Where the mind is without fear and the head is held high;…

Where words come from the depth of truth;

Where knowledge is free;…

Where the mind is led forward by thee into ever-widening thought and action –

Into that heaven of freedom, my Father, let my country awake.

Taken from Gitanjali by Rabindranath Tagore

Introduction

In last week’s column, we looked at the auditing arrangements for NICIL, the accounting implications of the vesting of State assets as well as their disposals, and the accountability for the proceeds. We noted there was a lack of compliance with the Companies Act in relation to annual financial reporting and audit since the audits for 2001 to 2010 were finalized within a little over one month in late 2012. A “clean bill of health” was also given to NICIL’s accounts. I acknowledge a mistake I made by including the 2001 audit report which I discovered was issued earlier than 2012. However, this did not change the complexion of my analysis.

When the assets vested in NICIL are disposed of, a windfall gain is achieved since NICIL acquired them from the Government free of cost. This apart, the vesting of assets for the purpose of selling them is not in keeping with the relevant section of the Public Corporations Act that was applied to vest assets in NICIL. (That section deals with the vesting of assets in a new corporation to assist it with its start-up operations.) The proceeds should therefore have been paid over to the Consolidated Fund, net of expenses. Instead, NICIL retained them to be used at the discretion of the directors.

Today, we take a final look at NICIL, particularly the growth in its assets base from 2001 through 2010 as reflected in the balance sheets at the end of those years. The audited accounts for 2011 are not yet available.

Position at the beginning of 2002

Prior to 2002, NICIL was a small administrative outfit that monitored the Government’s investments in public corporations and other entities. Its role was mainly to ensure that all revenues derived from these investments were collected and paid over to the Consolidated Fund. For this, NICIL received a small Government subvention which for 2001was $4.6 million. While the authorized share capital was 100,000 shares at $1 each, only three shares were issued, and this remained so until 2002, a clear indication of the intended nature of NICIL’s operations.

The main objective of the company, as set out in its incorporation documents, is “to subscribe for, take or otherwise acquire and hold shares, stocks, debentures or other securities of any company, co-operative society or body corporate”. However, the notes to the financial statements beginning 2002 referred to “holding the Government shares, stocks, debentures …” The implication is that with effect from 2002 the Government’s shareholdings in public corporations and other entities were transferred to NICIL, and the dividends received were retained as NICIL’s revenue, instead of being paid over to the Consolidated Fund as had been the practice prior to 2002.

Whether the transfer of shares to NICIL constitutes an acquisition is debatable, especially since there was no consideration, that is, NICIL did not pay the Government for these shares. Since then, NICIL considered itself a holding company; the concerned public corporations became its subsidiaries; and thereafter consolidated group accounts were prepared. The last set of audited consolidated accounts was in respect of 2005.

In 2002, all the authorized shared capital was issued, while the Government subvention increased to $53 million but ceased thereafter. At the same time, through a Management Co-operation Agreement signed by NICIL, the Privatisation Unit and the Government, NICIL took over the Privatisation Unit which was part of the Ministry of Finance. All the proceeds from privatization were considered NICIL’s revenue. In his 2002 report, the Executive Secretary of NICIL stated that the agreement paved the way for, among others, “the fulfillment of financial statutory obligations which NICIL had previously failed to do”. This is an extraordinary statement considering that it took 11 years to discover this “failure”, and the Executive Secretary was in charge of the Privatisation Unit going back to the early 1990s.

The agreement, however, cuts across legal boundaries since one cannot hive off a significant chunk of a Ministry and vest it in a company incorporated under the Companies Act, notwithstanding that it is a government company. In order to do so, one had to make Section 8 of the Public Corporations Act applicable to the company. This was not done in the case of NICIL.

The then President had issued a notification on 18 July 2000 that saw a significant amount of transfers of State assets to NICIL as well as their disposals. As in the case of the privatization proceeds and dividends received, the revenue from the sale of these assets is treated as NICIL’s revenue. The cumulative effect is that from 2002, a significant portion of State revenues was intercepted, diverted away from the Consolidated Fund, and placed under the control of NICIL.

In his statement to the National Assembly, the Minister of Finance referred to the words in parenthesis in Article 216 of the Constitution suggesting its applicability to NICIL. That article reads as follows:

All revenues or other moneys raised or received by Guyana (not being revenues or

other moneys that are payable, by or under an Act of parliament, into some other

fund established for any specific purpose or that may, by or under such an Act,

be retained by the authority that received them for the purpose of defraying the

expenses of that authority) shall be paid into and form one Consolidated Fund.

