The sugar corporation’s strategic plan for 2013-2017 has slashed by 100,000 tonnes the projected annual output contained in the 2009 blueprint and planned improvements at the troubled Skeldon factory will see the flagship project grinding only at 71% of what had been expected since 2008.

According to the plan seen by Stabroek News, the Guyana Sugar Corporation is projecting annual output of 350,000 tonnes within five years compared to last year’s figure of 218,000 tonnes.

The failed blueprint of 2009 had aimed at annual output of 450,000 tonnes but this has now been discarded amid the deepening woes of the company which has also racked up huge losses including a whopping $13.8b for 2011. The new plan envisages the continued use of all current estates and factories.

The plan said that GuySuCo’s shareholder, the Government of Guyana had been voicing its concerns over the performance of the industry relative to the 33% EU sugar price cut, the slumping production, high costs and limited cash reserves. It noted that in 2009 an interim Board was appointed by the shareholder to formulate a blueprint for the turnaround of the Industry. This was presented in April 2009.

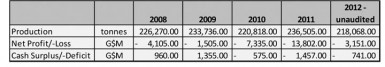

Noting that the blueprint listed a range of objectives to take the industry past 450,000 tonnes per annum, the plan said that the corporation “has since commenced implementation of these strategies. However due to limited availability of cash, unfavourable weather conditions, and other unforeseen hindrances such as the non-performance of Skeldon Factory, etc. the Corporation has yet to realize the aim of the Blueprint. Production and liquidity has not yet improved as seen from the table below.”

From the Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis of the individual estates and industry on a whole, GuySuCo said the following were the main weaknesses and threats highlighted:

Weaknesses

i. Unresolved/ prolonged technical difficulties with the New Skeldon Factory which began since the 2nd crop 2008, the year of its inauguration;

ii. As a result of the technical difficulties with the Skeldon Factory, Skeldon farmers have been reluctant to continue or come on board with GuySuCo

iii. Inability to consistently achieve the projected grinding hours resulting in significant increases in other costs such as, fuel consumption, mill dock operations and support services

iv. Inability to procure key inputs in a timely manner

v. Higher than anticipated wage increase

vi. Larger than anticipated decreases in private cane farmers supply

vii. Inability to make the necessary capital investments due to poor liquidity

viii. Low production levels

ix. Sub- standard work practices and poor supervision

x, Inability to attract and retain contractors;

xi. Non-achievement of the tillage/replanting/conversion programmes

xii. High level of absenteeism/poor labour turnout especially at critical times in both the field and factories;

xiii. Unable to attract workers due to better and tax free pay elsewhere;

xiv. Inadequate skilled labour supply

Threats

i. Additional inflationary pressures on key material inputs such as fuel, fertilizers and spares

ii. Inclement weather would hinder sequence and timing of all operations

iii. Unpredictably industrial relations climate

iv.

v. Loss of skilled and experienced staff to migration; construction, gold and rice industries and other sectors

vi. Reduction in production from private cane farmers due to their financial difficulties;

The plan said that to address these weaknesses and threats the following would be undertaken:

i. Increased Mechanization

ii. Factory Improvements

iii. Human Resources Initiatives

iv. Improvements to Accessibility and Cane Transport

v. Increased Production of Value Added Sugar

vi. Increase Partnership with Private Cane Farmers

vii. Improved Drainage

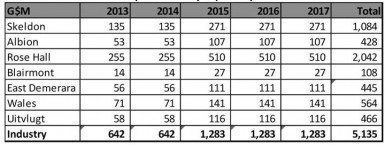

The plan revealed that a total of G$5Billion is projected to be spent in the next five years to improve the factories as per the table below. Allocation of funds is based on available cash as per the cash flows.

The plan acknowledged that since the commissioning of the Chinese-built Skeldon Factory in 2008, the “factory’s potential has not been realized.” It said that corrective works have been done by the contractors (CNTIC) and factory personnel and the performance did improve but “not to its potential.” Critics have said that the Chinese company was supposed to have delivered a trouble-free, turn key operation and was not penalized for the failures. Today’s grinding capacity is around 185 tonnes per hour of cane compared to the promised 350 tonnes per hour.

