Smallest

In a market of diverse ownership, Citizens Bank is one of three commercial banks that have majority Guyanese ownership. Its parent company is Banks DIH, a well-known and long standing local manufacturing company. Despite a growing asset base, Citizens Bank remains the smallest of the four banks that are part of the Guyana Stock Exchange and the Lucas Stock Index with a market value of over G$11 billion and assets just above G$40 billion. Within the last two years, Citizens Bank had average annual sales of G$2.5 billion. Like the other companies in the banking sector, it has been experiencing positive growth. It grew its deposit base by about 17 percent last year, its income-generating base by about 11 percent and added another location from which to serve customers. These are all indications of an enterprise that is determined to be one of the “leading financial service providers” of the industry as expressed by the Chairman of the company in the 2013 annual report. Yet, a review of two key profitability ratios raises questions about the business strategy that CBI hopes will take it to the top of the industry.

Distinguishable

Citizens Bank can be distinguished from its competitors in two ways. In the first instance, Citizens Bank has the highest loan-to-deposit ratio. The commercial banks have been very conservative with respect to the handling of customers’ deposits. The observation has been made periodically that the banks are not lending enough. According to the Bank of Guyana, only an average of 54 percent of the deposits of customers was being lent by the banks and there was significant variation between them. The making of loans does not merely depend on banks having excess deposits on hand. It depends also on business opportunity, the soundness of the planned investment and the creditworthiness of the borrower. A limiting factor of particular concern to CBI is the “limited lending and investment opportunities” that exist in Guyana, a concern expressed by the Chairman as he pondered the growth prospects of the company. But some way in this market of limited opportunity, CBI has managed to exceed the average loan-to-deposit ratio by a wide margin. With a loan-to-deposit ratio of 75.92 percent, CBI tops all the banks listed on the Guyana Stock Exchange and is in a statistical dead heat with Scotiabank.

Determined

It would appear that CBI understands that for money to be useful it must be spent and appears determined to make the deposits that it holds work for it. It is willing to take more risk than others in an industry with excess liquidity and falling interest rates. A key reflection of this posture is the loans-to-assets ratio and the second way in which CBI distinguishes itself from its

Consequently, the strategy of the bank has been to look for areas where it could invest its assets. The profile of the loan portfolio of CBI indicates that it reposes greater confidence in the stability in the cash flow of the business sector than in the household sector. Its focus has been on the business segment of the market rather than on the household sector. It has little interest in the household market since it invests less than eight percent of its assets in that market. According to the Bank of Guyana, CBI invested close to 59 percent of its assets in the business sector. Even within the business sector, it has been very selective in its lending. CBI targets two areas. These are services and manufacturing. It invests 31 percent of its loans in the services sector. This is understandable because the service sector is the largest sector of the Guyana economy and it has been growing at an annual average rate of six percent since 2007. Loan opportunities therefore are expected to be plentiful in that sector.

Niche Market

CBI also invests 20 percent of its assets in the manufacturing sector. In contrast to the service sector, the manufacturing sector is the smallest in the Guyana economy and has been growing the slowest. There seems to be very little investment opportunity in the manufacturing sector and the returns appear marginal, given the uncompetitive cost of energy. Yet, CBI invests 20 percent of its assets in the manufacturing sector. The only logical explanation for that is there must be a niche market in the manufacturing sector which offers lucrative returns and to which CBI has access. What is interesting is that even with its high loan-to-deposit and loan-to-asset ratios, CBI is not a lead creditor in any of the business sectors to which it lends.

