Important next steps

At this stage I alert readers to two tasks which remain to be tackled before I wrap up this discussion of the medium term macroeconomic outlook. One is to detail an exercise in what economists term as “accounting for, or decomposing” those formal macroeconomic relations, which account for the slippage in Guyana’s government debt to GDP ratio. Coincidentally, public discussion along this line is presently taking place across the Caricom region. This gives me confidence that my Guyanese readership would be happy to have these matters addressed in our local media in a non-technical manner.

Consensus

Many economists believe that the area of economics where there is the greatest consensus among different schools is the analysis of debt dynamics. For those who care, the major line of cleavage remaining is whether the interest rate is a social construction or has the status of a natural economic variable like consumption, capital accumulation, savings, the rate of growth and so on. Such esoteric concerns, however, do not need to detain us, as they are fully ventilated at a higher and more abstract level of economic theorising, pioneered by such notables as Marx, Smith, Ricardo and more recently Keynes.

On examination the basic relation reveals two things. First, the factors driving an increase in the denominator (GDP) would, other things remaining the same (the numerator), reduce the size of the ratio. And, by similar reasoning anything leading to a rise in government debt (numerator), if other things are held the same (the denominator), would increase the size of the ratio. Because in real life other things never remain the same, we realistically speak of this as a tendency.

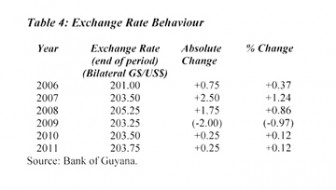

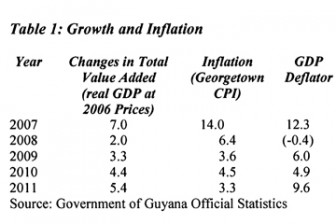

The GDP measure that is normally used in the ratio is expressed at nominal or current prices. Two considerations therefore drive changes in nominal GDP. One is real (or constant value) GDP changes (or growth more simply), and the second, changes in the price level (or inflation). As we saw last week inflation can be represented by either changes in the consumer price index (CPI) or the GDP deflator. The conclusion we may safely arrive at therefore, is 1) increases in economic growth and 2) inflation tend to support the containment, and even possibly the reduction of the government debt to GDP ratio. The behaviours of these two variables are presented in Table 1 below for the period 2006-2011.

Source: Government of Guyana Official Statistics

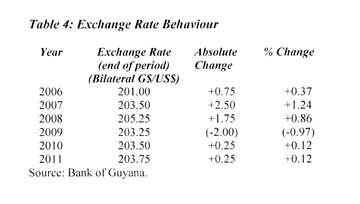

The question we have to ask next is: what leads to changes in the government debt or the numerator? One is clearly the fiscal effort the government undertakes to contain borrowing. This effort is measured by the size of the primary balance or the overall balance of the public sector. We expect that the larger the primary balance and the overall surplus of the public sector are, the better government debt is contained or reduced.

Recent data on both the primary balance and the overall balance of the public sector after grants are shown in Table 2 below. As we can see the primary balance has been positive, but the overall balance of the public sector (after grants) has been in deficit.

Source: Bank of Guyana, National Budgets and Estimates

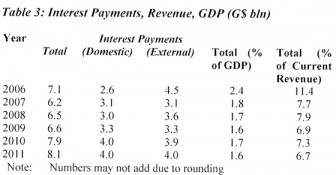

Secondly, the amount of interest payments paid on outstanding debt (both domestic and external) is clearly important. Table 3 below illustrates the behaviour of interest payments (total, domestic and external) as well as the relation of total debt to GDP and government revenue for 2006-2011.

Sources: Bank of Guyana, PRSP 2011, Budget and Estimates 2012 and Authors’ Calculations.

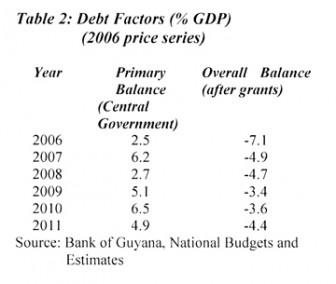

Thirdly, the size of the sovereign debt is affected by the behaviour of the nominal exchange rate for the currency in which the external debt is denominated. In Guyana, the crucial rate is the Guyana dollar to United States dollar bilateral market exchange rate. The behaviour of this rate since 2000 was shown last week. The situation is that, when the Guyana/US dollar nominal exchange rate depreciates, this increases the domestic dollar value of our debt denominated in US dollars. The more or less steady depreciation of the exchange rate since 2000 therefore has translated into a more or less steady increase in the domestic dollar value of the external debt. Table 4 below shows the behaviour of the exchange rate for 2006-2011.

Source: Bank of Guyana.