Found wanting

A major knowledge product of the World Bank was likely to undergo some revisions in the way in which data are collected and used in one of its flagship publications if the report of an independent panel that was commissioned by the Bank’s Presi-dent last year is to be accepted by him. The “Ease of Doing Busi-ness Report”, regarded as one of four knowledge products of the World Bank used in developing and executing its lending policies, has been found wanting by the expert panel that studied the report and its utility to member countries.

The panel was given the task of examining and evaluating the relevance and impact of the rankings used in the report on regulatory reform, private-sector development and economic performance. Two indicators were singled out for special attention in the terms of reference given to the panel. These were the employing workers index (EWI) and the paying taxes indicator. The Bank was sufficiently concerned about the report’s credibility and goodwill that it was willing to test a few of the fundamental premises on which the preparation of the report relied. As such, the experts were also asked to determine if the methodologies used to construct the indicators and the techniques for gathering data were valid.

Bad image

Delving into the data that make up the index, the experts found that the two indicators that they were asked to study did not provide an accurate representation of the regulatory environment. This defect caused the rankings to be misleading. One indicator pertained to the labour market regulations, reflected in the “employing workers indicator” (EWI) and the other to the “paying of taxes indicator”. Of the two, the EWI is of greater relevance to Guyana at this stage.

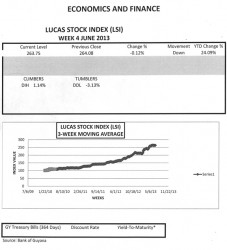

The Lucas Stock Index (LSI) declined slightly by 0.12 percent during the fourth week of trading in June 2013. In relatively light trading, a total of 20,700 stocks of three companies in the index changed hands this week. There was one Climber and one Tumbler, while there was no movement for the stocks of the third company. The Climber this week was Banks DIH (DIH) which rose 1.14 percent on the sale of 15,200 shares. The Tumbler was Demerara Distillers Limited (DDL) which fell by 3.13 percent on the sale of 5,300 shares. Sterling Products Limited (SPL) traded 200 shares with no change in value.

The way in which the EWI

was constructed gave labour a very bad image. The Bank gave the impression that labour market regulations were major impediments to business and job creation. However, a study of 45,000 firms in 106 countries found a different story from that carried by the World Bank. Only 3 percent of firms that were surveyed felt that labour market regulations were obstacles to job creation. In what could be seen as a victory for labour unions in a country like Guyana, the Bank accepts that the EWI presented a lopsided view of labour regulations. This lopsided perspective seems to be accepted by the Government of Guyana and has probably played a part in its preference to use contract workers in the public sector, the granting of menial wage concessions and the tolerance of mistreatment of private sector workers. The World Bank is now willing to look at both the costs and benefits of local labour laws.

It acknowledges that capturing key benefits of employment policies, such as worker protection, hours of work, rest and leave provisions, minimum wages, protection against dismissal, occupational health and safety requirements, social protection and respect of core labour standards must form part of the assessment of the labour regulatory environment. While including these factors might increase the cost of doing business, it might change the disposition of employers towards ensuring better training and a cleaner and healthier work environment for their employees.

Free of any regulations

The review was prompted by the concerns expressed by both academics and policymakers about the reliability of the “Ease of Doing Business Index”, a measure used to rank countries according to how easy or difficult it is to do business under the regulatory and legislative environment of each country. The report makes for good reading since it explains in simple terms much of the thinking that has gone into the development of the “Ease of Doing Business” index and ranking. As is well known, the World Bank embraces the view that the private sector holds the key to investment and job creation in each country.

This means that if private capital, domestic or foreign, is unable to flow freely then development would be retarded. Much of the burden for making it easy for private capital to flow freely falls on the regulatory authorities of a country. In the Bank’s view, the state of that environment is reflected in the 10 or 11 measures that make up the ranking index. To be ranked highly, a country virtually has to be free of any regulations or has to have a public sector that is willing to make those regulations work for their users.

That is a sore point in Guyana where the regulatory authorities can make many feel unwelcomed or uncomfortable. This aspect of the regulatory environment, though important, is not measured at all and reduces the usefulness of the index in the view of the experts.

Unfinished debate

Even though the debate on many issues remains unfinished, the panel returned a verdict about the usefulness of the index that was highly unfavourable. The Panel’s view is that “the Doing Business indicators need to be objectively reviewed to avoid unintended bias of selection, and should be updated on a regular basis to ensure their continued relevance, comparability and applicability”. The importance of this finding is significant because it stays the suspension of a practice that the Bank was discouraged from using by a consultative group in 2011 that also examined the validity of the ranking index. It was observed that the Bank used the “indicators for internal purposes in country policy

and institutional assessments”, and in setting terms and conditions for making loans to member countries. The Panel also found evidence that some international aid agencies adopted a similar disposition when it came to crafting policies on official development assistance to developing countries. The World Bank

has been forced to discontinue this practice.

Outcome of findings

It is not clear if the President of the World Bank would accept the recommendations of the experts since the major contributor to the World Bank, the USA, favours keeping the ranking. The public position of other donors is still to emerge and if it is closely aligned with that of the USA, then one could think that the possible reform of the report is dead. Therefore, it is left to be seen what would become of the

findings of the experts.