Introduction

In the 2012 Budget Speech, Dr Ashni Singh, Minister of Finance said: “Currently, in Linden, electricity costs between $5 and $15 per kWh, while on the GPL [Guyana Power and Light] grid customers pay an average of $64 perkWh. The total cost of this electricity subsidy was $2.9 billion last year, the equivalent of 10 per cent of GPL’s total revenues. Starting from 2012, reforms will be initiated to the tariff subsidy with the aim of giving effect to a progressive alignment of the subsidised rates with the national rates that are applicable on the GPL grid.”[Emphasis added].

There are a couple of small things wrong with that statement. Linking the subsidy to the total recorded revenue of GPL is tenuous at best, and misleading under any circumstances. Linden is not on the GPL grid; it is provided with electricity produced by Bosai Mineral Services for sale to Bosai Minerals Group and to the community through Linden Electricity Company and the Electricity Cooperative Society. Third, a random survey of the electricity bills for the most recent period of five GPL consumers, all staff of Ram & McRae, showed an average of $55 per kWh, high but 14% lower than the charge stated by the Minister.

Nothing progressive

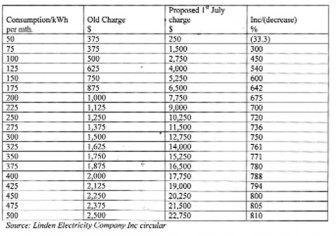

But what is patently misleading is that part of the Minister’s statement that speaks of a progressive alignment starting from 2012. Here are the increases which customers were being asked to pay before the tragic deaths which led to the rates being put on hold.

Anyone consuming 75 kWh or more of electricity will face an increase in their bill of at least 300%. In my group of five, the average consumption is 157 kWh. The increase applicable to them would be over 600% making it hard to find any word but deception to describe the Minister’s clever use of words.

This government which has a good sense of history has had twenty years to address the subsidised tariffs in Linden. Assuming a $5 per kWh in 1992, it would have required a semi-annual increase of roughly 6% to bring the tariff up to the same level as GPL. With fatal consequences, the government has attempted to do in one year what it did not do in 20 years.

Profiting from the subsidy

But the Minister is not the only person producing misleading information. Bosai Minerals Services Inc released recently a document described as an “Audited Operation report” showing that the company made a profit of US$233,000 in 2010. The public records however show that the company made a profit (before tax) of G$76,342,000, the US Dollar equivalent of $380,000. Since the company’s business is the operation of a power plant to provide electricity to its (group) bauxite operations and the community, it must explain this difference and whether it is permitted under the agreement with the Government of Guyana to make a profit from the subsidy.

There are other concerns about the electricity operations. The information the electricity company has provided on fuel costs needs explanation. Invoices for diesel imported by its parent company (Bosai Minerals) from the State Oil Company of Suriname show a lower cost of fuel than that reflected in the company’s income statement. Since its financial statements do not suggest that the company buys diesel from the parent company, the question is why does it not pay the same price from the same supplier as its parent.

A second concern has to do with the agreement signed with the government for the supply of electricity, a regulated service which would otherwise come under the Public Utilities Commission. The government has excluded Bosai from any regulatory obligation hence its freedom to charge rates that should have been fixed on a cost recovery basis. It seems incontrovertible that that would be the more appropriate basis since the supply serves the group and in some cases its service is specific to the group. For example, any plant capacity for the operation of the dust collector cannot be shared with the community charge while on the remaining plant, the pricing policy should be based on the marginal cost of providing electricity to the community.

Paranoia

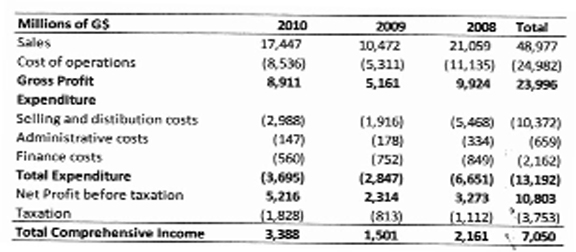

A third concern I have touches on the government’s paranoia that if it applies the country’s laws to Bosai, the company will pull out. Perhaps that is the message – or threat – the company communicates to the government in private. We should not fall for that. Bosai and China are here not to develop Guyana but to guarantee access to raw materials. They need Guyana as much as Guyana needs foreign investment. Our failure to recognise that allows investors and Bosai in particular to exploit the country. Let us look at Bosai’s Income Statement for the years 2008-2010.

Source: Audited financial statements

Order 8 of 2005 indicates that the company is subject to royalty at the rate of 1.5% but to a zero rate for the first five years. I searched the Laws of Guyana but could only find statutory authority for a 3% rate and first saw a reference to 1.5% in a 1997 Mining Policy and Fiscal Regime by Prime Minister Samuel Hinds. Mr Hinds’ paper did not even mention the Bauxite (Production Levy) Act 1974 which was introduced to ensure that the country gets a fair share of the revenues from its natural non-renewable resources.

Mrs Da Silva and Mr Hinds

The Hansard of the debate on the Production Levy Act in the National Assembly of September 25, 1974 records then leading member of the United Force as saying: “These big multi-national corporations seem to think that because they are huge multi-million concerns, that because they are big and we are small and we need the revenue from our bauxite so badly for the economy of our country, that they should have the upper hand and be allowed to dictate [to us]. That time has passed.” If you can hear me, Mrs Da Silva, that time has returned.

Those whom her party now supports in the National Assembly are prepared to waive royalties and to ignore the Bauxite (Production Levy) Act for a hugely profitable company which was on target to recover its original investment in less than five years. Prime Minister Sam Hinds, failing to appreciate the difference between royalties and corporation tax, has ensured that under Order 8 of 1995, the company will pay only the greater of royalty and corporation tax. In other words, if the corporation tax payable exceeds the amount payable as royalty, no royalty will be payable.

Let us put that into context. In the three years 2008 to 2010, the bauxite companies exported some 4,659,317 tonnes of bauxite with an exchange value of US$325.2 M. For this, the country received no royalties.

And if 2010 was a good year, 2011 was a great one. Bauxite production shot up in 2011 by 68%, from 1,082,512 tonnes to 1,818,399 tonnes. If there was no technical or economic case for a royalty waiver in 2005, there can be no financial case for an extension of that waiver in 2011.

And there is one other point which may have escaped the Government of Guyana. Without a Double Taxation Treaty between Guyana and China the income earned in Guyana would under normal tax rules, be subject to tax in China. In other words, income we do not tax is effectively contributing to the Treasury of China. If only we are courageous enough to negotiate a fair deal with Bosai, and apply Guyana’s tax laws including the anti-transfer pricing provisions as necessary, the country will be better off.

Conclusion

And let us end today’s column on this note. Guyana is a 30% shareholder in Bosai. So that when Bosai paid one billion dollars in dividends in 2010, Guyana received $440 million of that in revenues, $300 million in dividends paid to NICIL and $140 million paid to the Guyana Revenue Authority as withholding tax. And that is on top of the $708 million received from corporate taxation! If only we did not waive all those other taxes!

Clearly Region Ten is not a burden on, but rather a contributor to the state.

Next week I will identify some specific solutions to the tariff question.