Dull Atmosphere

Despite nearly one year of tentative and inconsistent governance, the Guyana economy is set to record another year of growth. This message was delivered by the report on the performance of the economy in the first half of 2012. Reportedly coming in at 2.8 percent, the growth was noticeable in two of the broadly defined sectors of the economy. At the top of the list was the mining and quarrying sector which registered 16.4 percent real growth. Production expanded and so did demand for most of the products making up that sector. Gold enjoyed the added benefit of higher prices that allowed it to bring in 17 percent more revenue than it did during the comparative period last year. The other contributing sector was that of services. Therein, the distributive trade and its companion activities of storage and transportation chipped in with a 5.5 percent growth in output. Despite the lower impact on growth, the most stellar performance was in the services sector. Transportation and storage contributed a whopping 20 percent to the performance of the economy. Transportation coming in as a bright spot in an otherwise dull atmosphere of governance, one might conclude that Guyana was on the move. The two successful sectors of mining and quarrying and services are expected to be joined by agriculture and manufacturing to give Guyana a 3.8 growth when the year ends.

Within the Numbers

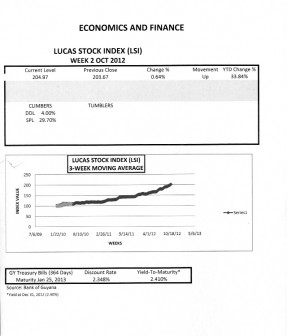

Despite the participation of five stocks in the second week of trading in October 2012, the Lucas Stock Index (LSI) recorded a marginal gain of 0.64 percent. The stocks of three companies, Banks DIH (DIH), Demerara Bank Limited (DBL) and Guyana Bank for Trade and Industry (BTI), remained unchanged from last week. The stocks of two companies Demerara Distillers Limited (DDL) and Sterling Products Limited (SPL) recorded increases of four and 29.7 percent respectively. As a result, the LSI now exceeds the yield of the 364-day Treasury Bills by over 31 percentage points.

Many variables were cited as contributing to the positive narrative about the buoyant economy. These include a sizable stock of foreign reserves, a decrease in the stock of domestic debt, an improvement in the overall financial performance of the public sector, declining interest rates, price stability along with stable exchange rates, rising foreign direct investment, enlarged customer deposits, expanded credit to the private sector and the expansion of reserve and broad money. When taken as a whole, they reflect an economy that has some sound legs on which to stand. But even as favourable as the economic environment seems, there is cause for concern lurking within the numbers, and not for the reasons offered in the half-year report.

Catawampus View

With the continued economic uncertainty in Europe, there is every reason to be concerned about the global economic performance for the rest of the year. But Guyana ought not to worry because the troubles in Europe have helped to sustain the comparatively high world price for gold. At current global prices, gold producers have the incentive to continue expanding output. In addition, another signature commodity of Guyana, rice, rests comfortably in a global economic zone. The price of rice has stabilized leaving Guyanese producers assured that their expanding output would not confront unduly weak world prices. With Guyana reportedly receiving half of its oil needs from Venezuela under the Petrocaribe facility on highly concessionary and flexible payment terms, there is relatively little to fear from a sudden upward movement in global oil prices. So, the global economic outlook ought to be the least of Guyana’s economic worries for now. The challenges for Guyana lie within its borders and in its catawampus view of economic opportunity and wealth creation.

Limited Will

For all the good that we see, Guyana lacks the wherewithal to take full advantage of some of the very key economic conditions that it cites in its half-year report. The money supply is expanding faster than Guyanese could come up with ideas of how to use it or how to convince creditors that they would be repaid if they loaned out that which they possessed. The financial institutions are adequately capitalized and there is plenty liquidity available. As a result, the credit market has seen continued growth. Yet, the excess liquidity can find nowhere to be absorbed, showing up the lack of creativity in the private sector and pointing to the limited will to fund investments outside of the traditional sectors. Much of the excess money sits in reserve as part of an overabundance of the monetary base needed to settle demand obligations moving between banks. A sizable amount also sits in slightly less liquid form as savings and time deposits. At the same time, the money needed to keep businesses going or to meet household obligations-notes, coins and cash instruments-declined by 4.1 percent, implying that there could have been a slowdown in spending. But that apparent spending gap also could have been made up by trade credits from vendors and lines of credit from commercial banks.

The lack of absorptive capacity might also be linked to how Guyana prefers to finance its investments. In looking at a calculated estimate of national savings, made up of private investment, public investment and the foreign trade balance, there seems to be a marked preference to finance investment more with foreign savings than with funds generated by the national economy. An expanding foreign trade deficit means that our investment is being funded increasingly from foreign savings. For this year, Guyana has expanded its reliance on foreign savings by 24 percent. How this penchant for foreign savings will play out to the end of 2012 is still unclear since all the data is yet to come in. Yet, it is worth keeping a close eye on the trend in national savings. From 2006 to 2011, the national savings averaged about G$49 billion per year. The national savings rate during the same period peaked at 12 percent of gross domestic product (GDP) in 2009, only showing growth twice in the last six years. However, since the savings rate started its decline, it has done so in successive years to reach seven percent of GDP last year.

The Issue

The tendency towards foreign savings is reflected in the goods and services that Guyanese buy. The growth in imported consumer goods means that Guyana is not producing what its consumers want. It is also true that Guyana is not producing the capital goods that it needs. The issue is which current or prospective investor is brave enough to venture into production of the type of items which is in demand by households and businesses in the face of competition from imports. The lack of capability and the prohibitively high capital costs rule out production of heavy equipment without a foreign partner. But, some consumer items are within reach. Consumer items like stoves and refrigerators, once produced in Guyana, are worth pursuing given the housing construction boom, and the anticipated demand for those items. The type of investor who could launch production of such items seems to be absent from among the internal investor class. There too foreign investment could be pursued. However, foreign investment remains concentrated in the extractive and communication industries. It is interesting also that the housing drive only seems to focus on materials for the structure. Guyana does not appear to have an appetite or incentive for producing basic items that every house should come with, even though those types of investment would bring jobs to the country and possibly change the current lopsided trajectory of human deve-lopment and economic progress.

In the context of the foregoing, the mid-year numbers should give Guyanese food for thought.