Introduction

For several years I have drawn attention to the matter of annual reporting by the Cheddi Jagan International Airport Corporation (CJIA), an entity established under the Public Corporations Act. I could not understand why the Audit Office which does the corporation’s audit, the Public Accounts Committee or someone, anyone, was not asking, nay demanding, that the law be complied with, with respect to the laying of accounts and reports in the National Assembly. So while there was incompetence on the part of Minister Robeson Benn who is the subject minister and of the Public Accounts Committee and the Audit Office, there was a question too whether the corporation did enough to counter speculation that it probably was unaware of its obligations under the act. It took them all more than a decade before the public was able to see for the first time any seemingly independent information on the corporation.

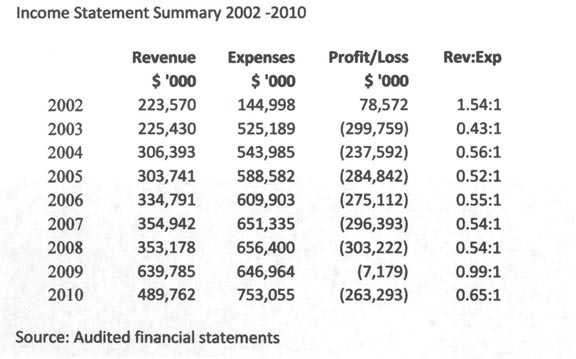

The income statement which shows the financial performance of the corporation does not make a pretty picture. Apart from the year 2002 when incomplete, unreliable and meaningless figures were prepared, for each of the years from 2003 to 2010, the corporation has been losing money. I would discount the year 2002 because no balance sheet was presented and it is virtually impossible for any professional auditor to report on the income statement in the absence of a balance sheet. Our Audit Office did. That and subsequent financial statements raise troubling questions about the quality of the financial statements which in violation of internationally accepted auditing standards are signed not by any of the directors but by the Chief Executive Officer and the Manager, Commercial and Administration.

What compounds the danger is that again, the statements bear no indication that they were approved by the directors. Of course the names of directors, whoever they are, seem to be a closely guarded secret although the name Ramesh Dookhoo as Chairman appears in the newspapers from time to time. Indeed up to late this past week he was reported as lamenting the chances of recovery of an advance of some US$20.7 million paid to the Chinese contractor who apparently has conducted some soil testing at the location.

Before dealing with the detailed numbers, I wish to do two things: look at that corporation’s accumulated losses since its inception against a background of the huge commitments which the Jagdeo and Ramotar administrations are seeking to impose on this country, and second, whether the corporation has provided the information which by law it is required to do.

Compounding losses

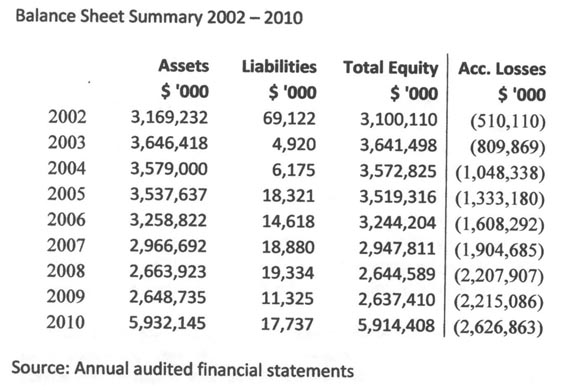

As at December 31, 2010 the corporation’s accumulated losses (incorrectly described by the Auditor General as a Net Loss) stood at $2,626 million. In a column last July titled “No such thing as a free chow mein”, I quoted Transport Minister Robeson Benn as announcing as the rationale for the airport expansion project that “we [meaning the government] had to enter into an agreement because we had a very narrow window in September where a Chinese Vice Premier came to the Caribbean with several billion dollars to fund projects and it was the only opportunity we had then to fund this undertaking.” One can accuse Minister Benn of many things but clearly he is an honest man even if he must have known how stupid it would sound that a government would embark on a $30,900 million project simply because someone was making the money available, on credit.

He must know that having a new airport will not automatically attract new airlines, but will immediately incur additional costs. Next week’s column will look at the contract signed with the Chinese, but for now maybe Mr Dookhoo might care to tell the public how the CJIA proposes to finance the huge Chinese debt and whether this will have to be borne out of the Consolidated Fund.

