Backseat

It is not often that so many issues of capital budgeting are discussed as stories in their own right in the newspapers, even though matters of public spending are reported upon quite frequently. Such matters usually take a backseat to the more dramatic and sensational news of crime, piracy and disasters, natural or manmade.

More prominent have been concerns about project performance and not so much about the cost and benefits of the project. When the discussion is about performance, it is usually a signal that Guyanese agree with the project, but do not like how the work was done. Of late, there has been an intensified scrutiny and criticism of a collection of investment projects in which concerns have been expressed about the soundness of the decisions themselves.

The debate and analysis are concentrated around the construction of the Marriott Hotel and the structure and size of its investment, the assignment to build the road to the proposed Amaila Falls hydropower facility and the financial soundness of the contract for the expansion of the Cheddie Jagan Airport.

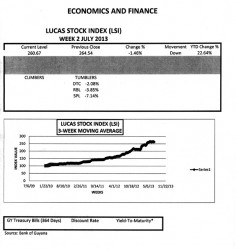

The Lucas Stock Index (LSI) declined 1.46 percent during the second week of trading in July 2013. With a small trading volume among four companies, a total of 16,100 shares in the index changed hands this week. There were no Climbers, three Tumblers, and no movement for the stocks of one company. The Tumblers were Demerara Tobacco Company (DTC), which fell by 2.08 per cent on the sale of 300 shares; Sterling Products Limited (SPL), which fell 7.14 per cent on trades of 3,800 shares and Republic Bank Limited (RBL), which fell 3.85 per cent on the sale of 10,000 shares. Demerara Distillers Limited (DDL) sold 2,000 shares with no change in value.

Outrageous

The language of capital budgeting is left to the chief executive officers and the titans of the boardroom, who along with their advisors and consultants thrash out the merits and demerits of the project before arriving at a decision. But Guyanese have found it necessary to get the conversation going outside the confines of the meeting room because of the lack of transparency and apparent inattentiveness to the wisdom of capital budgeting in public investment.

The latest drama surrounds the Marriot Hotel project. The matter has been deemed so outrageous that a Member of Parliament has decided to take it to court for resolution. As this writer understands it, the plaintiff in the case is seeking to prevent the National Industrial and Commercial Investment Limited (NICIL), the entity that controls the land on which the Marriott Hotel is being built, from entering into a long-term (99 years) lease agreement with Atlantic Hotels Incorporated (AHI), the owners of the hotel. The plaintiff felt compelled to seek redress through the courts because the financial terms of the lease, an annual payment of G$299,955, are abhorrent to the public’s interest.

Similarity

This matter bears similarity to the issue that was raised in one of the local dailies last year about the decision by the Guyana Power and Light Company (GPL) to lease instead of buy some generators for its operations. The decision had caused a furor because on the face of the available financial data, it appeared as if GPL had erred in making the choice to rent the generators.

In its defence, GPL explained that the generators were rented on a short-term basis, which meant that the generators were not needed permanently. It also implied that there was no intention of using the generators for more than one year since the timeframe for a short-term decision is generally seen as one year or less. All the attendant costs of owning the generators were avoided which would have widened the gap between the lease and purchase price.

GPL never did a good job of responding to the criticism and left open the possibility that other issues of public concern might have been behind the decision. It is not clear to this writer what the final outcome of the story was, even though it was possible from the available facts to sympathize with the decision that GPL made.

Scandalous

The case this time involves the leasing of land on financial terms that one could only describe as scandalous. To get a sense of the bias in this deal, it would be useful to compare the rate that AHI is being charged to lease the land to that which ordinary Guyanese pay for the land that they obtain from the government to build their homes. In a country where the population density is nine persons per sq. mile, ordinary Guyanese pay G$13 per sq. foot for land. The situation is worse if you are a Guyanese living abroad. The exploitation is worse if you currently live overseas. The cost could range from G$670 to G$875 per sq. foot. An acre measures 208.71 feet on each side which means that one acre of land is equivalent to 43,559.86 sq. feet. The 6.886 acres on lease equal 299,953.2 sq. feet. At G$299,955 per annum, the land is being leased at G$1 per sq. foot. When compared to what Guyanese have to pay for a piece of undeveloped land, the lease in question is a giveaway.

Present value concept

While the story is presented in a legal context, it has implications for public finance since the lease of state property constitutes one of the many ways in which the government raises revenues for budgetary expenditure. Members of the public, therefore, have an interest and a right to know if the government is making a financial decision that is in their best interest. The issue gets worse when the financial tools are used to measure the value of the deal.

The logical tool to use would be the present value concept since Guyanese need to know what the 99 payments are worth today, the time at which commitments are being made. A key factor in that decision would be the opportunity cost of the investment to the lessee, reflected in the return that could be received from placing the money in a bank account or purchasing debt or equity security. These are unknowns, which, however, could be inferred from a variety of options, including the return from stocks traded on the Guyana Stock Exchange, interest obtained from a bank account or the discount on Treasury securities.

One payment

Using the three options above, the deal could follow any of the scenarios below. The return from the stock market of 22.64 per cent means that the deal is worth G$1.3 million today or US$6,432. The interest on a savings account was reported by the Bank of Guyana to be 1.69 per cent at the end of December 2012.

Under this option, the deal is worth G$16.5 million or US$79,882 today. Under a 364-day Treasury-Bill scenario, the cost of the lease is G$17.3 million or US$84,090 today. None of the rates are guaranteed to stay the same throughout the life of the lease, but that is immaterial to a decision to be made in the present. Clearly, the lessee has more to lose by foregoing investments in the stock market and would therefore prefer that scenario. Given the annual lease payments, one would think that the government would go for the Treasury option, but no one knows.

Whatever the decision, any of the choices could be discharged in one payment, with the money received disappearing after one budget period.

The lessee in the meantime has 98 years to do anything with the property and recover more than the invested sum of money on the lease.