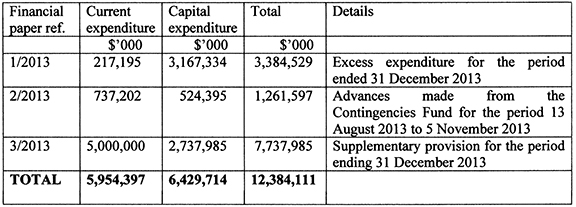

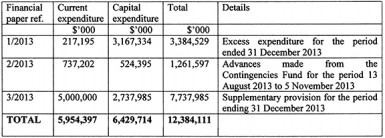

On 7 November 2013, the Minister of Finance tabled three financial papers in the National Assembly requesting the Assembly to approve of $12.385 billion in supplementary estimates, as summarized below:

The Assembly had approved of the 2013 budget in the sum of $163 billion against the Government’s original request of $208.8 billion. A similar approval was given in respect of 2012 for $172 billion against the original request of $192.8 billion. In this latter case, the Government mounted a legal challenge to the decision to reduce the budget on the grounds that: (a) it was unconstitutional for the Assembly to do so; and (b) the Assembly could either approve the budget or reject it, but not reduce it.

Chief Justice’s preliminary ruling

While deeming the action of the Assembly as unconstitutional, the Chief Justice ruled that the court could not grant any relief since the Government had amended the Appropriation Bill to reflect the reduction in the budget. The amended Bill was passed by the Assembly and assented to by the President, and therefore the court could not invalidate such actions. The only exception was the budget for the Ethnic Relations Commission (ERC) which is a constitutional body whose expenditure is a direct charge on the Consolidated Fund. Accordingly, the court ruled that the Minister could withdraw sums from the Consolidated Fund to restore the ERC’s budget. In no other situations did the court rule that sums over and above what is contained in the Appropriation Act could be withdrawn from the Consolidated Fund to restore the budget as presented. Only an Appropriation Act can authorize the Minister to make withdrawals from the Consolidated Fund.

One could well imagine that had the Government not amended the Appropriation Bill to reflect the wishes of the Assembly, the budget might not have been approved. This would have precipitated a constitutional crisis involving possibly a vote of no confidence in the government, thereby triggering fresh national elections. In the end, good sense prevailed and the budget was amended accordingly.

The Chief Justice made reference to the use of the Contingencies Fund as an option to restore the budget but only to the extent that the criteria for withdrawals are met. Article 220(1) states that Parliament may make provision for the establishment of a Contingencies Fund and for authorizing the Minister to make advances from that fund if he is satisfied that there is an urgent need for expenditure for which no other provision exists. In addition, in accordance with section 41(3) of the Fiscal Management and Accountability (FMA) Act, the Minister may approve of an advance from the Contingencies Fund if he/she is satisfied that an “urgent, unavoidable and unforeseen need for expenditure has arisen – (a) for which no moneys have been appropriated or for which the sum appropriated is insufficient; (b) for which moneys cannot be reallocated as provided for under this Act; or (c) which cannot be deferred without injury to the public interest”.

The Chief Justice argued that the extension contained in the FMA Act to include “unavoidable and unforeseen” is ultra vires Article 221(1) of the Constitution but did not make a ruling as such, as the court was not requested to do so. He nevertheless suggested that it is for the Minister to make that judgment, and not the court, as regards the criteria to be used in making advances from the Contingencies Fund. One would therefore expect that the Minister would exercise the greatest degree of caution and prudence in making that judgment since he has to subsequently seek the approval of the Assembly for the authorization of the expenditure from any advance from the said fund. The predecessor to the FMA Act, the Financial Administration and Audit Act did contain the words “unforeseen and urgent”, and it has been the practice as far back as 1992, and perhaps earlier, for the Audit Office to evaluate payments from the Contingencies Fund using the criteria contained in the FMA Act, a practice that continues to this day.

Financial Paper No. 1/2013

This paper deals with a statement of excess totalling $3.385 billion and is presented in accordance with Article 218(3) of the Constitution:

“If in respect of any financial year it is found: (a) that the amount appropriated by the Appropriation Act for a purpose is insufficient or that a need has arisen for expenditure to a purpose for which no amount has been appropriated by that Act; or (b) that any moneys have been expended for any purpose in excess of the amount appropriated for that purpose by an Appropriation Act, a supplementary estimate or, as the case may be, a statement of excess showing the sums required or spent shall be laid before the Assembly by the Minister responsible for Finance or another Minister designated by the President.”

Article 219 of the Constitution authorises the Minister to make withdrawals from the Consolidated Fund for up to four months, pending the passing of the Appropriation Act, to meet expenditure necessary to carry on the services of the Government. Since the 2013 budget was passed on 24 April 2013, the Minister would have authorized withdrawals from the Consolidated for the period January to April 2013. Traditionally, such withdrawals are based on the previous year’s budget. For current expenditure, the Minister authorizes withdrawals representing one-twelfth of that year’s budget for each of the four months. For capital expenditure, he/she authorises withdrawals for projects that are on going from the previous year since, for example, contractors have to be paid based on measured works, and other operating project costs will have to be met. Withdrawals ought not to be made for new capital expenditure, such as acquisition of equipment, since there is a financial risk involved, should the Assembly decide not approve of such expenditure.

The paper refers to the period ended 31 December 2013. In the absence of information to the contrary, this suggests that withdrawals from the Consolidated Fund were made beyond April 2013. If this is so, it would be a violation of Article 219 of the Constitution. That apart, in the 2013 budget, some agencies were not provided with allocations or were given reduced allocations. To the extent that money was withdrawn from the Consolidated Fund to meet expenditure of these agencies for the first four months of the year, this would have resulted in excess expenditure. For agencies with reduced allocations, excess expenditure can only occur if such allocations were insufficient to meet expenditure for the first four months of the year. There is no mechanism that allows the Minister to authorize withdrawals beyond the four months in excess of what Parliament has approved.

The following is a breakdown of the excess expenditure:

$’000

Provision of subsidy to GINA and NCN 217,195

Capital transfer to Guyana Power and Light Inc. 1,770,000

Provision for completion of hinterland airstrips 21,066

Capital grant to Civil Aviation for acquisition of equipment 80,000

Provision for modernization of Cheddi Jagan Int’l Airport 1,128,562

Provision for Specialty Hospital 167,706

TOTAL 3,384,529

As regards GINA and NCN, the Minister should have guarded against authorising withdrawals, knowing full well that the Assembly had rejected an amount of $211.570 million contained in last year’s financial paper No. 1/2012. Instead, he should have awaited the outcome of the deliberations on the 2013 budget. This is of course on the assumption that the amount of $217.195 million relates to expenditure in the first four months of the year. If any portion relates to a period beyond April 2013, then there is a violation of Article 219. As it now stands, excess expenditure totaling $571.627 million (inclusive of the ERC) for 2012 remained unauthorized.

In relation to the capital transfers to GPL, while the Assembly had approved of $5 billion in the 2013 budget, the amount actually paid out was $6.770 billion. The additional $1.770 billion relates to direct disbursements by the funding agency. This should not pose a problem for the Assembly since it a mere book entry to account for the disbursements. However, the capital grant of $80 million to Civil Aviation for the acquisition of equipment should have awaited the outcome of the budget.

The Assembly did not approve of any expenditure on the modernization of the Cheddi Jagan International Airport and on the Specialty Hospital. Yet sums totalling $99.880 million were drawn from the Consolidated Fund to meet counterpart expenditure. The balance of $1.196 billion relates to direct disbursements by the overseas funding agencies. It is unclear how the Assembly will view these transactions.

To be continued