Introduction

The Luncheonese in the heading is deliberate. Business Page of May 10 2009 wrote that the NIS faced real and disastrous consequences from Cabinet’s failure to act on the recommendations contained in the 2001 and 2006 Actuarial Reviews of the NIS.

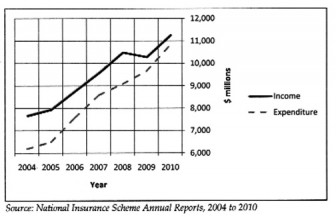

In one of the columns in that 2009 series on the annual report on the Scheme, I wrote that the 2006 Actuarial Report had projected that total expenditure would, in 2014, exceed total income for the first time in the scheme’s forty years and unless contribution rates are increased, the scheme’s reserves would be exhausted by 2022. I wrote then that with the likely loss of billions in capital and income in Clico and the inaction of the government and the board, including PPP/C fixtures like trade unionist Komal Chand and Chitraykha Dass, Chartered Accountant Maurice Solomon and business executive Paul Cheong, it was possible that the actuary’s fears about expenditure exceeding income could happen sooner rather than later.

Late reporting

We wait on the audited report for 2011 which Dr. Ashni Singh, as the subject-minister, is already late in presenting. But if the audit confirms the General Manager’s numbers then the actuaries are spot on with respect to their doomsday scenario – if the unlikely urgent and drastic preventive action is not taken. Indeed, since the last actuarial report predated the Clico debacle, the actuaries would have assumed that the NIS would be receiving a stream of income from Clico with no risk to its investment of nearly seven billion.

The audited financial statements of the Scheme at December 31, 2010 included accrued investment income from Clico of $90 million, and no provision for a loss on the investment. That is at best aggressive accounting – and as noted before in this column – is based on a misunderstanding of a statement by Dr. Luncheon as Head of the Presidential Secretariat to the NIS of which he has been Chairman since 1992.

But casual and irresponsible as Dr. Luncheon has been, he is not solely to be blamed for the almost irreparable financial damage to the NIS over the past ten years. At the policy level I would have to name President Jagdeo and the two Finance Ministers of the PPP/C since 2001 – Mr. Saisnarine Kowlessar and Dr. Ashni Singh.

Sharing the responsibility

Dr. Singh in particular has to take a lot of the blame because the acceleration of the deterioration was the collapse of Clico for which as Finance Minister he bears statutory responsibility, and tolerated and later excused. And he has not been contrite, modest or courteous about his serial failures in relation to the NIS. To check on the propriety of NIS investing in Clico, I wrote Minister of Finance Dr Ashni Singh a letter on February 24, 2009 pointing out that the NIS Act only allows the NIS to invest in securities approved of by the Co-operative Finance Administration (COFA) established under the Co-operative Financial Institutions. I pointed out in my letter that Dr. Singh as Finance Minister is not only the Chairman of COFA but as Minister, he also appoints its Board. The Minister of course also appoints the Board of the NIS. I asked him the following questions:

1. The names of the persons he appointed to COFA currently serving as members of the administration, and the commencement and termination dates of their appointments.

2. The securities which COFA approved for purposes of investment.

3. Whether the NIS had sought and received approval for any investments other than those determined by the administration and if so, the securities which have been so approved.

4. Whether the administration during his tenure as Minister has ever taken the opportunity under section 4 of the act for its Chairman or Secretary to attend any meeting of the National Insurance Board, and in particular the meeting at which any decision was made by the board for any special investments.

More than three years later, I am still awaiting a response.

The nature of the Scheme

The NIS is an actuarial scheme that seeks to balance out, in the long-run, its obligations against its resources. The NIS Act requires that every five years, external independent actuaries must review all the data on active and past contributors, project future income and expenses – of which pension benefits are always the more significant item – and then make recommendations to maintain/restore the actuarial balance of the Scheme.

The responsibility of the Government and the Board is to consider and act on the actuaries’ recommendations. However, for more than a decade, the Government has consistently allowed political considerations to undermine the proper management of the Scheme, ignoring the recommendations contained in the reports of the actuaries for the 2001 and 2006 reviews.

Between 2004 and 2007, every annual report of the NIS stated that the Board of Directors “is in the process of reviewing and implementing the recommendations”. But then in 2008, the Scheme’s annual report dropped the word “implementing”. Clearly, they gave up on their own plans to implement.Not surprisingly, and apparently frustrated by the failure to implement their recommendations, the actuaries in their Executive Summary of the 2006 Actuarial Review, categorically expressed a decision to limit their recommendations “given the outlook of the Fund and the concerns regarding some benefit provisions”.

We give up

They added that if the limited recommendations were implemented, “then other changes may be considered later.” In other words, ‘we give up’. When you get serious, we will too. This huge warning signal was missed by the entire Board of the NIS and the Cabinet of the country.

The result of this stubborn and irresponsible failure by the Government is that the NIS is now under serious stress from which no amount of spinning or flippancy will rescue it or detract from. In the most unbelievable statement to come out of the NIS, its Chairman Dr. Roger Luncheon, the 2009 announcement of whose removal from the Board was welcomed in many quarters, could find it possible to say that his government considers any decision on the Scheme in the same manner as it considers same-sex marriage or the decision on the death penalty!!

Under the immediate past stewardship of Drs. Luncheon and Singh, the failure to act on the recommendations of the actuaries, compounded by the collapse of its investment in Clico has left a $5 billion hole in the Scheme’s balance sheet, and no income from more than 20% of its investment. Significantly, the benefits most under threat are pensions for which the reserves to payments ratio has fallen from 4.95 times in 2002 to 1.82 times in 2010, the last year for which the annual reports of the NIS are available.

Ram & McRae in their 2012 Budget Focus repeated the fear that “the possibility cannot be ruled out that perhaps no later than in 2012, expenditure will exceed income with the situation worsening every year thereafter.” The accountants warned in their document that the resolution of the Scheme’s problems which began in earnest in 2004 cannot await the completion of the 2011 Actuarial review now in its preparatory stage. Immediate and decisive action is necessary, otherwise disaster looms.

Darkening clouds

The outlook for the NIS is grim and once again the smiling, avuncular doctor is trying to assure the public that things are not that bad. In his anniversary message he assures the country that the findings of the 8th. actuarial review would soon be presented to stakeholders who he “[expects] to contribute constructively to the resolution of the challenges facing the Scheme.”

Those confident enough to believe Dr. Luncheon are assured that the Board and the Management commits to spearhead this entire exercise with the intention of ensuring that the expectations of the stakeholders are solicited and recommended in any new disposition adopted by the Government of Guyana.”

This column is not optimistic.