CHICAGO/NEW YORK, (Reuters) – MF Global Holdings Ltd failed to protect customer accounts by keeping them separate from its own funds, said a top U.S. exchange regulator, another shock for commodity markets scrambling to contain fallout from the brokerage’s bankruptcy.

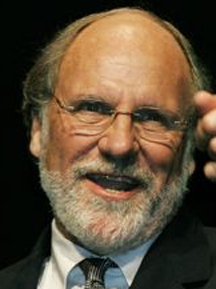

The revelation yesterday by CME Group Inc suggests Jon Corzine’s MF Global violated a central tenet of futures brokerages. It could erode confidence in a market that for decades has enjoyed a sterling reputation for safety.

MF Global cannot account for a large amount of customer money that was supposed to be kept separate from other funds, sources said, and regulators are scrambling to review the broker’s accounts. The cause of the shortfall — including whether the company pilfered client funds or merely cannot account for the money — was not clear.

The Federal Bureau of Investigation is showing preliminary interest in regulatory probes, a person briefed on the matter said.

MF Global did not keep customer accounts separate from the firm’s funds, said Craig Donohue, CEO of exchange operator and market regulator CME Group. Even though the client money could eventually be accounted for, the regulator believes the firm broke the segregation rules.

Another regulator, the Commodity Futures Trading Commission, voted to issue subpoenas to the firm, the Wall Street Journal reported.

Neither MF Global nor Corzine has been accused of any wrongdoing.

The New York Times reported late on Monday that federal regulators discovered that hundreds of millions of dollars in customer money — supposed to be segregated and protected from the rest of the business — had gone missing.

At the U.S. Bankruptcy Court in Manhattan, MF Global’s lead attorney, Ken Ziman, said all of the funds in the company’s broker dealer are accounted for.

To management’s best knowledge, “there are no shortfalls” in brokerage accounts, said Ziman, of law firm Skadden, Arps, Slate, Meagher & Flom, as MF Global’s first bankruptcy hearing began yesterday.

The fall of the brokerage led by ex-Goldman Sachs Group Inc boss and former New Jersey governor Corzine sent shockwaves through commodity markets.

While MF Global began what could be a complicated process of liquidating customer positions, some customers feared that millions of dollars were tied up in bankruptcy. Others expected lawsuits, according to interviews with brokers, funds and lawyers.

“We’re basically putting out fires,” said an MF Global employee. “Our customers are upset and we’re upset that they are upset.”

A company spokeswoman declined to comment.

Last night, the Investment Industry Regulatory Organization of Canada announced the suspension of MF Global Canada Co. Trading in Australian agricultural futures and options on the ASX 24 platform will resume on Wednesday after being suspended following the collapse of MF Global, exchange operator ASX Ltd said.

MF Global had $7.3 billion in customer assets on Aug. 31, according to Commodity Futures Trading Commis-sion data. It was the eighth-largest U.S. futures broker and had a big presence in commodity markets worldwide. The company filed for Chapter 11 bankruptcy on Monday after failing to find a buyer.