Symbolic milestone

“The problem is that our thinking, our attitudes, and consequently our decision-making have not caught up with the reality of things.” This view was expressed over 30 years ago by John Naisbitt in his book, Megatrends: Ten New Directions Transforming Our Lives, in which he discussed 10 major changes that were altering the economic, political and business culture of the United States of America (USA). Naisbitt went on to point out that the profound nature of the changes was disguised by their subtlety and caused many to either miss them or dismiss the changes as insignificant. One event that went unnoticed was the symbolic milestone that the USA by 1956 had started to produce information more than goods, and that within one year the information revolution had been globalized with the launching of Sputnik by the Russians. In his view, the inability of Americans to appreciate the shift in the locus of production fast enough had caused individuals, companies, and the country as a whole to act on assumptions that were out of date. The failure to stay in touch with the present realities led in many instances to inaccurate projections for the future and resulted in failure of future endeavours. Another of his many observations at the time was that if people continued to remain “out of touch with the present, [they were] doomed to fail in the unfolding future.”

The lessons

The lessons to which Naisbitt points in his book might be ones that Guyana should take note of as it begins 2014. Recent years have seen an impasse on almost every major initiative that was intended ostensibly to advance the interests and well-being of Guyanese. Guyana has undergone economic and political changes since 1988 with the introduction of the Economic Recovery Programme (ERP) and the continued implementation of reform primarily under the Highly-Indebted Poor Countries (HIPC) programmes of the International Monetary Fund (IMF) and the World Bank. Since the start of the reform process 25 years ago, a series of changes has occurred that have significance for individuals, private companies and the public sector, but not everyone seems to have understood and accepted these changes, and factored them into the decision-making about the future of the country.

Political posturing

Political posturing has left the nation hamstrung and the economy operating below its true capability. Compromise, the cornerstone of successful politics, has been cast aside in favour of partisan politics. There is nothing earth shattering in the observation of Naisbitt that anyone stuck in the past is likely to fail, but it looks like commonsense and appears to be very pertinent to the circumstances in which Guyana currently finds itself. Could it be that the implications of the changes referred to below have not sunk in enough that Guyanese are missing their significance and might be causing them to act in ways inimical to their best interests?

Structural adjustment

All these changes and other developments hold consequences for the way in which the Guyana economy could and should be operating in the future and it would be useful to examine the false assumptions Guyanese society is making. However, a very general point is expressed herein using relations with the multilateral institutions, the state of sugar and the perception of corruption as examples.

Highly adversarial

These changes were transported over relatively calm waters, but the vessel in which they arrived, totally controlled or highly adversarial legislative processes, was crudely built and made the journey to this point an unpleasant one. But that does not excuse the need for Guyanese to come to grips with the new reality of a struggling sugar industry living on life-support of subsidies and transition money from the European Union, a widening income gap where an estimated 24 per cent of the labour force enjoys less than eight per cent of income produced by the Guyana economy, nearly 40 per cent of the economy distorted by money laundering, the influx of foreign workers from near and far, the displacement of small investors in the retail trade by investors from China, a weakened police force, a dual education system (mostly free during the school day and high-priced after the school day), a health system that scares pregnant women despite improvements in life expectancy rates and many women left vulnerable to abusive partners. The research on most of the foregoing issues is yet to become available, but there are clear signs that overwhelming change has hit Guyana. The reaction to the changes, exemplified by the conflict between the executive and the legislature, might not only be slow but also precarious.

To many, the administration has overlooked the power shift in the legislature. But equally true of the constant conflict between the legislature and the executive is the opposition overlooking the reality of who truly directs the executive. The economic policy of the country is not dictated by the political interests of Guyanese alone, but also by the country’s commitments to structural adjustment that it signed with the IMF and World Bank. The following quotation from the most recent Article IV Consultations of the IMF Executive Board indicates the extent of the keen interest of the IMF over economic and social policy in Guyana. “… Directors encouraged the authorities to persevere in their commitment to sound policies and reforms to strengthen policy buffers, promote more inclusive growth, and further reduce poverty.” This is one of several points of advice offered by the IMF to the Guyana Government. Other pieces of advice include adopting tighter monetary policy, exchange rate flexibility, giving priority to reforms that aim to boost the efficiency of public enterprises and replace universal subsidies with better-targeted social assistance. Despite their impact on Guyanese, the administration needs to hold fast to them.

Sustained growth

The achievement of agreed targets has resulted in the continued flow of money from the multilateral institutions to Guyana and in debt relief under the Heavily Indebted Poor Countries Initiative (HIPC) and Multilateral Debt Relief Initiative (MDRI) initiatives. The success of sustained growth in an environment of declared macroeconomic stability was unlikely to shake the government from its apparent position of intransigence. It is doing what it believes is right and no amount of pressure from the legislature was likely to shake it loose from its position of rigidity for as long as it retains that belief and is being assured of it. The political opposition needs to come to grips with this reality if it wants to hold the administration accountable since the advice that the administration receives is not always the best. Moreover, some of the tactics used by the administration to achieve its economic and social goals have come under scrutiny.

Failed example

One failed example is seen in the travails of the sugar industry. The GuySuCo modernization plan was reviewed by the World Bank for technical feasibility and financial viability. The purpose of the restructuring exercise was to reduce Guyana’s vulnerability to a decline in the export price of sugar. The whole point was to lower production costs by improving efficiency through the use of better production facilities, downsizing operations and linking workers’ pay to performance. GuySuCo has not been able to achieve any of these goals. Under the circumstances, it is correct to insist on a re-examination of the technical and financial feasibility of the industry considering the significantly diminished role of sugar in the economy and the inordinate amount of subsidies that it continues to receive.

Corruption

At the same time, corruption remains a concern. It is seen as a drag on domestic and foreign investment as observed at the investment conference held in June last year at the International Conference Centre at Liliendaal. Guyana continues to rank very low on the Transparency International Corruption Perception Index. This low ranking is indicative of the low esteem in which the implementation strategies of the administration are viewed.

Releasing the deathgrip

For 2014, Guyanese as a whole must come to grips with the reality that the economy is different and that their role in it must reflect that difference. They have to prepare themselves to play the role that gives them the best chance at success. This means, as Naisbitt noted, Guyanese would have to release the deathgrip on the past and deal with the future. 2014 is part of the future and one could only hope that Guyanese would embrace it with a new attitude.

Happy New Year!

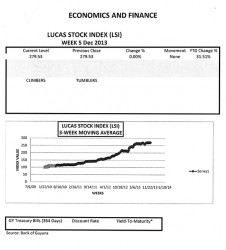

The Lucas Stock Index (LSI) remained unchanged in trading during the final week of December 2013. The stocks of two companies were traded with a total of 373,800 shares changing hands. There were no Climbers or Tumblers. Banks DIH (DIH) sold 148,800 shares while Republic Bank Limited (RBL) sold 225,000 shares with their values unchanged.