Ambitious

A review of the 2013 budget shows that an estimated $370 million are being directed towards small businesses this year. As presented in the budget, these resources are to be made available to beneficiary organizations through three facilities. One is the collateral guarantee facility. The other is the interest subsidy and the third facility is the low-carbon grant scheme. All three facilities are connected to the implementation of the low carbon development strategy and the money that Norway has offered the country for the proper management of the environment. The money which represents barely more than half of point one percent of Guyana’s 2012 gross domestic product (GDP) is expected to have a significant impact on the economy. The small businesses are expected to improve livelihoods-the code words for lifting people out of poverty, increase productivity and stimulate competitiveness. Even if somewhat ambitious, the goals of the planned expenditures on small businesses are commendable. But as commendable as the planned expenditures are, one must ask if the money is enough to support a sector that represents about 50 percent of the Guyana economy. With such little money to be spent on such an important sector of the economy, it also raises the issue of whether or not the goals of increasing productivity and stimulating competitiveness are truly attainable. The last goal of stimulating competitiveness is an eye-opener since one must wonder if small businesses are really expected to compete against big businesses.

Definition

A small business is defined as “any person or persons, including a body corporate or unincorporated carrying on business in Guyana for gain or profit…” By this definition, non-profit or charitable organizations are excluded and so are political parties. However, individuals, partnerships, co-operative societies and companies which are all properly registered can qualify as small businesses in Guyana. Despite the legal form, the Act also recognizes two types of small businesses. One is the micro business. This is a business that earns G$10 million or less in revenue. The other type is deemed a “small business”. Through a combination of value of assets, level of revenues and number of employees, this type of business could be identified in three ways.

It could have 25 employees or less and in excess of G$10 million and no more than G$60 million in revenue. It could also have 25 employees or less and G$20 million or less in assets. Or, it could have G$20 million or less in assets and in excess of G$10 million and no more than G$60 million in revenues. Anything in excess of those numbers makes the business a big one. Like their larger counterparts, such small businesses are expected to be VAT compliant also.

Investments

In a thematic discussion on poverty reduction in Guyana in March 2008, GOINVEST pointed out that small businesses account for more than 50% of economic activity in Guyana. The 2013 budget statement provides an indication of the industries in which small businesses operate. They include both crop and livestock of agriculture, garment manufacturing, cosmetology and leather craft. These economic activities are linked to the investments made by single parents under the Women-of-Worth (WOW) programme and fall mainly in the micro-business category. Based on past trends and the number of beneficiaries forecasted in the budget, the WOW group is expected to receive about five percent of the planned expenditure on small businesses in 2013. It is not clear as to how many businesses fall into the micro category and as to how many fall into the “small” category. The database of the Small Business Bureau (SBB) had 1,805 micro and small businesses at the end of 2012.

One has to assume that all 1,760 WOW investors had to register with the SBB to remain beneficiaries of the single-parent programme. In that case, it is possible that 98 percent of the small businesses that are likely to receive support from the administration are micro businesses.

Capital Investments

An issue that arises is whether the capital investments being made by the administration are helping these micro businesses to increase their productivity and efficiency. Studies show that productivity increases come from higher labour utilization and higher output per worker. These efforts could be enhanced by strong and stable infrastructure. The record might be spotty in this regard.

Based on field visits and newspaper reports, a major problem remains the availability of proper drainage and irrigation for small-scale farmers. Another area is water. Cosmetologists require a reliable and clean water supply to serve their clients very well. Here too the capital expenditure of the administration might not be giving the greatest bang for the buck to small businesses on account the quality of water that comes out of taps. Some of these businesses are likely operating below efficient levels because of having to spend time coping with infrastructure or government services that are not totally reliable.

Ambition and Discipline

Yet, the money to be invested, as small as it is, does have the potential to impact productivity. Most small businesses in Guyana tend to be labour oriented. The administration plans to train about 1,000 business owners in various areas of operation.

