Impasse

The impasse over the amendments to the 2009 Anti-money Laundering and Financing of Terrorism Act is a perplexing one. No new amendments to the bill are forthcoming. No negotiations are taking place and no leadership is being provided publicly on the matter. This means that the bill is at a standstill and will not advance until the parties find a way to talk to each other about it.

The stalemate has arisen from two angles. In one instance, the passing of the legislation has been linked to the establishment of the Public Procurement Commission (PPC). In another instance, the legislation has been subject to unspecified criticisms. The matter has been further complicated by the insistence of the administration that any movement on the PPC has to accommodate its desire to have a no objection role in the procurement process. A critical piece of legislation with serious consequences for the nation has been unable to motivate the political leaders to work together for a solution to the problem. The result has been the inability of Guyana to comply with the requirements of the Caribbean Financial Action Task Force (CFATF) on money laundering and the financing of terrorism.

Atmosphere for negotiations

Reopen dialogue

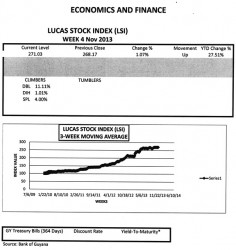

The Lucas Stock Index (LSI) rose 1.07 per cent in trading during the fourth week of November 2013. Trading involved seven companies in the LSI with a total of 253,893 shares in the index changing hands this week. There were three Climbers and no Tumblers. The stocks of the other four companies remained unchanged. The Climbers were Demerara Bank Limited (DBL) which rose 11.11 per cent on the sale of 1,000 shares, Banks DIH (DIH) which rose 1.01 per cent with a sale of 184,273 shares, and Sterling Products Limited (SPL) which rose 4 per cent on the sale of 4,500 shares. Demerara Tobacco Company (DTC) with a sale of 520 shares, Demerara Distillers Limited (DDL) with a sale of 61,088 shares, Guyana Bank for Trade and Industry (BTI) with a sale of 2,212 shares and Republic Bank Limited (RBL) with a sale of 300 shares remained unchanged.

Many Guyanese might be surprised to learn that there were significant developments subsequent to the CFATF warnings to Guyana about its deficiency in implementing the 49 recommendations to fight money laundering and terrorism. It should be recalled that the recommendations on which Guyana was required to act were made in 2011.

However, several developments in the work of the global Financial Action Task Force are worth noting in assessing the amendments proposed by the government and the attitude of the opposition towards them.

The view is held here that an identification and assessment of the subsequent developments should be sufficient to encourage the government and the opposition to reopen dialogue on the proposed amendments and to take additional steps that would enhance the implementation of the proposed changes.

Corruption

One of the major developments since Guyana was called upon to strengthen its anti-money laundering laws was in the area of corruption. FATF, the global body, began studying the link between corruption and money laundering in 2011. That first meeting of the expert group was sufficiently satisfied that there was a link between corruption and money laundering that it agreed to study the issue further to see how the anti-money laundering legislation could be strengthened to aid in the fight.

Between then and now, two additional meetings of the experts were held, one in October 2012 and the other in September of this year that justify some of the manoeuverings of the opposition.

Among the goals of the meetings of 2012 and 2013 were to see how best to identify risk factors associated with corruption and money laundering and to find ways to promote international cooperation on the matter.

Some Guyanese hold the view that no linkage should be made between setting up the PPC and the passage of the amendments to the anti-money laundering bill. The interest shown by FATF demonstrates a clear desire to see a nexus between corruption and anti-money laundering and that every effort be made by countries to fight the issue of corruption on all fronts. This also appears to be the sentiment of the leaders of the major developed economies who at their summit in 2011 regarded corruption as an obstacle to growth and development and “encouraged all jurisdictions to adhere to the international standards in the tax, prudential, and AML/CFT areas.”

The position taken by the leaders of the developed countries is not an unreasonable position as is the request by the opposition to have the Public Procurement Commission established as part of the means by which to fight money laundering and the financing of terrorism.

The establishment of the PPC is especially relevant given the acknowledgement by FATF that much work remains to be done before existing anti-money laundering measures could be used to fight corruption and terrorist financing. FATF is conceding here that amendments by a country based on its recommendations might be insufficient to curb corruption with the use of anti-money laundering measures.

