Dear Editor,

There has been a significant upsurge in interest in the Amaila Road Project (Motilall’s road) and the Amaila Hydro Project, no doubt occasioned by the termination of the contract and the visit of Sithe Global representatives to Guyana.This upsurge in interest is understandable given the recent disclosure by the Sithe representatives, and the accelerating costs of the hydro electricity project.

I had an opportunity to meet with the Sithe representative on his recent visit and I now wish to share some information I obtained from that meeting which allowed me to compute the true cost of this 20 years Build/Operate and Transfer (BOT) project. In essence, this means that within the 20 year period, the promoters and owners have to be repaid the amount invested together, with interest on borrowings and dividends on capital invested.

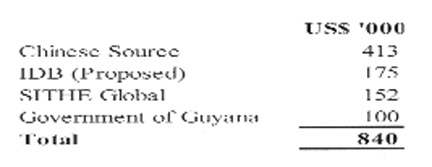

As it stands now, the capital construction costs as reported in the press from Sithe sources are US$840 million broken down as follows:

It is not clear whether the Sithe Global “Investment” is straight cash or promoter’s equity, which is not unusual in these deals where the promoter does work to put together the deal, particularly the financing components, but as far as Sithe Global’s role in the project is concerned, they did confirm the acquisition cost of Motilall’s “licence” is US$12 million.

While this is likely to be paid in cash, it remains difficult to figure out how much money (besides the deal with Motilall) Sithe has actually spent on the project, although from time to time they put out huge numbers.

Another disclosure made by Sithe is that they are to receive 19% guaranteed return on their investment presumably for the 20 years duration of the BOT. This is US$28.88 million per annum or US$577.6 million over the 20- year period.

As for the Chinese “Investment” of US$413 million, this will attract an interest of approximately 8.5% (at the lower end). This is extremely high for this type of project and is clearly usurious, exploitative and unconscionable. At 8.5% over a 20-year period, the total repayment of interest and capital is US$862,3 million, with interest alone being US$449 million.

The interest on the Chinese “Investment” of US$449 million together with the guaranteed “rate” for Sithe of US$577.6 million amount to US$1.02 billion. This brings the project to US$840 million. Plus US$1.02 billion = US$1.8 billion.

Now this is astronomical. Under normal circumstances, a hydro power plant of this size would be approximately US$320 million – US$360 million.

Note that this excludes interest on the proposed IDB financing of US$175 million and the Government of Guyana proposed US$100 million. The IDB loan if it materializes will certainly attract interest. As if this madness was not enough for Guyanese to bear, Sithe disclosed that the Chinese “Investment” is insured for political risk by a Chinese insurance company for the princely sum of US$96 million which is part of the overall cost of the deal.

I am familiar with the idea of political risk insurance which is offered by institutions such as MIGA, but the notion of a Chinese insuring another Chinese company’s investment where the engineering, procurement, construction and financing are all done by Chinese entities is quite revealing. And all of this insurance is done where the Government of Guyana has already guaranteed that the GPL would repay the debt through a power purchase agreement. In other words, with the sovereign guarantee the risk is zero and to ask for a $96 million premium is exorbitant, usurious and unconscionable. A government guarantee is built into the proposed transaction.

All of this was disclosed by Sithe, who reported that the price of power to be purchased by GPL at the switch would be US$0.12 per KW/hr.

It is clear that at a total so far declared costs – capital and interest/divided of approximately US$1.9 billion, repayable over 20 years, the GPL would have to find approximately US$950 million per annum average to discharge its obligations. This works out at $18.5 billion approximately at $204 to US$1

This means that GPL would have to purchase approximately 800 gigawatt hours at US$0.12 per kw hour. The present production of GPL is in the vicinity of 600 gigawatt hours with total system losses of 32%, or almost 1/3 of all production not billed at all.

The projected generation cost of GPL for 2012 of $19.5 billion is not much different from the average annualized cost of $18.5 billion, and for what is touted as a significantly more economical cost of production of energy. It is clear that in the rush to establish a hydro as a status symbol, no one has properly calculated the total costs, capital plus interest, the true savings, if any, in generation costs, the rate to be charged to the consumer, the additional cost of taking power to Essequibo and the true technical losses of transmitting power from Amaila to the load centres.

Equally importantly, no one has yet figured out what happens when the line fails or develops a fault, the availability of water over the next 20 years, and the insane idea of putting all the production for an entire country in one single line coming through the forest.

As for GPL, they are now spending over $6 billion producing power that is not billed to anyone. This is the real tragedy in the energy sector. And that is what we should first aim to fix.

In their presentation, Sithe scares everyone by talking about oil reaching US$200 per barrel. This is only speculation and scare tactics. What is real, however, is that the entire project is dominated in US$ and the power purchase price is in US$, but GPL is reselling power in G$. No one knows what the exchange rate of the US$ will be over the 20-year period. GPL will be carrying a serious exchange risk in this deal, if it ever goes through and eventually it is the consumer who will have to repay the US$1.9 billion.

This project needs to be seriously and comprehensively reviewed by competent, independent, professional, engineering and financial experts. According to Sithe, the World Bank has already declined to participate in the project.

This alone should be a warning. The project itself is shrouded in too much secrecy and the roles of the various Chinese entities, Sithe and Motilall must be examined.

This letter is an invitation to President Ramotar and the National Assembly to order such a review and public hearings on this matter.

If Sithe and or GPL wish to challenge the various premises outlined in this letter, I would be happy to pursue this matter provided that all the documentation, agreements, projected calculations and other relevant written material are in place in the public arena for study and discussion.

Yours faithfully,

Ramon Gaskin