Enigma

The Guyana stock market could hardly be regarded as a vibrant market place. The weekly transactions of stock trades are not the talk of the town and many might not even realize that a stock market exists in the country where shares of companies like Banks DIH, Republic Bank and Demerara Tobacco Company change hands. For many Guyanese who know that it exists, the stock market might still be an enigma and its relationship to the wider economy not fully understood. One company, Rupununi Development Company Limited (RDCL), has been added to the secondary list, a source informing investors of the stocksthat could be traded on the exchange. The Guyana stock market is still in its development phase and, even after more than eight years of operation, the stocks of many companies trade infrequently. Yet, the addition of the RDCL is a good sign since it suggests that some confidence in the fledgling market still exists. And rightly so, since for all its limitations, the Guyana stock market provides an opportunity for the construction of a stock index, and creates a window through which the general public could peer to gauge the market favourability of some of these companies, and the economy as a whole.

Struggle

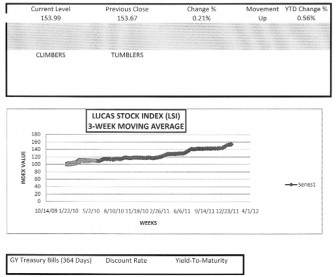

This writer publishes the Lucas Stock Index (LSI) weekly and with 104 weeks of recorded data is in a position to provide some evidence of the value of the local stock market. The use of the LSI helps to point out some of the interesting developments taking place in the Guyana economy and among the companies in the index. The LSI is made up of nine of the 14 companies participating in the stock market. That represents 64 percent of the companies on the exchange, all of whose stocks trade at various times during the year. The nine companies are in the banking and manufacturing sectors of the Guyana economy. The Guyana stock market will continue to struggle until more companies begin participating in it. Yet, there are important reasons the Guyana Stock Exchange should not be diminished and ways should be found to strengthen it. With the aid of the stock index, Guyanese would be able to see some of the dynamics of the economy and get a 3-dimensional view of company valuation that is not readily visible from annual reports or other company publications. As data are accumulated, this possibility increases further with an understanding of company performance coming in advance of any published reports by the company. In other words, the Guyana Stock Exchange has more value than meets the eye.

Saving of Money

There is a general tendency to regard the purchase of stocks as an investment. Accounting rules give credence to that perspective about companies and businesses, which, under certain circumstances, must record purchases of stocks or shares as investments on their financial reports. But the purchase of stocks really represents the saving of money. Stock acquisition simply reflects the transfer of cash from one location – maybe a bank account – to a brokerage account, a type of account used in stock trading. The exchange of money for a stock certificate leaves the purchaser of the stock owning the money, but not in control of it. In any event, it is not until that money is spent by a company or business that it becomes an investment. So, the value of the Guyana stock market as reflected by the value of the LSI is really an indication of the level of savings by Guyanese, including companies, and perhaps foreigners, if they participate in the exchange.

Disappointing

Many observers regard the level of activity of the stock market in Guyana as disappointing. Yet, the infrequency in trading could indicate that Guyanese like using the stock market for their long-term savings. The limited number of trades means that Guyanese are not willing to part with their shares, and are therefore happy to keep their money in this form. While further analysis is required, the trend in time maturities of one year or more held with commercial banks might contain some supporting evidence. From 2002 to 2005, a period when the Guyana Stock Exchange was in its infancy, time maturities of one year or more with the commercial banks increased annually by 11 percent. In the last four years, the amount saved with the commercial banks has increased by an annual average of five percent. Additional evidence of the impact of savings through the stock market on time maturities of commercial banks is reflected in the relative size of the savings. In 2004, savings in the stock market were twice the savings of time maturities of one year or more in commercial banks. By 2010, the difference was three times the extended time maturities in the banks, and was likely to be four times the figure in 2011. While the conclusion about long-term savings cannot be confirmed at this stage, the finding evinces an important perspective of the benefits of the stock market.

