Change in structure

A particularly interesting feature of the Guyana economy is the growth that it has exhibited over the last several years. As was pointed out in last week’s article, much of the growth has been in the non-traditional industries of the economy. That reality points to a change in the structure of the economy, and that the economy depends less on the production of agriculture and primary commodities and more on other industries. By way of comparison, agriculture and mining accounted for 50 per cent of the Guyana economy in 2002. Today, these very sectors are responsible for 35 per cent of the economy. They have yielded room to other economic units. In fact, all the losses exhibited by individual industries were in the area of agriculture and the two culprits were sugar and forestry. One suggestion of the resource shift is that Guyana is moving away from being a factor-driven economy and was moving closer to being an efficiency-driven one. A comparison of the characteristics of the two types of economies would disabuse even the most ardent and rabid peddler of such a viewpoint that that is not the case.

Export of primary commodities

In determining if a country is a factor-driven or efficiency-driven economy, one has to look at not only the structure of the domestic economy, but also how its production fits into the global scheme of things. It must also look at its productivity measures. A factor-driven economy is one that exports the primary commodities that it produces. It does not process a large proportion of its primary products into manufactured items for domestic or foreign consumption. With the exception of rice and sugar and a few other items, very few of the agricultural products produced in Guyana are processed beyond their initial primary stage for export. For example, it is known that cassava is converted into casareep and exported. Pepper is converted into pepper sauce and exported. The oil from the coconut is extracted and exported. Some local fruits are processed into beverages. Despite these and other instances, the vast majority of products are exported in primary form.

Evidence

Reference was made in last week’s article to agriculture and manufacturing growing their income at the same rate, seven per cent annually, over the last seven years. This indifference in the allocation of resources between the two sectors provides evidence that Guyana remains a factor-driven economy. This evidence is corroborated by the export revenues earned by Guyana during the review period. The five major exports of Guyana are bauxite, gold, rice, sugar and timber. And even with the processing to which sugar and rice are subjected, their value-added is not enough to make their export qualify as part of the manufacturing sector in international trade. Consequently, Guyana continues to obtain the bulk of its foreign earnings from the export of primary commodities with over 90 per cent of such revenues coming from the five major primary commodity exports.

Vulnerable

With over half (an estimated 55 per cent) of its gross domestic product (GDP) dependent on foreign demand, Guyana is vulnerable to the vagaries of the global business cycle. This condition reinforces the factor-driven character of the Guyana economy. Very often a downturn in the global economy has a deleterious effect on the country. This tends to reflect itself in two ways. One is in the demand for commodities and the other is in the price of commodities. This risk has not changed even with the diversification of the economic structure. During the global crisis of 2008, the price of several commodities fell. The price of sugar fell. The price of coconut oil fell. And after a short delay, the price of timber fell. The price of rice moved up and down on account of calamities that hit major producers like India and Pakistan.

Escape

Gold, however, was not one of those commodities whose price fell. Guy-ana’s escape from the negative consequences of that recession was therefore more a result of luck than policy. Guyana escaped the ravages of the global economic crisis of 2008 because one of its major exports, gold, was well positioned to play a role in protecting the wealth of the nervous investor. Uncertain of the true value of many of the assets that they held, many investors around the world sought refuge in gold when the price of real estate collapsed and credit became tighter. Uncertainty about the value of the US dollar played into the situation as well and led countries like China and India to add a higher share of gold to their mix of foreign reserves. The increased demand for gold caused its price to soar to record levels over the past seven years. In Guyana’s case, the price of gold moved from US$803 in 2007 to over US$1700 in 2011. This doubling in the price of gold was not determined by any policy position that Guyana adopted, but the positive price movement was good for the economy. And the expansion of gold production was a rational response to the price of the product.

Manufacturing

So far in making the assessment, the focus has been on what Guyana is. It is also good to look at what it is not. Guyana is not a major manufacturing country. It does not produce advanced products, an act that distinguishes an efficiency-driven economy from a factor-driven one. Several reasons have been advanced for that situation. Foremost among them is the high cost of energy which discourages investment in manufacturing. More recently there is the added complaint about the high cost of bandwidth that causes electronic-based services to be expensive and either discourages new investment in those industries or renders existing ones uncompetitive. But those are only a couple of the things that disqualify Guyana from being described as efficiency-driven. Four other variables are important. These are the existence of an efficient government administration, the development of efficient infrastructure, improving functional skills and access to investment capital with ease.

