Last week, we commenced reviewing the operations of the Guyana Power and Light (GPL) in the light of its disastrous performance over the years, despite the massive subsidies and capital contributions from the Treasury. To this must be added the continued funding from the Inter-American Development Bank since the early 1990s to assist in upgrading GPL’s operations.

In addition to the high salaries being paid to senior management personnel, GPL recorded massive losses totaling $12.282 billion for the last seven years. It also converted $7.5 billion ($1.5 billion in 2011 and $6 billion in 2012) in fuel subsidies from the Treasury towards an increase in its share capital but there was no evidence that Parliament gave the necessary approval for this change in arrangement. Had the subsidies been accounted for as revenue, GPL would have shown a reduced loss of $2.935 billion for 2011 and a surplus of $1.127 billion for 2012.

Today, we continue our analysis of GPL’s audited financial statements for 2012.

By constitution, the Auditor General is the external auditor of all entities in which controlling interest vests with the State. There is provision for contracting the services of Chartered Accountants in public practice to assist him. In selecting auditing firms, the Auditor General is assisted by a special committee from outside the Audit Office. He has contracted out the audit of GPL. However, since 2005, the predecessor firm has not received any assignment from the Audit Office, despite the fact that it had stood out among the other contracted firms in terms of performance and quality of work.

The Audit Office’s explanation was that the firm’s fees were too high. However, audit costs are a function of the extent of audit work involved, and once the audit procedures are agreed upon with the Auditor General, the practice had been for the contracted auditing firm to negotiate its fee directly with the client. The Auditor General would only get involved when there was a disagreement on the fee quoted.

We now turn to an examination of the audit opinion issued on GPL’s 2012 accounts. In fact, two opinions were issued: one by the contracted audit firm dated 13 May 2013 addressed to both the Auditor General and the GPL Board; and the other by the Auditor General to the GPL Board on the following day. Apart from the confusion in the wording of the latter about the extent of the Auditor General’s actual involvement in the audit, neither opinion referred to the loss of $4.873 billion or to the accumulated losses over the years. These losses would certainly have called into question the ability of the company to continue in its present operational state for the foreseeable future without the provision of support from the Government. In particular, because of these losses, GPL’s capital base has been eroded from $21.487 billion to $8.5 billion.

The Auditor General’s opinion repeats that of the contracted auditing firm. Prior to 2005, the Auditor General merely issued a concurring opinion if he was satisfied with the contracted auditors’ opinion. If not, he would request an amendment, failing which he would issue a different opinion, highlighting the areas of concern. That apart, one would have thought that, having carried out a detailed analysis of the financial statements and the contracted auditors’ opinion thereon, the Auditor General would have weighed in on the losses incurred over the years and provided some warning signals for the benefit of Parliamentarians and the public at large, at least by way of “an emphasis of matter”. These key stakeholders do not have access to the detailed audit findings contained in a management letter addressed to the client.

It is therefore simply not enough to state that the financial statements were fairly presented when they relate to state-owned/controlled entities that have a myriad of problems. Public accountability is far more rigorous than that which prevails in the private sector. It demands greater disclosures of the significant problems, notwithstanding that they may not affect the fair presentation of the financial statements.

The Auditor General is required to ascertain whether all moneys expended and charged to an appropriation account have been applied to the purpose or purposes for which they were intended. Since there was no evidence that Parliament sanctioned any change of arrangement regarding the fuel subsidies, one would have expected comments to this effect not only in the Auditor General’s report to Parliament but also in his opinion on GPL’s financial statements for both 2011 and 2012. Regrettably, nothing was mentioned of what appears to be a clear violation of the law and a manipulation of the accounts. This raises the important question as to whether GPL’s accounts should not have been qualified on these grounds.

GPL’s financial performance

We repeat below last week’s table showing the results of operations over the last seven years:

2006 2007 2008 2009 2010 2011 2012

$M $M $M $M $M $M $M

Turnover (revenue) 17,742 19,861 22,978 23,973 26,568 27,533 29,028

Generation costs 14,401 16,925 20,978 15,971 19,899 25,873 27,078

Profit/(Loss) from operations (1,581) (2,362) (2,898) 2,919 948 (4,435) (4,873)

before taxation

The most important items that influence the company’s financial performance are its revenue base and electricity generation costs. If generation costs keep increasing disproportionately compared with increases in revenue, the financial performance of the company will be adversely affected. This appears to be the case, as the average increase in revenue over the seven year period was 8.5 per cent compared with 12 per cent increase in generation costs over the same period. Further analysis revealed that there have been significant amounts of commercial losses due mainly to theft of electricity, defective meters and billing problems as well as technical losses due to seepages in electricity generation. In 2006, the total loss was estimated at 40 per cent which was three times the weighted average of 13.5 per cent for the Latin America and Caribbean regions. At that time, GPL had set as its objective the reduction of commercial and technical losses to 5.1 per cent and 10.3 per cent respectively. Regrettably, commercial and technical losses remain high at 15 per cent and 17 per cent respectively.

Interest payments and long-term liabilities

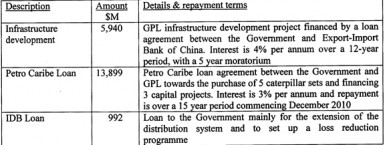

Interest payments have more than doubled in 2012 from $472 million to $1.011 billion. Long-term debts to the Government amounted to $20.381 billion while an amount of $839 million is shown as owing to a commercial bank. The company is therefore highly geared (i.e. ratio of debt to total financing) with over 70 per cent financing by way of loans as opposed to with equity or shareholders’ funds. As a result, a significant amount of the company’s revenue has to be set aside to service these debts.

The liabilities to the Government comprise the following:

Consideration of the need for financial restructuring

The following is a simplified and summarised version of GPL’s balance sheet i.e. its financial position as at the end of 2012:

$M $M

Net assets:

Non-current assets 33,739

Current assets 14,211

47,950

Less current liabilities (7,877)

TOTAL NET ASSETS 40,073

======

Financed by:

Share capital 21,487

Less accumulated losses (12,987)

Equity contribution 8,500

Long-term liabilities:

Loans from the Government 20,831

Loan from commercial bank 839

Other liabilities 9,903 31,573

TOTAL FINANCING 40,073

=====

Given the severe financial difficulties GPL is facing, in all probability it would be unable to repay its liability to the Government of Guyana. A restructuring of GPL’s balance sheet through a combination of the following is worth considering:

Eliminate the accumulated losses against the share capital which will then be reduced to $8.5 billion; and

Convert the loans from the Government to equity, thereby eliminating $20.831 billion in long-term liabilities with a corresponding increase in share capital to $29.331 billion. In 2010, the Government had approved of the retroactive conversion of $3.336 billion in net liabilities and a $621 million promissory note to share capital.

If this course of action is taken, GPL can start from a relatively clean financial position which will facilitate greater monitoring of the performance of management and the Board. The gearing ratio will also drop to roughly three per cent, assuming the other long-term liabilities do no attract interest charges. The restructured balance sheet is summarized as follows:

$M $M

Net assets:

Non-current assets 33,739

Current assets 14,211

47,950

Less current liabilities (7,877)

————-

TOTAL NET ASSETS 40,073

======

Financed by:

Share capital 29,331

Long-term liabilities:

Loan from commercial bank 839

Other liabilities 9,903 10,742

———–

TOTAL FINANCING 40,073

=====