Revealed public investment strategy

Last week’s column identified source documents from which the PPP/C’s public investment strategy might be revealed, thereby providing the basis for an assessment of its management. These documents include the National Development Strategy (NDS), Poverty Reduction Strategy Papers (PRSPs), Low Carbon Development Strategy (LCDS), the National Competitiveness Strategy (NCS) and the PPP/C Manifesto (Indeed the last highlights the role of the previous four source documents). Additionally, there are the sector plans of government ministries/agencies and state enterprises.

I had also indicated last week that the government’s public investment strategy is the first of four sequential phases in which it is managed. However, while the referenced source documents catalogue most (but not all) of government’s projects (including the ‘troubled’ ones), they also identify other projects, which have not been finalized. Given its origins therefore, the indicated investment strategy is best described as the government’s revealed preference.

Consequences

Two consequences follow. First, limited resources prevent all identified projects from being implemented over the immediate to near-term. Secondly, those that are affordable have to be sequenced for implementation. This leads directly to the second phase of public investment management (feasibility studies/project evaluations and the time-sequence for implementing approved projects).

Marriott Hotel

Public comments on the Marriott have exposed two fatal defects. First, there has been zero opportunity for taxpayers to independently assure themselves that due diligence has occurred. This can still be corrected if the full contract details are released to the public-at-large and/or the National Assembly. World-wide experience suggests that, without due diligence (independent professional evaluation) parties to public contracts usually find themselves in conflict; this often ends in the contract not being worth the paper on which it is printed.

Public information available for this project is spotty. This has been compounded by un-convincing efforts by the authorities to wholeheartedly involve local investors, particularly since this project is well suited for private investors (or private-public sector partnership).

Unofficial details on the Marriott investment indicate 1) Government is leading the hotel construction with the intention of selling it to unknown private purchasers on completion. 2) The most commonly reported construction cost for the hotel is G$10-11 billion, which is on the high end. 3) Further, there is no public accounting for the financial value of the tax giveaways, permits, licences, and other ancillary benefits, which the government is affording the hotel. 4) The hotel is modestly-sized and designed to have 197 rooms plus other facilities including a casino and provision for conferences, banquets, boutique sales, recreation and entertainment. 5) The total private (commercial) value of the hotel is therefore, at least the sum of 2 and 3 above, but it is not clear whether this will be the figure from which its later sale to private investors would start.

Similarly, the hotel’s financing remains fuzzy, although available information does indicate the government is its major financial driver. The project is being executed contentiously through NICIL and its subsidiary, Atlantic Hotels Inc (AHI). This is being sourced from off-Budget slush-funds and has already occasioned considerable concern by Parliament and other civil society gate-keepers of the public treasury. Notably, while the government is carrying most of the project risk, it appears to hold the last round of entitlements for repayment in the debt/equity financing structure of the project, in event of failure.

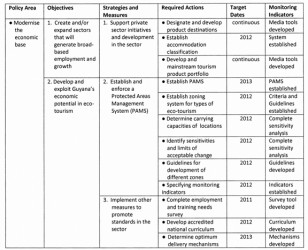

Furthermore, from the standpoint of the government’s management of its investment strategy, a particularly disturbing consideration is that the PRSP (2011-2015) does not mention the pending construction of the Marriott Hotel as a governmental priority! The PRSP Policy Matrix (Schedule 1 below) reproduces the eco-tourism policy area, as well as its objectives, strategies and measures, required actions, target dates (to 2015) and monitoring indicators for developing this sector.

Schedule 1: PRSP Policy and Performance Matrix (Eco-tourism), 2011-15

Source: Guyana Poverty Reduction Strategy Paper 2011-2015.

Conclusion

The conclusion, which seems to follow from the above, is that the Marriott Hotel is an opportunistic rogue public investment project. That is, one divorced from concrete evidence of systematic linkage to the analytic elaboration of government’s public investment strategy. While one cannot expect any public investment strategy to be rigid and inflexible, particularly in regard to opportunities for large projects that are externally selected and financed, but yet yield significant benefits and pose no significant local economic burdens, this cannot be said for the Marriott Hotel investment. Government’s financial commitment is considerable and, based on widely known occupancy rates in Guyana’s hotel industry, investment risks are high.