Business focus

A new year has begun and many businesses are getting in stride with implementation of the plans that they would have developed for execution in the unfolding operating period. For the well organized and adequately resourced, production plans are already set and might even be in progress. Indeed, this would be particularly true for those companies that use a fiscal year and not a calendar year to measure their output and performance, since they would have started their new business year in 2013. Those businesses should be in second gear by now. This article attempts to paint a picture of what these and other businesses would have seen in the Guyana economy to lead them down their chosen path of economic focus and business strategy. What should emerge, therefore, is an indication of the sectors and industries that hold promise for well-managed investments. It should also be possible to see which sectors and industries harbour significant risk for current and future investment. Perhaps, most significant would be the realization that Guyana, while showing strong indications of an efficiency-driven economy, remains essentially a factor-driven economy at heart. This particular factor would be examined in the next article. The focus of this article will remain on the performance of the economy over the past seven years.

Structure of the economy

The discussion starts with an identification and evaluation of the structure of the economy. Guyana continues to present the classification of its national accounts in accordance with the International Standard Industrial Classification (ISIC) method. Consequently, the broad range of economic activities is subdivided into agriculture, manufacturing, mining and services. In addition to rice, sugar and other crops, agriculture accommodates three other industries. These are forestry, fishing and livestock. Mining harbours the bauxite, gold, diamond, manganese, sand and stone industries. The manufacturing sector does not claim any special industries even though it interacts with forestry for its wood products, agriculture for its meats, fruits and vegetables and the distributive industry for its acquisition of capital equipment, raw materials and other intermediate goods. Services consist of every other industry in Guyana. It therefore has the largest number of industries which is part of the reason that it accounts for the largest share of output in the Guyana economy. It is on the basis of the preceding structural classification of economic activities that the direction and trends in the economy are being assessed.

Share of output and income

Every economic actor does not look at the data with the same critical view. Yet, those who enter the market seem driven by some knowledge of opportunity. One is clearly the size of the market. Others are the amount of money to be had from the market. In order of size, the Guyana economy is dominated by the services sector which, from 2006 to 2012 accounted for an average 62 per cent of the country’s output. This is followed by the agricultural sector which is responsible for 21 per cent of the goods and services produced by the country. The mining sector contributed 10 per cent of output while the manufacturing sector added an average of seven per cent over the last six years. In terms of income, the story is pretty much the same. Services were responsible for the majority of income, 58 per cent, earned during the period of discussion. Agriculture was responsible for 23 per cent while mining provided 15 per cent of the revenues earned. Manufacturing, however, contributed only four per cent.

The growth shown by the four sectors alters the economic picture significantly. While the services sector is the largest part of the economy, its output grew at the same pace as that of the mining sector. Both grew at an annual average rate of six per cent from 2006 to 2012. Though its share of output is much smaller than that of agriculture, output of the manufacturing sector grew faster than that of agriculture. The output of the latter grew at the rate of one per cent over the period under review while that of manufacturing grew at the rate of two per cent per annum. The income generated by the four sectors also tells a vastly different story. Despite their similar growth rates in output, the income produced by the mining sector grew twice as fast as the income earned in the services sector. Mining grew by an annual average of 25 per cent while that of the services sector grew by 11 per cent. This substantial shift in resources towards the mining sector provides the first clue that Guyana remains a factor-driven economy. Both agriculture and manufacturing saw their income grow by seven per cent annually. The indifference in the allocation of resources between agriculture and manufacturing provides a second clue that Guyana remains a factor-driven economy.

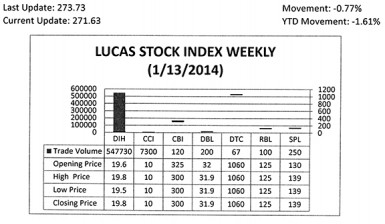

The Lucas Stock Index (LSI) declined 0.82 per cent in trading during the second week of January 2014. The stocks of seven companies were traded with a total of 555,767 shares changing hands. There were two Climbers and two Tumblers. Banks DIH (DIH) rose 1.02 per cent on the sale of 547,730 shares while Sterling Products Limited (SPL) rose 6.92 per cent on the sale of 250 shares. The shares of Citizens Bank Inc (CBI) fell 7.69 per cent on the sale of 120 shares and that of Demerara Bank Limited (DBL) fell 0.31 per cent on the sale of 200 shares. The stocks of the remaining three companies Caribbean Container Inc (CCI), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 7,300; 67 and 100 shares respectively.

