By Rawle Lucas

Cannot be overturned

As noted in last week’s submission, the administration controls the entire procurement process in the public sector. Under this condition, a bidder is at the mercy of the administration. Successful bidders are usually determined by the Evaluation Committees of each ministry. However, the authorities of every ministry can overrule a decision of the Evaluation Committee that examines submitted bids for contracts. This means that a contractor who is selected by an Evaluation Committee can be rejected by the Cabinet Minister. Any decision reversed by a Cabinet Minister cannot be overturned. The noose is just as tight with respect to the review process. A study of the review process shows that the administration’s grip on the procurement review is firmer than one realizes and a bidder with a grievance stands little chance of obtaining a fair review and any relief under the current review mechanism. Even if a bidder is denied a contract for other reasons, an appeal is useless since the administration, through the Minister of Finance and the Attorney-General, picks two of the three members of the Bid Protest Committee (BPC). The third panellist has to enjoy the confidence of the Minister of Finance to become a part of the BPC. Under those circumstances, the administration remains in control and a “No Objection” role has the potential to threaten and undermine fair competition, and even legitimize discrimination.

Delivery of good services

The second reason for letting the “No Objection” role go is connected to the management of the public sector. Using the “No Objection” clause as a public financial management tool is redundant. Public financial management is concerned with finding and using the most advantageous and favourable way of raising revenues and spending the resources. An example is making the choice to raise money through taxes or borrowing. That choice could be extended further to whether to use a direct tax like the income tax or an indirect tax like the value-added tax. There is also the expenditure side. An important tool in this regard is the budget. A public sector budget is prepared every year to forecast revenues and to plan the amount of money that the government would like to spend. The budget is also used to monitor and control the amount of money spent by each budget agency. In a properly managed public sector, one has to assume that a Cabinet Minister takes an interest in the activities of his or her ministry. To the extent that the minister is interested in the delivery of good services to the public by his or her ministry, he or she would ensure that the budget of his or her ministry could be defended in the National Assembly.

Full control

A Cabinet Minister has the duty to ensure that projects for implementation are being identified, selected and executed properly. For capital projects where large amounts of public funds are involved and benefits are returned over extended periods of time, project selection requires the use of sound capital budgeting techniques. Professor Clive Thomas over the last few weeks has discussed the importance of using a professional approach to this aspect of public sector budgeting and financial management. The process, he noted, should take account of the unique nature of public sector investment, and should be extensive and deliberative to ensure the best outcome for taxpayers. The Cabinet Minister has full control over this process and if he or she so wishes could object to any proposal or refuse any recommendation that the officials, technocrats and consultants of his or her Ministry make. This objection could be done long before a vendor or contractor gets involved or is selected.

Ample opportunity

The minister also has control over the amount of money that should be spent on the project. This is typically achieved through the budgeting process. Every year a Budget Circular goes to all the budget agencies giving them a chance to make a budget submission. This process allows the minister to decide how much money he or she wants to spend and the items on which the money would be spent. In the last two years, the budget proposal submitted by the government was cut by the National Assembly. The basic reason for the reductions was that the government was unable to provide proper explanations for the money requested. Clearly, there is a flaw in the budget process of some budget agencies, and Cabinet either does not notice or is not too concerned. Irrespective of which it is, Cabinet has ample opportunity to participate in the most important part of the value-chain process, deciding on which projects should be implemented or which goods should be procured and how much money should be spent.

Surprise and a shame

Everyone knows that governments like to spend money once they get their hands on it. An interested Cabinet would be curious as to how moneys are being spent. It would therefore expect a report from the relevant minister at Cabinet meetings and make its objections known long before a project reaches the procurement stage. Moreover, Cabinet cannot have ministers who have responsibility for billion dollar budgets and then behave as if it does not know how moneys are being spent until a multi-million dollar project has been awarded to a contractor. That is what the “No Objection” role implies. In cases where the budget has high-profile projects, the focus of the Cabinet is presumed to be even sharper. It would be a surprise and a shame if Cabinet is suggesting with the reliance on the “No Objection” clause that it only becomes aware of the planned expenditure of billions of dollars after a contractor or vendor has been selected to execute the work.

No good effect

The desire for a “No Objection” role in the procurement process should not even arise if the Cabinet is doing what is required of it. After all, the “No Objection” role is built in to the executive responsibility and authority of the administration. Even with the added “No Objection” role, Cabinet did not stop contractors without experience from receiving multi-million dollar contracts as in the case of the bridge that collapsed over the Rupununi River. Even after that and similar experiences, the “No Objection” role did not stop the award of contracts to unqualified or incompetent contractors to build the road to Amaila Falls and to widen the highway on the East Coast Demerara. Given these and other experiences, the “No Objection” role outside of the executive authority is of no good effect, and only gives Cabinet the right to tamper with competition and market forces.

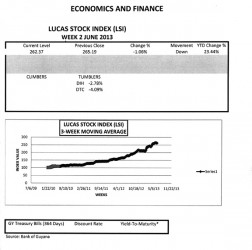

The Lucas Stock Index (LSI) fell 1.06 per cent during the second week of trading in June 2013. A total of 233,600 stocks of seven companies in the index changed hands this week. The LSI recorded two Tumblers while there was no movement for the stocks of five companies. The Tumblers this week were Banks DIH (DIH) which fell 2.78 per cent on the sale of 180,200 shares, and Demerara Tobacco Company (DTC) which fell 4.09 per cent on the sale of 5,900 shares. The value of the stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Guyana Bank for Trade and Industry (BTI), Republic Bank Limited (RBL) and Sterling Products Limited (SPL) remained stable on trades of 16,300; 24,200; 4,000; 2,000 and 1,000 shares respectively.