Questionable Performance

The effort to distinguish itself from its competitors might contain challenges which, if not handled very well, could diminish the competitive strength of CBI. While the return on assets has been growing, the economic performance of the

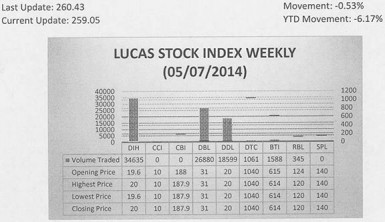

The Lucas Stock Index (LSI) declined 0.53 percent during the first period of trading in May 2014. The stocks of six companies were traded with a total of 83,108 shares changing hands. There was one Climber and two Tumblers. The value of the stocks of Banks DIH (DIH) rose 2.04 percent on the sale of 34,635 shares. The value of the stocks of Guyana Bank for Trade and Industry (BTI) declined 0.16 percent on the sale of 1,588 shares while the value of the stocks of Republic Bank Limited (RBL) fell 3.23 percent on the sale of 345 shares. In the meanwhile, the value of the stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 26,880; 18,599 and 1,061 shares respectively.

assets remains questionable. This concern is reflected in the ratio of reserves-for-loan-losses to gross loans. CBI maintains an eight-percent ratio while the industry average is four percent. Further evidence of the concern about the performance of the assets is seen in the marginal revenue produced by changes in productive assets, and in the asset turnover. For example, an expansion in income-generating assets of G$4.3 billion in 2010 produced an increase in sales of G$155 million which resulted in a marginal revenue of four cents on every dollar of asset invested. Last year, however, an expansion in income-generating assets of nearly G$5 billion only produced an increase in sales of G$130 million resulting in a marginal revenue of three cents.

The implication of this decline in marginal revenue is a decline in the efficiency of the assets. This is reflected in the condition of asset turnover. From 2012 to 2013, asset turnover fell by less than half of one cent. Yet, that was enough to cause CBI to suffer an efficiency loss of as much as G$7 million. The picture over the longer term is just as intriguing. Asset turnover from 2010 to 2013 fell by about half of one cent on every dollar. The result was an overall efficiency loss in revenue of G$12 million over the period.

Increase

However, the bank has been able to report an increase in the return on assets that was higher than in 2010. One gets an understanding of how that was possible from the following remarks of the Chairman of the company. “In 2014, the Bank will continue its efforts at managing our expenses and ensuring robust risk management which remains key to our continuing success in a very dynamic sector”. It is evident from the remarks of the Chairman that CBI has to continually work at keeping costs down to derive benefits from the investment in its assets. A critical part of the cost control strategy is the expanded use of technology. Again, this business strategy is evident from these additional remarks of the Chairman which appear in the 2013 Annual Report of CBI “The utilization of technology to improve our operating processes leading to increased efficiency will continue during 2014 bringing benefits to our customers and the organization”.

Despite the commitment to, and the application of, greater amounts of technology, it is not surprising to find that the return on equity has declined over the last two years. It also reflects a long-term financing strategy that might be in need of recalibration. After rising from 17.98 percent in 2010 to 22.6 in 2011, the return on equity declined to 21.25 percent in 2012 and slipped to 19.33 percent in 2013. This situation is a consequence of the declining rate at which profits have been increasing in contrast to the rate at which equity has been rising. Profits increased by 37 percent in 2010 and by over 50 percent in 2011. However, the increase has been much smaller since then, increasing by 15 percent in 2012 and by 9 percent in 2013. The smaller increase has occurred inspite of the income tax concessions of 2011 and the property tax concessions of 2013.

Chairman’s Wish

CBI maintains a stable relationship between its current assets and current liabilities reflecting that its short-term strategy is driven primarily by the deposits of customers. The long-term financing strategy is more interesting. Retained earnings grew by 32 percent in 2013 when compared to 2012 thereby helping internal equity to grow faster than any other equity component of the company. The long-term financing depends heavily on internal equity since external equity makes up only about 10 percent of the long-term financing of the business. The distribution between internal and external equity gives management full control of the future of the enterprise. Consequently, the decisions that it makes will determine if CBI could fulfill its Chairman’s wish of becoming a leading provider of credit in the banking sector in Guyana.

Happy Mothers’ Day to All, and

especially the reading mothers!