NEW YORK, (Reuters) – Investors fled Wall Street in the worst stock-market selloff since the depths of the Great Recession in early 2009 in what has turned into a full-fledged correction.

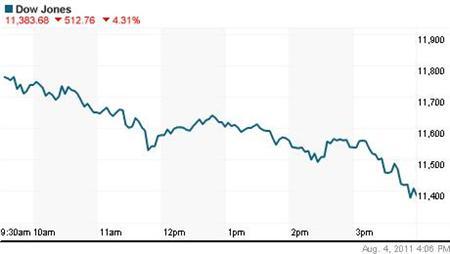

The Dow and the S&P tumbled more than 4 percent today and the Nasdaq lost 5 percent on fear the United States is staring at another recession and that Europe’s sovereign debt crisis is swallowing two of its largest economies.

Analysts predicted further losses even though stocks have fallen on nine of the last 10 days. Two-year Treasury yields fell to a record low as investors sought safety in short-term government bonds.

The S&P 500’s drop puts it more than 10 percent below its April 29 high, considered a correction. More than 13 billion shares changed hands, the busiest trading day in more than a year. Decliners beat advancers on the New York Stock Exchange by about 19 to 1.

The market’s recent malaise stems from a number of factors. U.S. economic data has worsened, suggesting slowing growth from already sluggish pace in the first half. Europe’s sovereign debt crisis has defied remedies and threatens to engulf large euro-zone economies Spain and Italy.

“The debt troubles in Europe, especially with the yields on Italian and Spanish government bonds soaring, are making investors gather as much liquidity as possible,” said Stephen Massocca, managing director of Wedbush Morgan in San Francisco.

The Dow Jones industrial average was down 512.46 points, or 4.31 percent, at 11,383.98. The Standard & Poor’s 500 Index fell 60.21 points, or 4.78 percent, at 1,200.13. The Nasdaq Composite Index lost 136.68 points, or 5.08 percent, at 2,556.39.

Some 13.8 billion shares changed hands on the New York Stock Exchange, NYSE Amex and Nasdaq, the highest since June 25, 2010, and well above the daily average of around 7.48 billion.

Losses occurred in all sectors. Among stocks hitting new 52-week lows were Bank of America, down 7.4 percent at $8.83, Citigroup, down 6.6 percent at $34.81, and Hewlett-Packard, down 5.1 percent at $32.54.

Among sectors, losses in energy and materials outpaced others, with S&P energy down 6.8 percent and materials down more than 6.6 percent.

U.S. crude futures settled down $5.30 to $86.63 a barrel in New York.

The CBOE Volatility index jumped 35.4 percent to 31.66, its highest since July 2010. It was the biggest rise since February 2007.

Overseas, the European Central Bank signaled it was buying government bonds in response to a deepening European debt crisis. In Japan, the government intervened in currency markets to stem recent gains in the yen.

On Friday the government releases July’s payrolls report, a closely watched number to gauge the U.S. economy.

Wall St plunges in worst selloff in two years