Expanding output and income

A ranking of the 18 industries that are measured by the government gives a better picture of the direction and trends in the economy. It also helps to identify the sectors that are attracting larger amounts of resources and those which are losing money. The top 10 industries hold few surprises as sources of income for Guyanese. The many delis, beer gardens, hardware stores, supermarkets, clothing stores, personal care services and other retail outlets that are opened in all parts of the country allow the distributive trade to stamp its authority on the economy. Perhaps, because of the low barriers to entry, low skill and technology requirements, and the lack of enforcement of regulations, the wholesale and retail trade continues to attract the largest amount of resources in the economy. It accounts for an average of 15 per cent of the income earned in the country over the last six years. The unwillingness of participants in the various activities of the industry makes it difficult to determine how well or how badly each is doing.

The industry that ranks second is that of construction which accounted for an average of 10 per cent of the income generated by the economy within the last six years. Government spending and the construction of warehouse space and private dwellings have enabled this industry to maintain some strong growth. The transportation industry ranks third with eight per cent of the income earned in Guyana. As an industry that is ancillary to all the others, transportation remains well positioned to continue growing. This industry would face continued challenges if there is not a rethink of the geographic placement and maintenance of roads.

Retreat from gold

It probably would be a surprise to many that the fast growing gold industry competes with the information and communication technology industry for fourth place. Gold was able to outperform the information and communication technology industry as people shifted resources towards gold production. This trend is not surprising since the export price of gold has remained relatively high for an extended period of time, and the high income has attracted larger amounts of investment. However, the export price of gold has declined causing the margin between revenues and cost to narrow. Further, the high cost to enter and operate in the industry now and the lower returns were likely to slow the rate of investment in, and even a retreat from, this industry as prospective investors measure the opportunity cost of investing in gold.

Better positioned

This gives the ICT sector a chance to move ahead of gold. Where the information and communication technology industry (ICT) is concerned, it was better positioned to sustain the growth in income for two reasons. One reason is that demand for its services was likely to remain high as businesses try to improve their production processes and competitive position within the domestic and foreign markets where relevant. The second reason is that the supply of skills is short relative to the demand for the existing and anticipated ICT services. The other five industries in terms of rank were sugar, other crops, financial services, rice and education. Sugar is producing a mere six per cent of income, other crops is producing five per cent, financial services four per cent and rice and education sharing the ninth and tenth spots with 4.7 and 4.8 per cent respectively.

Health

Though not on the radar screen right now, the health industry holds major surprises for the future of the Guyana economy. At this point in time, the health industry provides two per cent of the income earned in the economy. But after gold, it is the fastest growing in terms of resource earnings. As the population, which is relatively young, grows and becomes more active, the demand for health services was expected to rise. It has troubles which it must overcome if it is to realize its full potential.

Vulnerable

Three industries that appear particularly vulnerable to the resource movements were sugar, forestry and other services. The last of the three, other services, an industry with miscellaneous activities, was the one that suffered the most loses, 13 per cent. This ought not to be surprising since the nature of the industry suggests that resources are not committed on a long-term basis to any one activity. It is not clear from the existing information which industry is drawing most of the resources but with its sizable and rapid rise in income, gold is a prime candidate. Both forestry and sugar have been losing resources at the same rate, three per cent per annum.

Potential

It should be clear from the foregoing that the Guyana economy has the potential to create new and exciting opportunities for the people of this country if it could enjoy their full confidence. The simple things that build trust, institutions that work, policies that are fair, health, social and security services that are reliable, and justice that is meted out equally under the law, need to work better for the economic opportunities to yield results.