Non-compliance

As the following extract shows, the Minister/corporation has failed to comply with the requirements of the Public Corporations Act, section 64 of which states:

64. (1) A corporation shall not later than six months after the expiry of each calendar year, submit to the concerned Minister a report containing —

(a) an account of its functioning, throughout the preceding calendar year in such detail as the concerned Minister may direct; and

(b) a statement of the accounts of the corporation audited in accordance with section 48 (relating to accounts and audit).

(2) A copy of the report mentioned in subsection (1) together with a copy of the report of the auditor in relation to the same period shall be laid before the National Assembly not later than nine months after the expiry of the calendar year to which it relates.

It is a sad reflection of the National Assembly and the cavalier approach of Minister Benn that he would lay before the National Assembly incomplete reports of a major corporation for which he has ministerial responsibility. Unfortunately the CJIA is not the only such entity with the GGMC having been another recent example. This suggests a need for some quality control and professionalism which is currently missing in this regard in the National Assembly and its secretariat.

Income Statement

Before we comment on particular line items, it is important to note that the corporation has been unable to obtain a clean audit opinion for its entire existence. This is because it has failed to address the valuation of fixed assets amounting to close to $3 billion taken over from the Ministry of Public Works and Communications, a failure that affects both the income statement and the balance sheet.

With that explanation, let us return to the Income Statement with emphasis on the year 2010. On the basis of presentation, content or technical standards, the financial statements of the CJIA compete strongly with the Georgetown City Council for the worst financial statements published in Guyana. Readers are confused between the primary statement and what should be a note expanding and explaining the particular line item, so that an item shown as Security Fees in the primary statement is described as Departure Fees in Note 8. For the years 2002 to 2004 the Income Statement shows that no depreciation was charged, a requirement of International Financial Reporting Standards.

Readers will probably have noted that the 2010 income was lower than that of 2009, the reason being what appears to have been a change in accounting policy with respect to Govt/IDB Contribution. Accordingly, the 2009 income would have been unusual and the 2010 revenue represents the normal income. Now there is something very unusual about the income, a situation that has implications for the constitution and accountability.

Dealing with income and profits

According to Note 8 to the financial statements, “all revenue earned and collected from aeronautical services is transferred to the Ministry of Public Works. CJIA Corporation is financed by 37.5% of every departure.” While allowing for the poor and nonsensical choice of words, we cannot ignore the fact that the auditor of this corporation is the state Auditor who knows the constitution. He would or should know the requirements of the Public Corporations Act. Section 4 makes it pellucid that a public corporation established under the Act is a body corporate: it owns it has an independent existence. The Act gives no role to a ministry in the operation of any corporation except under section 23 which empowers the concerned minister “to give to a corporation directions of a general character as to the policy to be followed by the corporation in the exercise and performance of its functions.”

The Act requires a corporation to set up a general reserve fund into which its profits, or such part of these as are specified by the concerned Minister, are to be placed. Where only a part of its profits are placed in the reserve fund, the corporation is required to pay the other part into the Consolidated Fund. The Auditor General must surely know that the payment of some 62.5% of the revenue of the CJIA is a breach of the Act as well as the constitution. His opinion should have been qualified and he should have drawn this to the attention of the Ministry of Finance.

Someone, probably from the National Assembly/Public Accounts Committee needs to ask the Auditor General and the Minister of Public Works to account for the sums paid to it by the CJIA. Based on the 37.5% which the note states is used to finance the corporation, it means that in 2010, the amount paid over to the ministry was $514,758,000. There is no indication in the National Estimates that that money was paid into the Consolidated Fund.

Balance sheet

There is nothing that seriously stands out in 2010 except perhaps some $300 million of work-in-progress and a bank balance of $176 million, down from $414 million in 2009. Amazingly, the 2010 Statement of Cash Flow not only has no comparative (2009) figures but is incorrectly prepared while the 2009 financial statements have no Statement of Cash Flow. Is it possible that they could not balance it?

Next week, Business Page will look at the contract for the airport expansion.

Correction

In last week’s Business Page review of the 2012 annual report of The Guyana Bank of Trade and Industry, I incorrectly stated that the bank had duplicated its loan portfolio composition. In fact, one of the charts was for the banking sector as a whole while the other was for the bank only. The loan composition is shown below.

Correction

Loan Portfolio Composition %

Banking sector GBTI

Agriculture 10 14

Mining and Quarrying 4 6

Manufacturing 22 11

Services/Distribution 41 49

Households 23 20

Business Page apologises to the bank for the error.