NICIL was not created by an Act of Parliament but was incorporated under the Companies Act. Nor was the revenue retained by NICIL for the purpose of defraying its expenses. NICIL’s revenue was also several times its operating expenses, hardly a contemplation by the framers of the Constitution. No one disputes the Minister’s statement that “NICIL like any other company is entitled to retain its revenues”. This is beside the point. So was his reference to the revenues of GUYSUCO and GUYOIL. Using this argument, then the Guyana Revenue Authority (GRA) should also retain the moneys collected from taxes, duties etc. As in the case of the GRA, NICIL is merely a collecting agency on behalf of the State.

Increase in assets base from 2001 to 2010

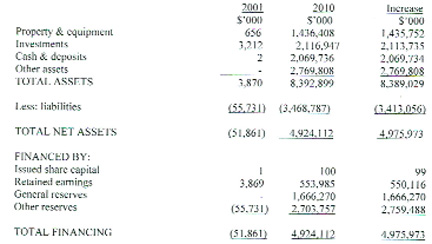

From 2001 to 2010, NICIL’s total net assets increased from a negligible amount to $4.976 billion. The following table below summarises the balance sheet position at the end of the two years in question. The 2001 audited accounts are not available at NICIL’s website. However, the comparative figures in the 2002 accounts showing a re-stated position were used.

The value of Property and Equipment represents assets vested in NICIL with the corresponding entry being to Other Reserves. Similarly, the Government shares transferred to NICIL are recorded as investments with the corresponding entry being to the General Reserve. NICIL also has its own investments, for example, ten per cent shareholdings in New GPC and Hand-in-Hand Trust Corporation. Other assets represent amounts due to NICIL such as inventories, receivables, and related party transactions,

The re-stated 2001 balance sheet showed an adjustment of $55.731 million to recognize a liability to the Georgetown City Council because of a court ruling. As a result, the re-stated position at the beginning of 2002 reflected a negative $51.861 million in net assets. At the end of 2002, the net assets base increased to $2.093 billion through an increase of $888.272 million in Property and Equipment as well as in Investments. At the same time, cash and deposits increased to $1.163 billion. The accounts also reflected an adjustment of $1.313 billion due to the recognition of assets not previously recorded or which were understated.

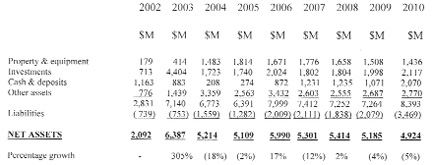

The position with regard to the growth in net assets over the period 2002 to 2010 is summarized below:

At the end of 2003, the net assets base increased to $6.387 billion, or 305 per cent compared with the position at the end of 2002. This was mainly due to a six-fold increase in investments because of the take-over of LINMINE, BERMINE and Surpana, following the winding up of BIDCO. However, there was a decrease in 2004 by 18 per cent, mainly due to a significant drop in investments. LINMINE was wound up and specific assets transferred to NICIL, resulting in a significant increase in other assets such as inventories and receivables. However, NICIL was unable to realize the full value of its investment in LINMINE.

Between 2005 and 2010, the growth in the net assets of NICIL fluctuated between a negative 12 per cent and a positive 17 per cent. After an initial recovery in 2006 to $5.990 billion, there was a continuous decline to $4.976 billion at the end of 2010.

Conclusion

NICIL was incorporated under the Companies Act to monitor Government’s investments and to ensure that all revenues derived therefrom are promptly collected and paid over to the Consolidated Fund. With effect from 2002, NICIL’s operations took on a different complexion through three highly controversial actions:

● The transfer of Government’s shares in public corporations and other entities;

● The hiving off of the Privatisation Unit of the Ministry of Finance and transferring it to NICIL; and

● The vesting of State assets in NICIL.

These actions saw the interception of a significant portion of State revenue and the placing of it in the hands of NICIL. In order to regularize matters, I repeat last week’s recommendations:

● Re-align NICIL to what it was prior to 2002 or alternatively wind up its operations;

● Ascertain precisely how much should have been paid over to the Consolidated Fund from 2002 to present date against what was actually paid;

● Initiate an investigation as to what happened with the difference; and

● Take appropriate disciplinary against the concerned officials if it can be established

in a Court of Law that there has been a violation of Articles 216 and 217 of the Constitution.