The Micro and Small Enterprise (MSE) Development and Building Alternative Livelihoods for Vulnerable Groups project, the first project to be administered through the institutional framework created by the Small Business Act of 2004 has been tasked with ensuring that a total of 2,200 jobs are either created or sustained within the first two years of the project.

Chairman of the Small Business Council, University of Guyana Lecturer Sukrishnalall Pasha told Stabroek Business earlier this week that the council will provide the Small Business Bureau – which will serve as its secretariat – with technical advice that will include support in the evaluation of applications to the bureau for financial or other forms of support. Pasha said the council is currently developing “objective criteria” for evaluating applications for assistance and that these will be applied in the decision-making process in the matter of allocating loans and grants and facilitating applications by small and micro enterprises (SMEs).

Pasha said the council was also in the process of developing tools designed to determine the likely viability of projects.

“Actually, there are some fairly reliable criteria that can be applied in order to determine the likelihood that a small business venture will succeed or otherwise,” Pasha said. He said that each evaluation of the viability of a project will be attended by an explanation to the owner of the project regarding the assessment procedures and outcomes.

The creation of what Pasha described as “technically sound criteria” for evaluating applications and approving applications for support of small business projects in the form of loans, grants or training is consistent with the pronouncement made last week by Acting Tourism, Commerce and Industry Minister Irfaan Ali that the project will offer no “free money” to applicants.

The programme will consist of two components, the first of which, access to finance, will develop instruments to respond to the limitations faced by SMEs with regard to their access to credit from the commercial lending sector. Component One will include the allocation of resources to finance the implementation of a Credit Guarantee, an Interest Payment Support Facility and a Low Carbon Grant Scheme to assist to assist potential beneficiaries with seed capital to start up or expand their businesses.

The second component will address the issue of lack of access to proper training by providing resources for technical and business development training activities for beneficiaries of the programme.

The US$5 million allocation for the programme will be financed by an allocation from the Guyana Redd+ Investment Fund (GRIF) and will be executed by the Small Business Bureau with the Inter-American Development Bank serving as a “partner entity”.

Under the Small Business Act “a small business desirous of becoming an approved small business may make an application to the Small Business Council.”

The Small Business Act makes provision for an 11-member council appointed by the President and must include representatives of the ministries responsible for Finance and Small Business and four persons “being members of legally constituted bodies or organisations – designated by the Minister as representing a small business in Guyana. While critics of the act have frowned on what they say is the excessive decision-making powers of “the Minister” under the legislation Pasha told Stabroek Business that he was satisfied that the composition of the present council reflected the “skills and experiences” which it needed to function effectively.

Meanwhile Pasha said the Small Business Council would be depending heavily on the Institute of Private Enterprise Development (IPED) in developing criteria for evaluating applications for support from the bureau. “IPED certainly has the institutional experience as far as lending to small businesses is concerned. We are currently waiting on them to provide us with data that will help us develop our own evaluation tools,” Pasha said. IPED’s Chief Executive Officer Ramesh Persaud is a member of the council.

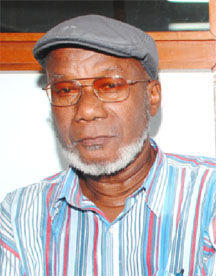

The project also acknowledges the traditional role of the Small Business Association in mobilising small and micro business organisations by including its long-standing Head Patrick Zephyr as a member of the council. During a recent interview with some council members Zephyr said that the association should be credited with producing the first draft of the current Small Business Act which has now become the engine for taking the local small business sector forward.

While the IDB has already signed off on the long-awaited financial allocation to the project, its promised imminent launch is still awaited. Stabroek Business had been told some time ago that the project would have been launched by the end of March. Recently, this newspaper was told that the launch may still be several weeks away.

The project has already attracted the attention of several small business owners and aspirants and Stabroek Business understands that more than 1,500 small business owners have already signed up with the bureau.