The plan said that an audit was done by an external firm, Bosch Engineering of South Africa, which highlighted some critical upgrades to the factory which will increase the throughput of the factory from 185 tonnes/hour to 250/tonnes per hour.

These are:

1) Replacement of the inboard dumper with the winch system, projected cost US$1M

2) Upgrade of the X001 and replacement of drives and cane conveyor belt, projected cost US$0.5M

3) Replacement of critical pumps and associated spares for the Diffuser and Mills, projected cost US$1M

The plan said that these works are estimated to be completed by mid-year 2014. It said that improved performance in the factory was seen when there was uninterrupted cane supply to the factory resulting in continuous grinding. It said that increased throughput will result in improved factory efficiencies and recoveries. Availability of cane to the Skeldon factory has been a major issue as there was insufficient cultivation on the estate and from surrounding private cane farms.

A punt dumper at Rose Hall’s factory costing almost US$1M is also to be installed. This, the plan said, will increase the throughput of the factory, resulting in improved efficiencies and recoveries.

Due to tight cash over the years, limited investment has been made in the other factories, the plan said.

“The basic out of crop maintenance programmes were cut short due to extended grinding periods and ‘short term fixes’ had to be done in some cases where necessary in light of limited funds. This has contributed to declining recoveries”, the plan said.

Critics have been saying for years that the industry has been starved of funds for crucial works and plant husbandry. They have argued that only some of the large amount of money made available by the European Union, following the reform of its sugar regime, has gone to the industry.

“As a result significant investment has to be done to retool the factories in order improve on recoveries and efficiencies and reduce on costs. Works includes extension to the bagasse logie at Albion, Skeldon and East Demerara (US$700,00), in order to preserve bagasse for the use of cheap fuel and reduce on dependency for the diesel, new turbines at Albion, Rose Hall, and Uitvlugt (US$3.6m), new high and low grade baskets at Albion and Rose Hall (US$ 835,000), a new alternator at Albion (US$750,000), upgrading process house at Enmore ($244,000), a new boiler and reverse rotation cane knives and carrier (US$ 3.6m), and replacement of boilers at Wales and Uitvlugt ($2m)”, the plan said.

The government has come under sharp criticism from the opposition over the state of the industry particularly in relation to the major problems at the Skeldon factory, which investment had been heralded by the Jagdeo administration as transforming the industry. The Skeldon Sugar Modernisation Project had been launched to the tune of around US$180M to be funded by the industry, government and loans. Critics have said it has been an enormous failure and burden to the economy.

The new plan also provided a long-term outlook for the industry.

It said that within the next five years, the Corporation hopes to attain almost 350,000 tonnes of sugar, a 60% increase from its current production.

“The ultimate vision of the Corporation is to achieve a production of a half a million tonnes of sugar. Therefore in addition to yearly reviews on the targets stated in this plan, on-going reviews will have to be done to identify opportunities for increasing the production levels to the targets vision. This is still a long term goal of the company.

“After the expiry of the EU Sugar Quotas in 2017, the Corporation will have to compete with other sellers into the EU market at a price which may be reflective of the World Market. The EU Sugar Quota accounts for a significant amount of the Corporation’s sugar production, 195,000 tonnes. In 2012 sales of bulk sugar to the EU accounted for 71% of total sales and this percentage is targeted to reduce to 56% in 2017. However, this is still a significant proportion of our production and expiry of the Quota will impact heavily on the Corporation. Therefore the Corporation has to have a strategy to counter the effects of this”, the plan said.

It added that the main strategy for this current plan of increasing output of value added sugars will continue in the long term. In addition to this, a long term strategy of diversifying operations will also be reviewed.

“An Ethanol Plant and a Distillery could be established providing feasibility studies show they can be profitable. Additionally the feasibility of setting up a refinery at Skeldon will be revisited as the market for refined sugar in Caricom is capable of taking off the output. The Common External Tariff (CET) will enable the refined price to compete with extra regional refined sugar”, the plan said.