Such a position on this matter is of great significance to Guyana because public procurement activity is a substantial part of the Guyana economy and a major source of annual revenue for many private businesses and contractors.

Politically exposed persons

FATF also specifically linked the issue of corruption to the behaviour and treatment of politically exposed persons (PEPs), an issue on which Guyana was found to be deficient and was asked by the CFATF to correct. Two issues on this recommendation have been flagged by FATF. One issue is that of conflict of interest and the other is that of bribery. The FATF recognizes that many PEPs hold positions that could be used to launder illicit funds. FATF has gone so far as to offer guidelines on how to deal with the issue of PEPs in domestic legislation, but these guidelines would have emerged after the government tabled its amendments. Consequently, one cannot be certain that the helpful ideas are part of the amendments proposed by the administration. Only a careful review and discussion of the changes could help.

No evidence

Moreover, while FATF recognizes that the family members of PEPs are also politically exposed, there is no evidence that the administration readily accepts this concept as part of the money laundering scheme. There is the well-known case of conflict of interest involving the Minister of Finance and his wife who works as a director in the Office of the Auditor-General.

Ever since that issue was raised, the government never took any steps to correct it. Clearly, the government does not agree with the views of the FATF on the issue of conflict of interest and appears to have dug in its heels on this matter. This point of view was reaffirmed with the signing of the Memorandum of Understanding (MOU) for the construction of a recycling plant and the vigorous defence of the action by the ministers in the Ministry of Local Government. In that instance, the daughter of a minister of the government was closely connected to the company that signed the deal and the involvement of this PEP did not trouble the administration one iota. The deal fell through after the selected contractor was exposed as not being sufficiently qualified to undertake the job.

The experts of both the G-20 and the Anti-Corruption Working Group (ACWG) who jointly studied corruption and conflict of interest noted that “corrupt PEPs will take great pains to disguise the identity and the source of the funds in order to place corrupt money in the financial system without suspicion.” The anti-money laundering measures to address such matters are regarded as inadequate by the FATF. With low confidence in the current anti-money laundering measures, FATF acknowledges that money laundering and the financing of terrorism must be fought on several fronts. In this regard, an effective functioning of the Integrity Commission looms large as a means of ensuring that PEPs receive an appropriate level of scrutiny.

Designing correct set of changes

Even if one sets aside the conflict between the parties regarding the establishment of the constitutional commissions for integrity and procurement, there could still be problems with designing the correct set of changes to the anti-money laundering law. A review of the proposed amendments raises questions of whether certain types of business activities are adequately treated in the legislation. Of specific interest are businesses that are described as money services businesses. These include cambios which are involved in buying and selling of foreign currencies, money transfer agencies like Moneygram and Western Union, issuers of money orders like the Post Office and providers of prepaid access like Digicel and GT&T. The first two types of money services are addressed in the amendments. The other two do not appear to have been given full consideration in the amendments.

FATF has raised concerns about prepaid access as an easy means of placing and layering money obtained unlawfully into the financial system. Just as there are specific references to insurance companies, cooperative societies, securities dealers, there should be an explicit reference to the post office as an issuer and redeemer of postal or money orders. In addition, there is no reference to the facility of prepaid access. While the cards of commercial banks have been treated in the amendments, there is no reference to prepaid services such as topup minutes and prepaid electricity as potential conduits for money laundering and therefore deserving of special treatment.

Frequent changes

In a report published in February 2012, the Financial Action Task Force acknowledged that it had revised and updated the recommendations to fight money laundering and terrorism. One of the things that it did was to eliminate the need for the nine special recommendations that dealt with terrorism. This change would be of relevance to the work of the CFATF and hence to the actions Guyana takes in this regard. FATF also acknowledged having difficulties in reaching a mutual understanding of what the recommendations mean and how a country should judge its performance relative to the recommendations, since the recommendations are periodically revised and new methodologies for analyzing money laundering and terrorist financing are being adopted constantly. FATF noted that many changes in laws and other procedures take time. There is therefore a recognition that countries need time to act on recommendations so that they could get them right. There is now time to act. The politicians need to do so.