Commendable Changes

Commendable changes to the Guyana economy go beyond the behaviour of physical output. It is also about the structure of the economy and whether or not the policy tools being used will help to change the structure to help expand employment and incomes. Two important areas of attention will not match the self-adulation of the administration. These are the inflow of foreign investment and the inflow of current account receipts. Both have healthy positions, but not for any reason traceable to the policies of the administration. The political atmosphere in Guyana is stressful, but not sufficiently tense to discourage foreign investment. That means that investors who believe in democracy have confidence that, whichever Party comes to power in Guyana, their investments would be safe. With its natural endowment of agricultural and mineral resources, Guyana has plenty to offer foreign investors, and is likely to attract them.

But, foreign investment cannot be taken for granted since it is driven entirely by self-interest. Foreign investment generally pursues three interests from the point of view of the investor. They are made where market opportunities exist in the host country for intermediate and final consumer products. The domestic market in the host country must be large enough for investment in productive facilities to make sense to an investor. This writer and others have pointed out that the Guyana market is very small and the country relies more on export markets to make production profitable. So, foreign investors are not coming because of a policy position on domestic spending. And, any export market opportunities they enjoy could also come from the work of their own governments.

Cheap Labour

Foreign investment is made also where cheap labour and suitable skills exist in the host country. In the recent spat with the public regarding the construction of the Marriott hotel, the administration itself has admitted that neither of the two represents advantages that Guyana has. Other cost-based advantages like cheap energy and efficient transportation are not variables that work in Guyana’s favour either. Consequently, Guyanese do not believe that foreign investment is coming to Guyana on account of any special human resource or production related advantage that the country has.

Desired Natural Resources

Foreign investment follows the money and its own economic interests. They are made where desired natural resources exist in the host country or where essential services like in telecommunications and transportation are needed. Guyana has plenty natural resources including gold, diamond, bauxite, manganese and uranium. Except for the traditional exports, most others are yet to materialize or come on stream. They all have value-added benefits but Guyana is not in a position to take advantage of those benefits. Without value-added production, the expected benefits to the host country are usually the creation of employment opportunities and the ability to learn and absorb new methods of production and management, often referred to as transfer of technology. These occur at the individual and enterprise level. The administration is unable to disclose how many new jobs were created in Guyana as a result of foreign investment.

Boosts Reserves

There are benefits with broader macroeconomic implications also. The inflow of foreign currency from the investment boosts foreign reserves that support the importation of goods and services used in intermediate and final consumption. The level of foreign investment in 2012 was reported as US$294 million and came mainly from the mining and telecommunication sectors. Such inflows often help to spur domestic production and the expansion of the wholesale and retail trade when the imports are used in value-added production. Even though the wholesale and retail sector grew by 6.7 per cent, the administration is unable to indicate how much of the increase in output is due to foreign investment. According to the 2013 budget statement, manufacturing turned in a mixed performance suggesting that that sector received no foreign investment or very little benefit from such investment.

Preempt Losses

The spending from the foreign investment and the wages from the employment that usually accompany the investment also help to expand the economy through its multiplier effect. That is the case when local labour and managerial talent participate fully in the employment opportunities. But, foreign investment might be adopting a new attitude. Among them is the protection of intellectual property rights and a greater desire for better quality control. While the two are linked to new elements of global trading rules, a third factor appears to be emerging. That is the attempt by foreign investors to preempt losses arising from political risk. Companies seek to control entire production processes under the guise of quality and cost control by bringing their own labour. The administration cited several examples of projects undertaken in Guyana that relied almost entirely on production processes exclusively controlled by the investor. This practice limits the multiplier benefits that a country like Guyana could obtain from foreign investment. To the extent that this practice will continue or expand, foreign investment brings no real benefits to Guyana.

Two Words

An issue of equal or perhaps greater concern is the high dependence by the country on two sources of revenue that provide no guarantee of long-term reliability. Upon reviewing its performance, Guyanese will see that the economy could be summed up in two words: gold and remittances. It was largely remittances at one time. Now gold has stepped forward in a big way to bolster the economy. (To be continued)

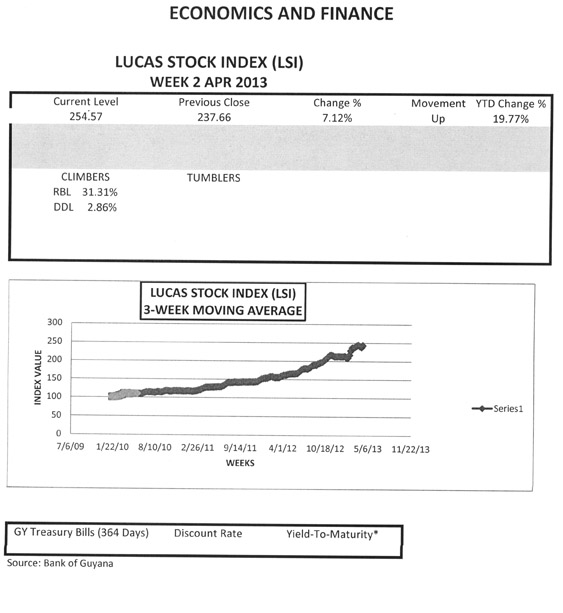

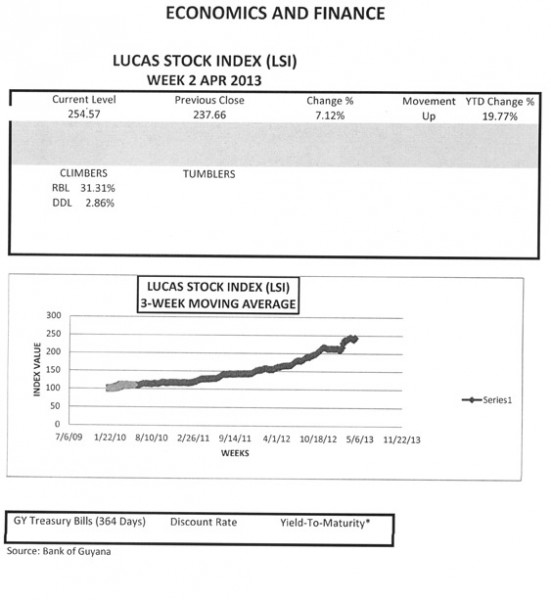

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) increased significantly during light trading in the second week of April 2013. The 5,750 stocks of four companies traded with mixed results. Banks DIH (DIH), which saw 1,034 of its stocks change hands, recorded no change in its stock value. Demerara Bank Limited (DBL) traded a volume of 2,000 stocks with similar results. The positive gains in the index came from Republic Bank Limited (RBL) and Demerara Distillers Limited (DDL) which increased their value by 31.31 and 2.86 per cent respectively. The change came on less than half of the volume of the shares that were traded.