Green-colored currency

It is the season when money matters and as Christmas draws near Guyanese will spend plenty of it. For those who opt to use cash, the dominant form of payment in Guyana, the attractive-looking new $5,000 bill will come in handy. Though it would not increase the bulge and load of the shopping basket, the new bill would lessen the bulge and load in people’s pockets. That lessening of the bulge might just be enough to throw predators off guard and keep alert shoppers safe. As attractive and useful as the new Guyanese currency is, it is not the story that is drawing attention near and afar. It is the increasing pressure that the more influential green-coloured currency, the US dollar, is facing to retain the title of undisputed king of global trade, global capital flows and global foreign exchange reserves. The pressure is coming from China and its allies in the group of countries referred to as the BRICS. The yuan is now the second most used currency in global trade, surpassing the yen and the euro. China has managed to achieve this status while keeping firm control over the management of its currency.

Analytical Convenience

Many stories have been told about the BRICS, made up of Brazil, Russia, India, China and South Africa, but not of how its formation might have helped China to avert political and other pressure to liberalize its currency fully, rapidly and prematurely. The concept of BRICS emerged around the turn of the 21st century from a paper that was prepared by Goldman Sachs for the purpose of forecasting future global economic trends. Goldman Sachs is the name of a leading investment banking firm in the United States of America (USA) that provides a wide range of financial services to private and public customers across the world. At the time of its analysis, the focus was on four of the five countries, South Africa not being seen as economically significant enough to warrant inclusion in the study. A grouping created for analytical convenience has now become a reality that is helping to reshape global economic and currency relationships. The interesting thing is that this change might be happening faster than conceived possible in the paper that led to the coining of the name of the group.

Significant Progress

Importance to global economy

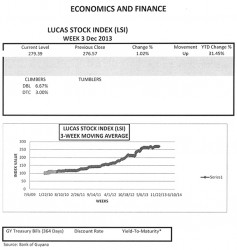

The Lucas Stock Index (LSI) rose 1.02 percent in trading during the third week of December 2013. The stocks of four companies were traded with a total of 217,096 shares changing hands. There were two Climbers and no Tumblers. The Climbers were Demerara Bank Limited (DBL) which rose 6.67 percent on the sale of 200 shares and Demerara Tobacco Company (DTC) which rose 3 percent on the sale of 1,825 shares. The stocks of Banks DIH (DIH) which sold 212,021 shares and Republic Bank Limited (RBL) which sold 3,050 shares remained unchanged.

The importance of the BRICS to the global economy is also measured in terms of foreign investment flows, world trade and the extent of their openness to such trade, and the level of foreign reserves that they hold collectively. In almost all of these areas, China leads the way. In terms of foreign investment flows, they have outpaced a few major industrialized countries as destinations for foreign currency. Brazil and China for instance receive far more foreign investment than Japan and the United Kingdom. Collectively, the five countries receive 18 per cent of foreign investment, nearly as much foreign investment as the USA, the largest recipient of such flows. The contribution of these countries to foreign trade is also significant. Their share of world trade has grown from 4 per cent to 15 per cent. In this instance, all five countries made positive contributions to the advancement of in global trade even though the contribution from China was a primary cause of the large growth.

Shortly before the first meeting of Foreign Ministers of the group in June 2006, China began making adjustments to its exchange rate regime. It began by replacing the US dollar as the only currency to which it pegged the renminbi. In replacement, China created a basket of currencies that reflected the significance of South East Asia to its own economic future and their importance to its global ambitions. Known to be in the basket of currencies were the South Korean won, the Singapore dollar, the Malaysian ringgit and the Thai baht. The choice of currencies was influenced by the foreign trade, foreign investment and foreign debt profile of China, thus persuading it to include the yen, the euro, the British pound, the Canadian dollar, the Russian rouble and the Australian dollar in the broad-based basket as well. Even though it was retained in the basket, the influence of the US dollar was reduced.

Probes

The move to spread the exchange risk around was followed by probes to form the group of BRICS. Almost immediately after the start of consultations about forming the grouping, these countries began to make noises that could not be ignored by the rest of the world. Very early in their discussions they began to talk about settling trade transactions in their own currencies and to create an institution that would help to manage their financial relationships. By the end of the fourth summit of the group, China had made some currency moves with far-reaching consequences for international relations. It decided in 2010 to eschew the use of the US dollar in its bilateral trade with Russia. Shortly after, in April 2011, China, along with Russia, joined with Brazil, India and South Africa in an accord to conduct trade with each other in their own currencies. Each of these countries is a dominant actor in its region. These initiatives now appear as carefully calibrated moves by China to set up the eventual checkmate of the opposing king, the US dollar. The moves were no doubt aided by the financial crisis which Western economies encountered in 2008.

While the potential for expanding trade among BRICS exists, intra-BRICS trade is so small that it raises questions about China’s currency moves in relation to that group. Trade among the BRICS is less than 10 per cent of their total trade. However, China has gone ahead with commitments to trade in the currencies of BRICS and other trading partners. Some of these moves followed its economic assertiveness at the G-8, the influential countries of the world, which rapidly expanded to the G-20 upon accepting the important role of China in bringing stability and growth to a desperate and troubled international financial and economic system. That assertiveness played out in the IMF which, with many European countries in trouble, was forced to revise its voting and management structures to make room for China and its circle of influential friends known as the BRICS. South Africa was the only member of the group who did not make it into the upper echelons of the IMF’s management structure.

A different look

However, today currency relationships take on a different look. Taiwan, a territory at odds with mainland China, is a major economic participant in the Chinese economy and is among those countries that now peg their currencies to the renminbi. The six powerful East Asian countries of Indonesia, Malaysia, Philippines, Singa-pore, South Korea, and Thailand have often been suspicious of China. Yet, each of these countries, along with Taiwan, ties their currencies to the renminbi. The shift in currency alignment among the countries of South East Asia has undoubtedly emboldened major oil producers to reduce dependence on the US dollar as the medium through which all trade in oil is settled. The United Arab Emirates (UAE) and South Korea agreed to settle trade transactions in their own currencies. Indonesia and South Korea have decided to do the same thing. China has signed a deal with the UAE to use their own currencies in trade transactions. Iran is trying to join the BRICS and there are indications that Saudi Arabia is using the renminbi in oil trade with China. China has signed deals with countries like Argentina, Australia, Belarus, New Zealand, Pakistan, Turkey, the United Kingdom and several other countries.

Sooner than predicted

Despite surging past the euro and the yen in trade financing, the renminbi lags far behind the US dollar which accounts for more than 80 per cent of global trade financing. The renminbi is also responsible for less than one per cent of total payment flows. But, it is important to note that trading in the renminbi has more than tripled to US$120 billion per day in a few short years. This development is further evidence of China’s arrival at the front door of the global economic edifice and its continued efforts to influence what goes on inside it. With help from the rest of the BRICS, it might be able to do that sooner than Goldman Sachs predicted.

Merry Christmas to all!