These include agro-processing, food handling, packaging, and labeling. The areas of training are important aspects of production operations for small businesses. To the extent that the training could increase efficiency, especially among owner-operators, in the productive areas of the businesses it could indeed help to boost productivity and output. But, many operate also as sole proprietorships or owner-employee enterprises which mean that the success of the businesses depends not only on the competence of the owners, it also depends on the ambition and discipline of the owners.

In a meeting among women entrepreneurs last year, it was disclosed that record-keeping and handling of administrative matters were major challenges for many small-scale operators. Part of the reason was that they preferred to concentrate on the income-generating part of their operations.

This often resulted in deficiencies in the administration of the business.

Consequently, training in the support functions of marketing, business management and information technology are important. But, that might not be sufficient to help the micro operators to improve their efficiency since there was no guarantee that they would exercise the discipline necessary to meet their administrative responsibilities. Instead, it might be more beneficial to establish a separate support system, if it does not exist already, to help the proprietors to administer their businesses properly and effectively.

Competition

The other objective of the planned expenditure for small businesses is to use them to stimulate competition. The question would be competition among whom? Small businesses have plenty competition among themselves. Part of the reason is that the industries in which they operate are low-skilled that require the use of unsophisticated technology. In other words, the barriers to entry are miniscule. It is unlikely that these small businesses could compete against the larger established businesses since there is usually a link between the larger and smaller businesses. The sale of beverages is a good example. Except for the sale of homemade drinks, small businesses have to become customers of big businesses.

The fast food industry is another example of small businesses depending on the patronage of big businesses. The major inputs like chicken or beef need to be standardized and meet certain quality control levels.

Putting all the measures in place might be beyond most small operators causing them to operate through a larger supplier who also provides a quality control service in the value chain.

The two examples above, while not exhaustive, causes one to wonder if the investment to be made in small businesses this year could really stimulate competition at the planned level of spending.

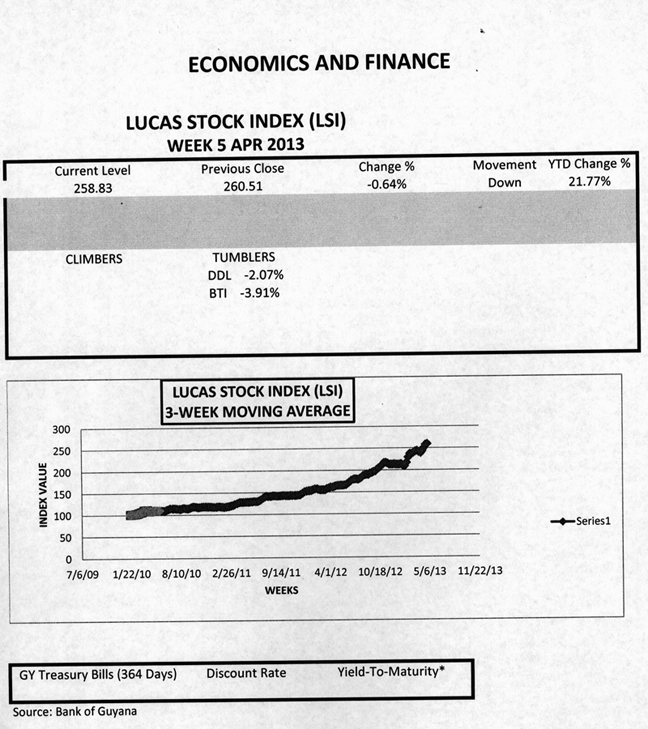

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) almost gave up all that it gained last week by declining 0.64 percent in continuously light trading during the final week of April 2013. A mere 26,800 stocks of four companies changed hands. Demerara Distiller Limited (DDL) traded the highest number of stocks, 25,400, with a 2.07 percent decline in value while Demerara Tobacco Company (DTC) traded 500 shares with no change in value. The banking industry had mixed results in very light trading. Guyana Bank for Trade and Industry (BTI) sold 700 shares and saw the value of its stock decline by nearly 4 percent. On the other hand, Republic Bank Limited (RBL) traded 200 shares with no change in value.