Not well managed

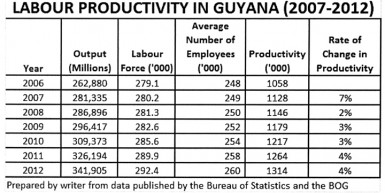

The simultaneous existence of those factors ought to let the country reflect high levels of productivity. Much of the discussion of the Guyana economy over the last two years has produced evidence that the public sector is not well managed. The reports of the Auditor-General are replete with examples of waste and abuse of resources. A substantial amount, over 62 per cent, of government spending goes through the procurement process. This process is intended to achieve efficiency and effectiveness in the use of public resources. From the evidence emerging in the audit reports, this goal is not being achieved. The public is also aware of capital works such as the wharf at Charity, the stelling at Supenaam and the bridge across the Rupununi River which were not constructed well and had to be redone. Communities are all too familiar with poorly maintained or constructed roads, unreliable water supply, poor drainage and an insanitary environment. The data in the table on page 23 about labour productivity when disaggregated bear that out.

Labour based

The Guyana economy is primarily a labour-based one. Using the tax data of 2011, it is estimated that 38 per cent of the income generated in the country was paid in wages and salaries. With a further 20 per cent going in personal and consumption taxes, the remaining 42 per cent of the income produced by Guyana is shared between business profits, social responsibility and business taxes. Labour assumes an important part in the productivity of the country. In looking at labour productivity, the objective is to measure the value added by each employee within the measurement period. In this case, it is one year. An efficiency-driven economy would show consistent signs of moving in the direction of higher rates of productivity. Such positive movement reflects a better trained staff, an efficiently run public sector and investment in infrastructure that makes economic sense. The repeated need by households to replace furniture and other household items damaged from continuous flooding of their dwellings retards their personal economic progress. The constant need to stay away from work because of flooding also retards the economic progress of the economy as a whole.

Productivity

The issue of labour productivity in Guyana has to take both the de-motivating environmental factors and the level of functional skills into account because labour productivity indicates how well workers are performing and these two factors have a direct impact on workers’ attitude and ability. Keeping that in mind, a suitable measure of labour productivity is gross domestic product (GDP) per hour worked. In that way, the measure would not be affected by industrial action or inclement weather which is of relevance to many of the important industries. Information about hours worked is unavailable currently to this writer. So a reasonable substitute is GDP per employee. The table below reflects what GDP per employee has been over the last six years.

Despite the limitations of the measure, it is possible to get a picture of what productivity has been over the years. The significant bump in productivity in 2007 undoubtedly reflects the reconfiguration of the economy and the inclusion of more industries in counting GDP. The large increase in productivity therefore could be explained by the numerator effect. Once the effect from the widening of the economic structure was over, productivity returned to more realistic levels. Workers have been adding more value each year, but the increases have been coming more from the private sector whose productivity has grown at an average of three per cent per year than from the public sector whose productivity has been virtually stagnant, even declining in some years, 2009 and 2012 being examples. This is further evidence of a poorly run public service.

Backward technology

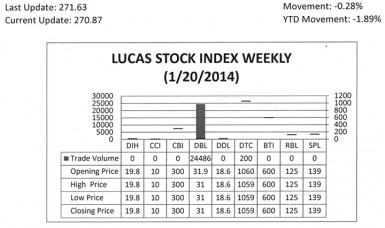

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 0.28 percent in trading during the third week of January 2014. The stocks of two companies were traded with a total of 24,686 shares changing hands. There were no Climbers and both traded stocks were Tumblers. The shares of Demerara Bank Limited (DBL) fell 2.82 percent on the sale of 24,486 shares while the stocks of Demerara Tobacco Company (DTC) fell 0.09% on the sale of 200 shares.