A surprise

It must appear as a surprise to investors from China that many in a country with which it has shared friendly ties for four decades view its economic participation in the Guyana economy rather dimly. It is not that China is a stranger to Guyana even though the reticence of those Chinese present in the country would make it appear that way. China-Guyana relations started in the early 1970s and manifested themselves, initially, in strong social and cultural ties. With time and China’s rise to global economic prominence, the relationship with the administration has evolved into a passionate economic romance. As a consequence, China is today supporting an array of economic ventures in Guyana and many of its nationals are active in various aspects of the domestic distributive trade. Of late, however, many of the activities that China is associated with in Guyana have come under severe criticism from political and civil quarters. The Marriott project, the expansion of Guyana’s international airport, the construction of the Amaila Falls hydro station and part of the road leading to the hydropower site are some of the high-profile activities where money and expertise from China are involved. Complaints about these join the long-standing ones about the Skeldon sugar factory project since its commissioning in 2008.

Bad publicity

The bad publicity surrounding the projects makes China appear to be a country that is insensitive and unfriendly to the needs and interests of Guyanese. Some even feel that the economic romance is an exploitative one. The tensions that have arisen seem out of character with the type of diplomacy that China is known to practise. China is associated with a quiet diplomacy that has allowed it to grow its influence without alarming its global competitors, and without terrifying its clients. That disposition and its strategic use of multilateral diplomacy have allowed it to strengthen its links in the Caribbean region and other parts of the world. It would appear that China did everything right to place itself in the favour of Guyana and other countries of the Caribbean.

Instant readiness

No one should be surprised by the aggressive nature of China’s economic conduct in Guyana or elsewhere in the Caribbean. Two years ago, China, in a news release, made it clear after the third economic forum in Trinidad and Tobago that it intended to deepen and strengthen cooperation with Caribbean countries and that it wanted to see results within a 3-year time span. It was obvious that making it a reality not only required the rapid availability of Chinese aid and loans, but also greater amounts of investment from China and an apparent instant readiness on Guyana’s part to receive the capital inflows. China is obviously bent on sticking to its timetable, although for what reason is not clear. However, one could only speculate that it assumed the wounded economies of the US and Europe would recover in that time and once again pose a severe challenge to its economic ascension.

Opportunity

Indeed, China’s penetration of the Caribbean was well timed and took advantage of adjustments in economic relationships that were occurring globally. First, Europe decided to loosen its links with the Caribbean with the abandonment of the special trading arrangements that started in 1975 with the Lomé Convention. Second, the transition by the Caribbean was not well supported by Europe and other Western powers. Third, the Economic Partnership Agreement (EPA) has not enjoyed the same profile, attention and acceptance as the precursor agreements with the African-Caribbean and Pacific states. Fourth, the global economic crisis left many Caribbean countries gasping for air in turbulent economic waters. Fifth, as far back as 2008, Europe and the USA were themselves struggling with their own economic problems and were in no position to do much for anyone else. As a consequence, China literally had the Caribbean to itself and it made use of that opportunity.

The speed with which China is moving in Guyana and other parts of the Caribbean no doubt has created anxiety among Western countries. Such was the case in the Pacific and other parts of South East Asia where news reports say that the US, Europe and Australia were stunned by the rapid rise of China’s influence. There is no doubt that these countries are figuring out a response to the rise of China’s economic influence in Guyana and elsewhere in the Caribbean.

(To be continued)

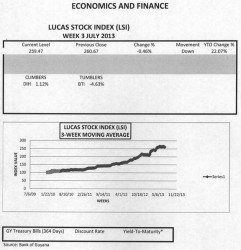

The Lucas Stock Index (LSI) declined 0.46 percent during the third week of trading in July 2013. With a relatively small trading volume among four companies, a total of 44,600 shares in the index changed hands this week. There was one Climber, one Tumbler, and no movement for the stocks of two companies. The Climber was Banks DIH (DIH) which rose 1.12 percent on trade of 12,500 shares. The Tumbler was Guyana Bank for Trade and Industry (BTI) which fell 4.63 percent on the sale of 1,000 shares. Demerara Bank Limited (DBL) sold 1,000 and Demerara Distillers Limited (DDL) sold 30,100 shares with no change in value.