(Part 1)

Choice of Theme

Last week the Institute of Chartered Accountants of Guyana held its annual conference under the theme “Focus on Financial Services”. According to the organizers of the conference, the choice of theme was influenced by the uncertainty surrounding the future of the financial services industry in Guyana stemming from likely reforms. For example, reforms of the insurance industry could modify the practice by lenders of linking long-term debt to the acquisition of life insurance. In addition, the desire of the US Government to close tax evasion loopholes through the application of the Foreign Account Tax Compliance Act (FATCA) could impact banking relationships and the level of bank deposits. Perhaps most significant of the lot are the amendments to the anti-money laundering and financing of terrorism Act of 2009 that were before the parliament last week. No one could predict with certainty what the impact of those changes would be on the financial services industry.

I was invited to make the opening presentation to the conference of professional accountants. What follows is a summary of the main points made in that presentation that, among other things, looked at the contribution of the financial services industry to the economy of Guyana. It also incorporates thoughts of other discussants at the conference that help to give an updated status of the financial services industry. Owing to its length, this article will be presented in two parts.

Not All Negative

The arrival of critical developments at the doorsteps of the firms providing financial services brings a certain degree of urgency to the preparedness for handling these matters whether in the form of delivering the financial service or product, accounting for the financial services or products or managing the financial relationships that derive from the provision of the services or products. It is this need to be ready that also underpinned the choice and relevance of the theme for the conference of the accounting profession in Guyana. The news about the industry is not all negative. Starting early next year, bank customers were likely to find that their debit cards issued by their local banks could be used at the ATM machine of any local or foreign bank. The expected outcome of this initiative is a further expansion of electronic banking services in the country.

Concept of Financial Services

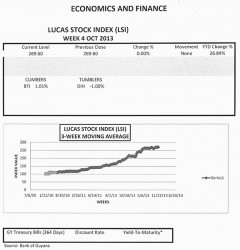

The Lucas Stock Index (LSI) showed no movement in trading during the first week of November 2013. Trading involved five companies in the LSI with a total of 322,086 shares in the index changing hands this week. There was one Climber and one Tumbler while the stocks of the other three companies remained stable. The Climber was Guyana Bank for Trade and Industry (BTI) which rose 1.01 percent on the sale of 11,300 shares. The Tumbler was Banks DIH (DIH) which fell 1.00 percent on the sale of 304,802 shares. Demerara Bank Limited (DBL) with a sale of 3,246 shares, Demerara Tobacco Company (DTC) with a sale of 1,250 shares and Sterling Products Limited (SPL) with a sale of 1,488 shares remained unchanged.

To a certain extent, the concept of financial services is self-identifying in that the word finance leads one to think about money and the economic services that money helps us to perform or satisfy. In that sense, money remains a universal unit of account which enables us to value items and even measure intangible economic relationships. As a store of value, money allows us to hold investments for short and long periods of time, and when necessary, we could activate its market powers in exchange for goods and services. With that succinct overview and with the aid of the Financial Institutions Act (FIA) of 1995 it is easier to define the industry. Within the Act, financial services are defined in five ways.

In the first instance, the Act helps us to see that any activity involving the receipt of deposits and funds from the public through loans, advances and extensions of credit constitutes financial services. The Act also identifies the receipt of funds through the issuance of debt obligations, shares, securities or similar means as constituting financial services. Money to be useful must be spent or otherwise utilized. In this regard, relending or investing the deposits or funds referred to above as loans, advances, receivables, debt obligations, shares and securities of any kind is deemed a financial business. Making leases to finance the acquisition or use of movable or immovable property is also part of the financial services sector as is holding oneself out to be in the business of a lending institution, finance company, factor, discount house, leasing company, trust, merchant bank, securities or loan broker, underwriter or dealer and unit trust. These activities are not dissimilar to what we would find elsewhere in the world. The volumes might be different and some financial assets might come with variations such as options and warrants which have value in their own right.

Identification of Industry

But it would be obvious to most if not all that the FIA, despite its many parts, is somewhat limiting in its definition of the financial services industry because it is silent on insurance services, accounting services, real estate activities, currency exchange, wire transfers and remittances as examples of the scope of activities tied to the industry. This is not a fault of the Act since its purpose was specific. Be that as it may, the definition identifies many of the services which the industry provides. When the additional activities of insurance, accounting services, real estate activities, currency exchange and the like are added, it enables us to see that the industry is rather expansive and encompasses a wide range of actors.

Relying on reports of the Bank of Guyana again, it is possible to discern that the commercial banks, insurance companies, trust companies, mortgage companies, micro-financing companies, foreign currency and money transfer dealers are all part of the financial services industry. Public knowledge and awareness allow us to add real estate agencies and accounting firms, and credit unions to the set of institutions that are part of the financial services industry. The preoccupation with money laundering and financing of terrorism casts a wider net to include trade in precious metals, gemstones and the theoretical small-sized lending through pawnbrokers in the industry.

Scope and Reach

Working backwards from activity to institution also helps us to gain a better understanding of the scope and reach of the financial services industry. In this way, we are able to use the asset-size and volume of activity associated with each institution or family of institutions to identify the structure of the industry and the influential players therein. This framework would also enable us to see what opportunities and constraints the industry might be facing as it looks to the future and seeks ways to move forward. Before we do that it would be necessary to situate the industry within the national economy. Taking this step allows one also to identify the usefulness of the industry to the many parts of the economy.

Structure of Industry

Any consideration of the contribution of the industry to output and employment in the future must take account of its current structure. Upon examination, it would be seen that the dominant component of the financial services industry is the banking sector when measured by size of assets, one of the common variables among the publicly available information about the industry. By controlling about 70 percent of the financial services industry, the banking sector dwarfs every other financial service provider or group of providers and, as a collective of banks, could be regarded as a monopoly. Comparatively, the banking sector is 41 times larger than the trust business, 13 times larger than pension, 10 times larger than insurance, eight times larger than the finance companies and seven times larger than the New Building Society (NBS). The statistics confirm the highly concentrated nature of the banking sector.

Contribution to National Economy

Unlike the real sector, the financial services industry is a composition of machine, man and money that come together to create, record and account for financial flows and stocks that are used in all other parts of the economy. Driven largely by a culture of conservatism seen in the existing low ratio of loans-to-deposits of the dominant banking sector, the financial services industry remains stuck at four percent of GDP for the last seven years, all of which have been identified in various reports as growth years of the Guyana economy. As GDP generally includes the income spent and the income earned by businesses, we could also say that the financial services also accounted for four percent of the income earned in the Guyana economy last year.

When viewed in that manner, it is possible to observe that the GDP measures the payments that the industry made for services received from others, the payment of the wages that accrued to employees and the profits that the industry obtains for matching demand for financial flows of households and micro, small, medium and large businesses, and risk protection for the same economic groups with the supply of these services. It is not possible to ascertain separately how much of the other services such as brokerage services, accounting, financial and tax advisory services are included in the measure of the industry heretofore identified. The activities of pawnbrokers and dealers in precious metals are not included in published reports of the regulatory agency.

This information gap might change with the regulatory reforms being introduced into the industry. Regulatory reforms linked primarily to strengthening anti-money laundering measures have increased the need for businesses like pawnshops and dealers in precious metals to maintain better records and to share information with regulators. The principal requirement for the entire industry is to increase its due diligence. All sectors of the financial services industry are required to know their customers better and are mandated to report suspicious activities. At the same time, compliance with FATCA remains a work-in-progress.

(To be continued)