Dear Editor,

The Alliance For Change (AFC) would like to reiterate its position that the PPP’s VAT remains one of the principal burdens on the people. The PPP has made the VAT into their primary revenue source, and the outcome has been more wasteful spending and extravagance and a higher combination of income tax and VAT tax burden on the workers. Unfortunately, the economists of the PPP failed the nation by not informing the people that these higher rates of tax would increase losses in economic output. These higher taxes along with poor public policy are some of the principal reasons for the crowding out of private investment in Guyana, thus stifling the economic growth of the nation.

Why did the Jagdeo government never experience a growth rate of 7% or more to migrate Guyana from its perpetual state of overwhelming poverty for the masses? Increasing taxes reduces economic growth opportunities and this is exactly what the PPP did with the introduction of a cash-gouging VAT rate. The AFC is not against VAT, we are against the high tax rates.

In 2007, when the PPP experienced a windfall of $13 billion increase in tax revenue as a result of the introduction of VAT and its sister excise tax, they chose not to make the tax cash neutral by reducing the rate. They introduced the VAT with the promise of cash neutrality, but never delivered on their promise. This tax and spend policy, is an extremely irrational, self-defeating public policy that is just not sustainable in the long run, and it takes a leader with limited vision to pursue such a public policy.

The smarter thing to have done was to restore long-term fiscal integrity and push for the 7% economic growth that was experienced under Asgar Ally with a balanced combination of spending reductions, tax cuts and incentivization of the private sector to drive economic expansion. The AFC has made it absolutely clear that we will cut the size of the national budget and will offer the following tax reduction as outlined in our Action Plan to the workers so their pay checks can stretch further:

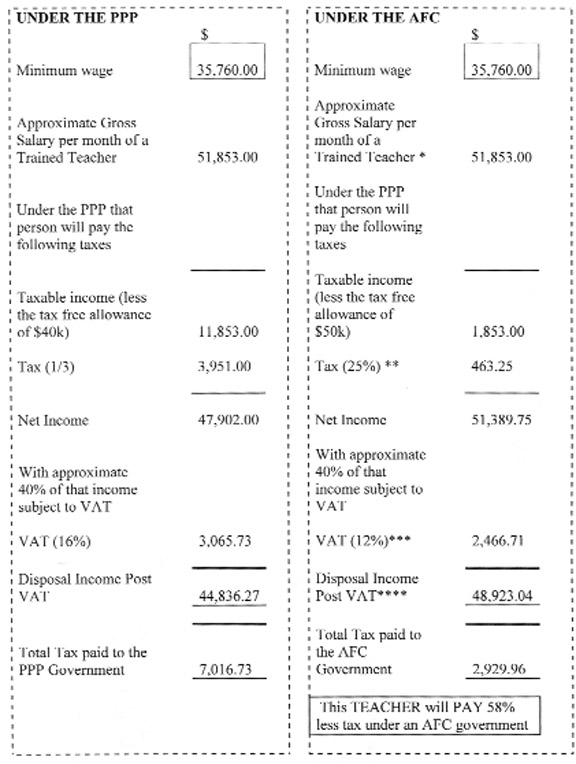

1. reduce VAT from 16% as it is under the PPP to 12% on the first day in office;

2. reduce the PAYE for workers from 33.3% as it is under the PPP to 25% in the first term;

3. increase the PAYE tax threshold from $40k as it is under the PPP to $50k in the first month in office.

In addition to this our presidential candidate Mr Ramjattan is about to announce that an AFC government would give a very substantial increase in salaries (actual percentage) to all public servants – soldiers, police, teachers, nurses, workers in government departments, cleaners, etc. But even if I am to discount the salary increases as proposed by Ramjattan and just focus on the other tax measures we have already publicly announced that we would introduce in office, the AFC’s tax measures are far superior for workers to what the PPP currently has on offer.

When I was in Guyana, I met a teacher who earns $51,853.00 and she confessed she was better paid than most Guyanese. I shall use her salary to show how under an AFC government she will still be paying 58% less taxes than under a PPP government, and this will generally be the story for all the other grades of workers – and we have not even included the Ramjattan proposed salary increase:

We estimate that each additional billion of revenue that the PPP collects in tax, it costs the local private economy at least $2 billion, comprising $1 billion in taxes and $1 billion in lost GDP. Most academics recommend the VAT, but at a lower rate.

Yours faithfully,

Sasenarine Singh