidizing (granting preferences) to inefficient Caribbean sugar producers. Shamefully, most Caribbean governments and peoples echoed these accusations, but never acknowledged their unreasonableness as the reverse situation had applied at the time the SP came into force. The decline in sugar prices that occurred later was not anticipated by experts as in the 1970s long-term world commodity shortages were being consistently predicted.

Secondly, from its inception the SP has been executed within the wider framework of the management of the EC’s domestic sugar regime, which had come into force as long ago as 1968. This is clearly revealed in the way in which the price of raw sugar was arrived at in the framework of the annual setting of the delivery price for raw sugar from the ACP countries to the EC refineries.

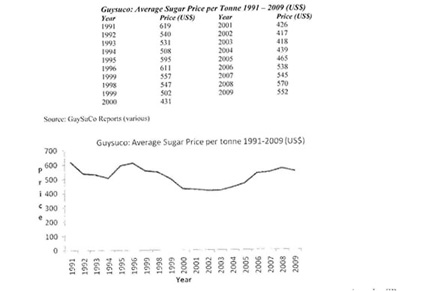

GuySuCo average sugar price

As we shall observe more fully later, as of October 2009 the Sugar Protocol, with ACP concurrence is no longer in legal effect. The data in the table and graph below reveal the average price per tonne (US dollars) received by GuySuCo for its sugar sales over the last two decades during which the SP was in effect. Readers should note that the average price shown in the table reflects the sale prices obtained by GuySuCo in its various markets. In other words this reveals the ‘revenue-earned mix‘ for GuySuCo.

Over the period 1991-2009 the annual price for raw sugar received by GuySuCo from its SP sales exceeded the average annual price on the world market. Furthermore, the SP price, (annually negotiated) fluctuated less severely than the price prevailing on the world market. Those two observations highlight what are undoubtedly the two most important direct benefits provided by the SP arrangement to Guyana.

First, the SP generally afforded more stable prices for Guyana’s sugar exports than that which would have been realised, if these were sold on the world market.

This is a most important benefit, as the historical data show unambiguously that fluctuating primary commodity prices on world markets constitutes one of the most important obstacles to

international development and the development prospects of poor countries that rely on these exports.

Second, to the extent that the annual price paid for sugar under the SP exceeded that on the world market, Guyana would benefit from an income transfer from the EC. Of course, if the reverse occurs (that is, the SP price fell below the world price) then Guyana would be making an income transfer to the EC.

Next week I shall continue the discussion from this point, and as readers will observe the income transfers received by Guyana would depend on the price-gap (between the annual SP price and the world market price) as well as the volume of sugar Guyana exported under the SP.

As I shall stress GuySuCo cannot sustainably survive at sugar prices lower than those historically provided by the SP. GuySuCo would fall on hard times and as Guyanese would say, it would be forced to ‘suck salt.‘