Continued from last week

Asymmetry of information

The proposed regulatory changes identified in the previous part of this article reflect several deficiencies in the form and substance of reports. Irrespective of the reporting deficiencies, the motivation for entering or remaining in any market is the returns that accrue to the investment made in that market.

Except for the companies that have the obligation to report their financial results publicly, one is at a disadvantage when it comes to measuring performance by way of profits earned or even asset size by the broader financial services industry. This deficiency might be especially true about the fractured pension system in which many pension schemes are not registered with the proper authorities.

Data on the real estate sector are also not up-to-date with reporting on official mortgage data lagging some three years behind. By way of example, published data suggest that net borrowing for new housing might have peaked in 2009. The asymmetry of information represents a real barrier to forming a sound opinion about the status or future of the industry.

One of the most important services of the financial industry is the intermediation services of the commercial banks. The banks collect money in the form of savings from those persons who do not need the money immediately and make the money available in the form of loans to those with an immediate need. Some of the key products supplied by the commercial banks are auto loans, business loans, consumer loans, residential mortgages, savings and time deposits and foreign currency transactions. In this way, the banks help to create money and allow for the settlement of debt and the acquisition of financial and non-financial assets. No other financial services organization supplies the variety of products as do the commercial banks.

The combination of institutions that fall outside the banking sector does not match the level or volume of business done by the commercial banks, except for two organizations. The closest rival in terms of an option for savings is the fledgling Stock Exchange which will be considered later. The dedicated mortgage service provided by the New Building Society (NBS) matches those of the commercial banks. According to the latest annual report of the Bank of Guyana, the NBS with a mortgage portfolio of $46 billion exceeds that of the commercial banks whose mortgage portfolio stood at $41 billion last year.

Not operating at peak

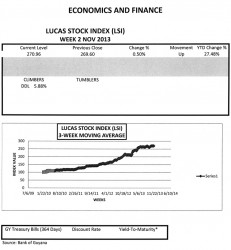

The Lucas Stock Index (LSI) rose 0.5 per cent in trading during the second week of November 2013. Trading involved four companies in the LSI with a total of 181,448 shares in the index changing hands this week. There was one Climber and no Tumblers. The stocks of the other three companies remained unchanged. The Climber was Demerara Distillers Limited (DDL) which rose 5.88 per cent on the sale of 11,667 shares. Banks DIH (DIH) with a sale of 104,955 shares, Demerara Bank Limited (DBL) with a sale of 59,676 shares and Demerara Tobacco Company (DTC) with a sale of 5,150 shares remained unchanged.

Despite the positive contribution of the industry to the economy, the financial services industry is not operating at its peak or most efficiently. Except for the two instances above, the competition in the financial services sector is limited and the banking industry has a tight grip on a vast portion of that industry. Unless more competition could be introduced into the industry, financial services would continue to be dominated by the commercial banks. It stands to reason that the cost of doing business in Guyana could be much lower if there was greater competition. Evidence of that position could be found in the quantity of money created last year. Economic theory says that with a reserve ratio of 12 per cent and average excess reserves of $10 billion, Guyana had the capacity to generate $80 billion in new money last year through the banking system. Judging from the net change in the loan portfolio of the banks, the anticipated loan capacity was never realized. The reasons are varied, but among them is the understandably conservative disposition of the banking sector that dominates the industry.

They have depositors’ money to protect and that they must do so. But it is equally true that not enough good investments are in the domestic economy. One contributing factor is the inadequacy or insufficiency of research that produces good ideas which could be converted into good business plans and possibly profitable investments.

Economic theory also says that as interest rates fall, the supply of deposits would fall resulting in a decline of loanable funds. In what appears to be an economic paradox, the supply of deposits has been rising steadily. Comparing the rate of growth of deposits from 1999 to 2005 with the period 2006 to 2012, deposits grew 9 per cent during the first period and by 12 per cent from 2006 to 2012, defying economic logic.

While it is true that the growth rates vary among the various categories of depositors, all categories saw sustained growth in deposits. When one adds the impact of inflation, it appears necessary to rethink the years of settled economic theory about the inverse relationship between the supply of a commodity and its price. It is a paradox that leads to the hypothesis that the disposition towards savings in Guyana is not influenced by changes in the interest rate. Clearly, some comparative studies are necessary to understand the reason for the growth in deposits over both the short-run and the long-run as the savings rate continues to fall.

Stock exchange

One beneficiary of the declining interest rate should be the Guyana Stock Exchange. From what could be observed, it appears as if the investment options are stacked against the financial investor. The returns from saving in the Guyana exchange were between 11 to 14 times greater than saving money in the banking system. Yet, the stock market remains underutilized for this purpose. One prevailing view among persons who show interest in these matters is that not enough is known among Guyanese about the existence and operation of the stock market. Another viewpoint is that Guyanese do not have sufficient funds in excess of their basic and emergency needs to place on long-term hold in the local stock exchange.

Therefore their disposition is to keep their savings as liquid as possible and close as possible to their hands. A review of time deposits seems to support that perspective. Over 50 per cent of time deposits are held for no more than three months at a time. And nearly two-thirds of it carries maturities of six months or less, even though the returns on these short-term maturities do not match the returns from capital appreciation in the stock market. One could also surmise that banks do not offer maturities over one year because there would probably be few takers.

But there are two other viewpoints that need to be considered. The third point of view is that the market might not be as open and transparent as necessary to imbue potential investors with confidence. An investor is expected to complete a transaction in at most six days. This is not always the case and several weeks could pass before an investor completes a transaction.

Any opportunity to capitalize on a positive movement during the waiting period could be lost. The fourth viewpoint is that the status of almost all the companies on the stock exchange might be discouraging foreigners from participating in the market in a major way. All the stocks on the exchange, except one are not officially listed, and this might be acting as a disincentive to participation. The exchange celebrated its 10th anniversary this year, and 10 years is a long time for the domestic companies to be testing the stock market while paying nothing to enjoy the benefits of the market. All four views appear plausible, but would require further research for validation.

Important trend

An important trend in the financial services industry is the continued introduction of interactive technology that facilitates broad participation in the financial market.

At an institutional level, online banking and other electronic services have emerged. Investors learn of new apps virtually on a daily basis that could be used to keep the connected and up to date with market trends. The narrow time-span to make decisions requires that Guyanese be equally equipped to remain informed and to be in a position to make decisions in real time. That calls for investment in research and development in software development and in the training of our human resources to be equipped to operate in a virtual financial world. In addition, the emergence of complex financial products that are part of cross-border crimes also requires that accounting education be emphasized at an early stage in the accounting education process. There is a burning need for law enforcement officials to be trained in accounting, and more particularly, forensic accounting, if the industry and Guyana as a whole is to be in a position to properly manage and protect the financial assets of investors.

Confidence

A lack of confidence in the financial system, whether as a result of corruption or incompetence, will not encourage anyone, especially foreigners, to invest large sums of money in the Guyana economy. Indeed, leading economists and financial analysts argue that over 46 per cent of the economy is rather informal. Apart from underestimating economic value, it exposes unsuspecting practitioners of the craft to undue risk. Guyana has to be able to build confidence in its economic and financial system so that investors could feel reassured about the integrity and safety of their investments. The education process needs to begin.