Big Favour

Placing the defects of the stock market aside, those Guyanese who use it are doing themselves a big favour. The value of the LSI at the end of 2011 was 153.14. This number means that the value of the stocks making up the index has increased by 53.14 percent since January 2010. In terms of value, it reflects the increase in savings by Guyanese from January 2010 to December 2011. The savings of Guyanese through the stock market have grown in the last two years from G$57 billion to G$87 billion. The movement in value translates into an 18 percent return in 2010 and a 35 percent return in 2011, including the returns on income brought forward from 2010. This outcome would be true for any Guyanese who held all of these stocks in their portfolio for the last two years. This is a handsome capital gain that beats the return on Treasury Bills and the interest on the best investment product offered by any commercial bank in Guyana.

Dynamics

The dynamics of the stock market in the Guyana economy do not stop there and help to provide a 3-dimensional view of the market favourability or unfavourability of companies. This picture is painted by the resource allocation function of the market and shows the allocation of resources among the stocks of companies, the allocation between the two sectors, banking and manufacturing, making up the LSI, and the rate at which the stocks of various companies are attracting resources. For example, in 2010, Republic Bank Limited (RBL) accounted for 29 percent of the value of the nine companies in the index. By the end of 2011, RBL’s share of the market had risen to 33 percent, clearly indicating a favourable disposition towards this company. Banks DIH had a different experience during the same performance period. In 2010, Banks had the second highest value of the stock market with an 18 percent share. By 2011, even though Banks DIH retained the second highest share of the market, its share had fallen to 14 percent.

In addition, the index is made up primarily of companies in the banking and manufacturing industries. The majority of the money allocated in 2010 was split between the two sectors. RBL, GBTI, DIH and DDL shared the top four spots. By 2011, the bulk of the money was directed at the stocks of the banking industry with all the manufacturing companies falling to the bottom. This is another signal that the manufacturing sector in Guyana is underperforming.

Speed

More interestingly, though, is the speed with which companies increased their value over the last two years. In 2010, GBTI was only able to increase its share value by 24 percent, a rate similar to that of Banks DIH. Republic Bank raised its value by 40 percent while DDL lifted its value by 11 percent. Demerara Bank Limited (DBL) managed to raise its value by three percent while Sterling Products Limited (SPL) lost seven percent of its value. The others Demerara Tobacco Company (DTC), Citizens Bank (CBI) and Caribbean Container Incorporated (CCI) barely moved. In 2011, GBTI was able to increase the rate of growth of value to 69 percent overtaking RBL at 51 percent, and demonstrating the greatest market favourability. Significant movement was shown by CBI, 44 percent, DeBL 30 percent, and SPL 15 percent in 2011. It was indeed surprising that for all its activeness on the stock exchange, DIH was only able to grow its value by four percent in 2011, perhaps pointing to some weaknesses in its operations that might be discouraging investors, and confirming the struggles of the manufacturing sector. On the other hand, the financial services industry is expected to show strong growth.

Connection

It should be evident from the foregoing that the connection between the stock market and the Guyana economy is real. Where it exists, the index of the stock market serves as a leading indicator of the economy. It is no different in Guyana, and the LSI offers some clues of how the Guyana economy behaved in 2011. At the end of June 2011, the value of the LSI stood at G$77 billion or about 17 percent of the national income reported by the Jagdeo Administration in its half-year report on the economy. The 17 percent relationship between the stock market and the Guyana economy suggests that the income generated by December 2011 the size of the national economy minus taxes and subsidies should be close to G$453 billion. Anything above that figure indicates that the economy did even better than imagined and anything below should be cause for concern about the reliability of information coming from the administration.

Optimistic

So, while many may remain disappointed about the effectiveness of the Guyana stock Exchange, there is plenty to be optimistic about. As more data become available and greater use is made of the data emerging from the market, the appreciation of the stock market will grow. One has got to hope that the newly formed government, including the Opposition would make an effort to strengthen the market.