Judging by the numerous requests which I have received from readers to comment on the Hydropower Purchase Agreement (PPA) between GPL and Amaila Falls Hydropower Inc (AFH Inc) this seems to be, by far, the public’s most troubling concern about the Amaila Falls Hydropower Project (AFHP). This is not surprising since the PPA contains the negotiated average price ($US per kilowatt hour) at which AFH Inc commits to sell and GPL commits to buy, agreed amounts of hydroelectricity as per arrangements contained in the PPA.

At present, I do not know what this average price will be. However, I am aware, as reported in previous columns that GPL has publicly stated its plans to sell electricity, after the introduction of hydropower, at 25 to 40 per cent cheaper than today’s price. Indeed this lower selling price is one of the principal reasons it advances in favour of the project.

Power purchase agreements

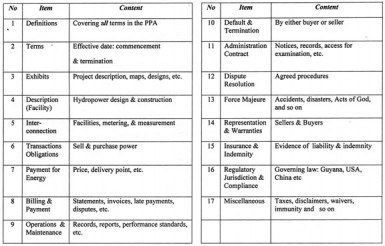

At this stage a discussion of PPAs would be helpful for readers. Schedule I below indicates the main items a typical PPA would contain. While the listed items should not be construed as fixed or immutable, they nevertheless represent substantially the contents of pro forma or model PPAs. The schedule displays 17 items, which is an immediate indication of how detailed PPAs are. They are very tightly written, as legal documents usually are, and designed to cater for all eventualities. Thus there are even provisions for dispute resolution, as well as other rigorous provisions expressing the jurisdictional, regulatory, and compliance frameworks under which the parties to the PPAs should operate.

Most importantly, for our purposes, PPAs legally specify how the average price for power is to be determined (as well as ancillary matters like billing and payment methods, late payments, defaults and terminations).

One would expect also that under the PPA, GPL would carry a mandatory legal obligation to purchase an agreed amount of electricity from AFH Inc. Of course AFH Inc would reciprocate and carry the obligation to sell to GPL the power it demands, as per agreement. To facilitate this GPL would construct the requisite interconnection facilities and provide for monitoring the electricity it receives.

There is no singular way for structuring a PPA. The schedule below displays a summary of the key items to be found in these. In some PPAs several of the items I have identified could appear as separate addenda, and in others, the PPA may be constructed along the lines of legal articles and not items.

Schedule 1

Structure of a Model Power Purchase Agreement

How is the purchase price GPL will pay determined?

Typically in PPAs the average purchase price for power is expressed in dollars per kilowatt hour, (KWh). In the case of GPL this may be expressed as US cents/KWh. Typically also, the average price of power (PAV) in PPAs comprise three main components. First, the energy purchase charge (E). This is the charge placed on each net unit of electricity supplied to GPL and covers 1) the project’s hydro costs incurred in ‘fuelling’ power generation and delivery to GPL; and 2) operation and maintenance (O&M) for the variable portions of AFH Inc’s operations.

Second, the capacity purchase charge (CP). This is the charge on each net unit of electricity supplied to GPL and covers 1) investment in the hydropower facility and transmission lines; 2) O&M for the fixed portions of AHP’s operations; 3) insurance; and 4) general and administration.

Third, supplemental or residual costs (S). This is the charge on each net unit of electricity supplied to GPL to cover plant start-up costs, plant ramp-up costs, ancillary services and miscellaneous charges, as provided for in the PPA.

The average price and its components are normally calculated on a monthly basis (the standard billing period).

Conclusion

Readers would have noted that the descriptions given above are direct, yet precise. Because of this precision and directness, they yield themselves to algebraic representation. This in turn makes it easy to arrive at rapid and precise computer calculations. This column, however, cannot risk scaring off its readers by pursuing this aspect any further. In conclusion readers should note that if the average price under the PPA that is, (PAV), comprises the energy charge (E); the

capacity charge (CP); and the supplemental/residual charge (S); all of which are placed on each unit of net electrical energy supplied to GPL (E ENERGY), we can restate this as:

PAV = (E+CP+S)/E ENERGY

Through hard bargaining all PPA’s expand/develop from this basic relation to arrive at a mutually agreed formula for determining the average price of the electricity traded. For readers to be able to go deeper in their understanding of PPAs generally, and GPL’s with AFP Inc in particular, one cannot avoid making the effort to understand their pricing formulas.

Finally we know from practice that, in all business deals, the final average negotiated price will have to take into account the different exposures to risk for the seller (AHP Inc) and the purchaser (GPL). AHP Inc will seek to cover some of its risk, if not all, in the elements that make up the average price. GPL will therefore have to ensure an affordable price outcome during the tough bargaining over the PPA.